ARTICLE AD BOX

- WisdomTree sees XRP as the only altcoin that matches the Bitcoin utility.

- The market has retained its sentiment status, riding on its value propositions.

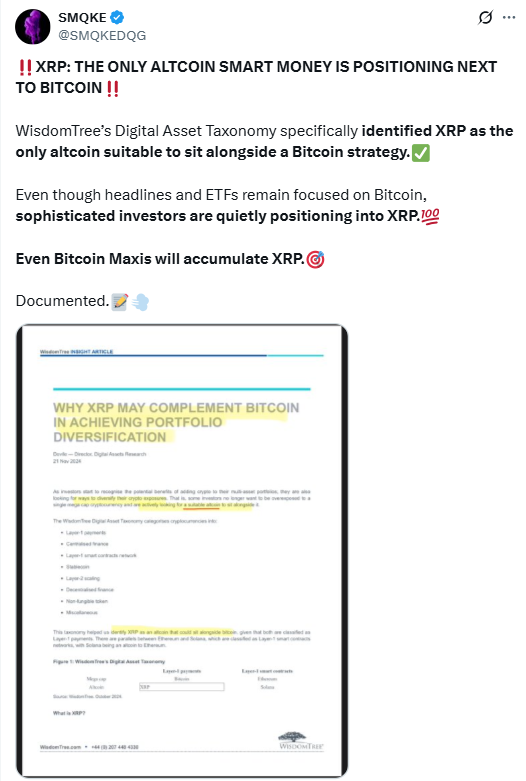

In its latest report, WisdomTree, a $100 billion asset management firm, designated XRP as the best altcoin for a long-term portfolio strategy alongside Bitcoin. XRP community member SMOKE on X brought the market’s attention to the report.

XRP to Complement Bitcoin Strategy

In the report, WisdomTree noted that institutional investors are no longer content with exposure to a single mega-cap cryptocurrency. The firm has, therefore, identified XRP as a fitting companion to Bitcoin based on its utility, performance, and classification as a Layer-1 payments asset.

WisdomTree categorizes digital assets into key sectors, including Layer-1 payments, Layer-1 smart contract platforms, NFTs, DeFi, and stablecoins. The firm classifies Bitcoin and XRP under Layer-1 payments based on their primary function as digital payment instruments.

The firm’s classification positions XRP as the altcoin counterpart to Bitcoin in the payments category. This distinction resembles how Solana parallels Ethereum in the smart contract segment.

Indeed, the XRP’s designation as an alternative to Bitcoin is not without premise. XRP is designed for fast transactions and scalable payment solutions. Transactions on the XRP Ledger (XRPL) settle in between 3 and 5 seconds.

As we discussed earlier, over 300 financial institutions are now connected to RippleNet, emphasizing its recognition in global finance. Also, XRP utilizes a Proof-of-Association consensus model that consumes less energy than Bitcoin’s Proof-of-Work.

Moreover, XRP has low correlation with Bitcoin and Ethereum, strengthening its case for diversification. XRP’s performance tends to follow a more independent trajectory, a trait WisdomTree considers valuable for risk management. On the other hand, Bitcoin and Ethereum often move in tandem. Besides, XRP has what it takes to compete against Ethereum and Solana in the DeFi sector, as we previously explored.

XRP Reduced Supply

XRP’s controlled supply is another reason behind WisdomTree’s perspective. XRP has a fixed cap of 100 billion coins, gradually released through Ripple’s escrow system. Each month, Ripple returns unused coins to escrow.

In a recent study we reported on, Ripple re-locked 700 million XRP in escrow. As of now, XRP’s circulating supply stands at 58.55 billion coins.

Furthermore, WisdomTree highlighted that XRP operates under a long-term deflationary model, where network transaction fees are burned. Investors see parallels with Bitcoin’s scarcity-driven value proposition since most XRP is distributed or locked, and its total supply is nearing full circulation.

XRP supporters interpret WisdomTree’s report as evidence that smart investors are accumulating XRP as a strategic counterpart. They argue that XRP’s positioning alongside Bitcoin in institutional portfolios seeks a balance between store-of-value and real-world utility.

Meanwhile, the US government also mentioned XRP as one of the assets to consider for its strategic crypto stockpile.

Nonetheless, XRP’s institutional credibility has greatly improved as the only altcoin officially recognized alongside Bitcoin in WisdomTree’s framework. Moreover, WisdomTree is pursuing an ETF that would invest directly in XRP. This product will offer traditional and institutional investors regulated exposure to the asset.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)