ARTICLE AD BOX

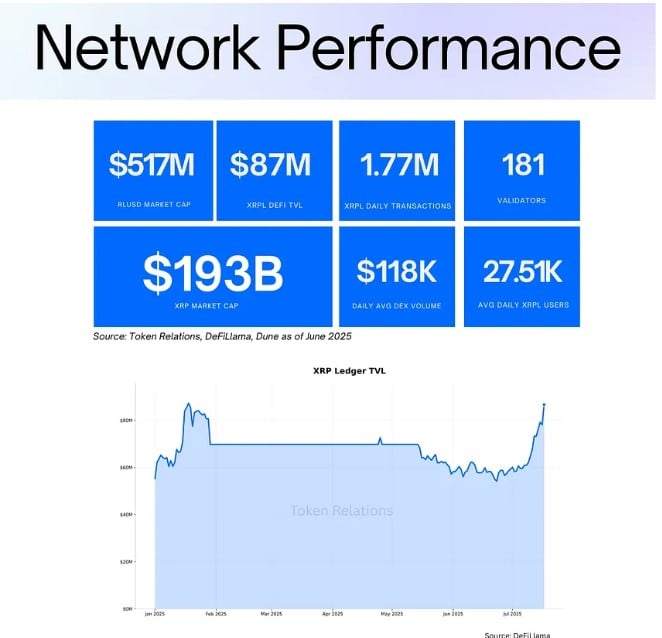

- The Real World Assets (RWA) value on the XRP Ledger (XRPL) has increased from $5 million in January 2025 to $118 million in July, signaling strong institutional interest.

- Five million RLUSD tokens have also been minted on the Ethereum blockchain, with 77.5 million minted in July alone.

While XRP is nearing its all-time high price of $3.8 at a jaw-dropping pace, its underlying blockchain, XRP Ledger (XRPL), witnesses booming activities as the value of tokenized Real World Assets (RWA) on it jumps by a staggering 2,260% in almost seven months.

The Details of the Report

According to a report published by Token Relations and Ripple, the value of tokenized RWA on XRPL was around $5 million in January 2025. Today, this has significantly increased to more than $118 million. Fascinatingly, the reason has been attributed to the rising interest in tokenized assets by major institutions like the U.S. Treasuries.

Apart from this, XRPL has also become a dominant force in the Decentralized Finance ecosystem as its Total Value Locked in this sector surges by 57% to $86.66 million. On top of this, its daily transaction is averaging 1.77 million, triggered by the increasing use of stablecoin and Decentralized Exchanges (DEX).

Source: Token Relations and Ripple

Source: Token Relations and RippleAmidst the backdrop of this, Ripple’s stablecoin RLUSD has just crossed a market cap of $530 million after 5 million tokens were just minted on the Ethereum blockchain. In July alone, 77.5 million have so far been minted. RLUSD is also expected to be accessed by a wider user base as AMINA Bank announces support for its custody and trading for institutional clients, as we covered in our latest report.

XRPL’s Strong Network and Ongoing Adoption

The success of XRPL has been attributed to its strong network which is evident in its more than 170 active validator nodes and more than 900 nodes globally. Also, Ripple has, over the years, prided itself on its under-cent transaction fee and its capacity to handle over 1,000 transactions per second.

Its global expansion is also going on smoothly as it obtains a license from the DFSA in the UAE to access the $400 billion trade market. It has also joined hands with Ctrl Alt in Dubai’s real estate market to tokenize property title deeds, as noted in our earlier post.

Ripple has partnered with BDACS in South Korea and Straits in Singapore alongside the likes of DZ Bank, BBVA Switzerland, DekaBank, and Mercado Bitcoin to boost the Ripple Custody Service and power RWA integrations, as highlighted in our previous article.

On the other hand, its native token XRP has recorded an impressive rise of 22% in just 7 days, trading at $3.4. According to CoinMarketCap data, XRP’s monthly gains have increased to 68% while its year-to-date returns rise to 50%.

As outlined in our recent blog post, XRP could hit $14 as an analyst spotted a bull pennant on its weekly timeframe. However, the price would have to first break above the higher resistance level of the triangle to embark on a 530% surge.

In a recent update, we also discussed that broader economic shift, institutional attention, and Exchange Traded Fund (ETF) pressure are some of the catalysts that could push the price to this predicted height.

.png)

8 hours ago

2

8 hours ago

2

English (US)

English (US)