ARTICLE AD BOX

- Falling funding rates on Binance suggest rising short positions despite Bitcoin’s bullish momentum.

- Short liquidations on Binance may accelerate upward pressure as traders misjudge the market trend.

Bitcoin continues to show strength, but not everyone seems convinced. In recent days, the largest crypto asset has been moving in the range of $100,000 to $110,000, and interestingly, traders have started to take the opposite approach.

Boris Vest, an on-chain analyst at CryptoQuant, noted that the funding rate on Binance has been declining despite the Bitcoin price trending upwards. Not only that, but Binance users are increasingly opening short positions—betting that the price will fall.

Source: CryptoQuant

Source: CryptoQuantSkepticism Dominates Even as Prices Keep Climbing

This raises a big question: why do people choose to go against the flow when the price is rising? A decrease in the funding rate usually occurs when there are a lot of short positions open, and in the context of an uptrend, that’s a combination that can trigger a chain effect.

Traders who are in the wrong position will be forced to increase margin or get liquidated, and that will only push the price higher. In other words, pressure from short sellers could actually accelerate the rally.

Moreover, Binance is the exchange with the largest volume at the moment. So, the data from there can be said to reflect the overall market sentiment. And if the sentiment is skeptical despite the price going up, we could be witnessing the beginning of a bigger move.

Bitcoin Sees Big Volume, but Short Bias Remains Strong

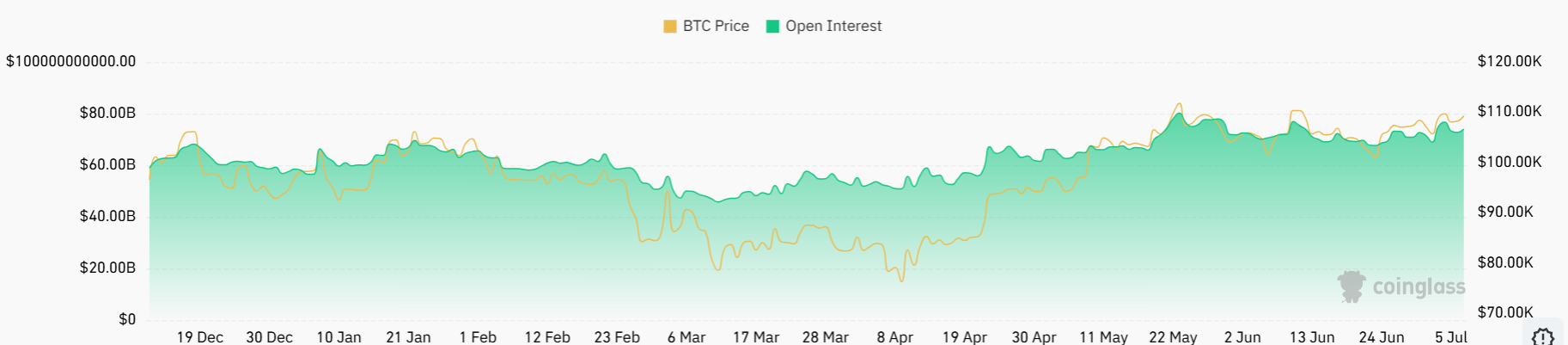

On the other hand, the latest data from CoinGlass reveals a massive spike in activity in the last 24 hours. Bitcoin trading volumes surged 162.49% to $57.45 billion. This shows that capital is flowing back into the market, especially from traders who see opportunities amid the increasing volatility.

Source: CoinGlass

Source: CoinGlassFurthermore, open interest in derivatives markets also rose 3.36% to $74.90 billion. This means that more positions are being opened and not closed—both long and short—as the tension between market confidence and uncertainty over price direction increases.

Meanwhile, Bitcoin options volumes also soared 162.87% to $2.61 billion. So, it is clear that traders are increasingly active in using various instruments to anticipate movements that could explode at any time.

But there is one data that raises eyebrows. The long/short ratio in the BTC/USDT pair on Binance, based on the number of accounts, is now at 0.5952. What does that mean? The number of accounts taking long positions is much smaller than those taking short positions. The majority of retail traders do not seem to fully believe that this rally can last.

CNF also reported something interesting a few days ago. Retail traders are actually increasing their exposure to Bitcoin, while large holders, aka whales, are starting to reduce their positions. This situation shows a fairly striking shift in short-term sentiment.

However, one thing that cannot be ignored is the fact that open interest on Binance Futures has still not been able to break through its resistance level. This could mean that the momentum among derivative traders is not yet fully strong. But if the pressure on short positions continues to grow and prices continue to rise, the potential for a squeeze remains wide open.

Besides that, as of the writing time, BTC is changing hands at about $108,453.76, slightly up 0.31% over the last 24 hours, with $39.63 billion in daily trading volume.

.png)

4 months ago

7

4 months ago

7

English (US)

English (US)