ARTICLE AD BOX

- XRP shows a lower high pattern and low trading volume, raising early signs of potential bearish continuation in the near term.

- Despite rising derivatives volume, falling open interest suggests traders are closing positions and losing short-term confidence.

XRP is facing pressure that is starting to be felt on the chart, although at first glance it is not as severe as Bitcoin which has recently been getting closer to its highest level.

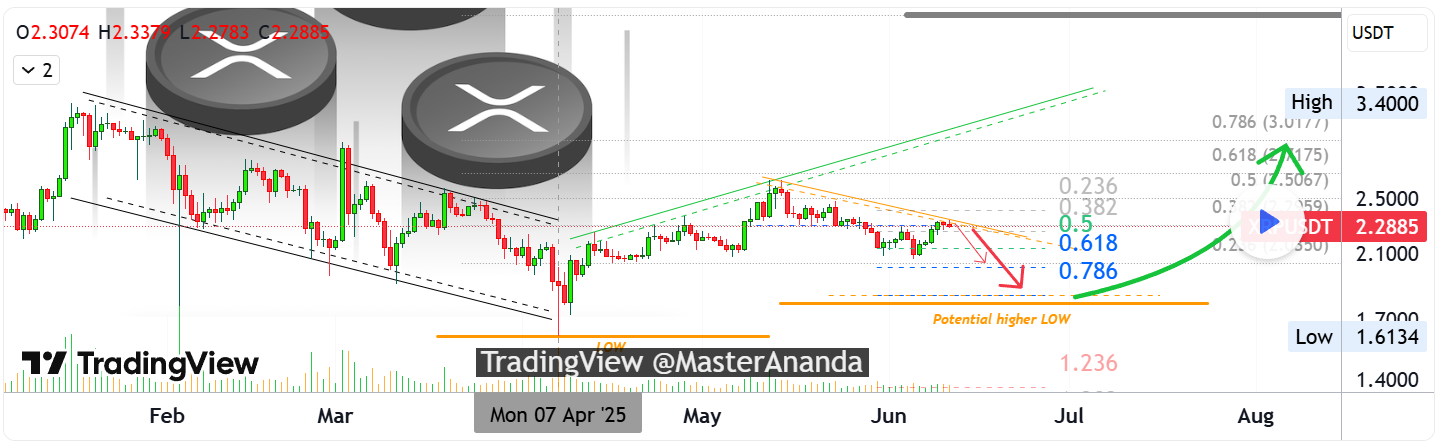

But according to crypto analyst Master Ananda on TradingView, XRP’s condition actually shows a slightly different story—and it’s not good news. In his view, the bearish signal is not yet too obvious, but a lower high pattern has formed. Trading volume? Quiet. And low volume like this is usually a sign that the current trend can continue without significant resistance.

Rising Volume, Fading Confidence: XRP Traders in a Tough Spot

Looking closer, XRP’s latest high occurred on May 12, then continued to retracement. A few days ago, to be precise on June 9, another lower high appeared. Even today’s trading session looked strong, but was immediately closed with a full red candle.

Source: Master Ananda on TradingView

Source: Master Ananda on TradingViewMaster Ananda reminded that all major assets, such as Bitcoin, Ethereum, and Cardano, often move in the same direction. So if one collapses, the others usually follow suit. XRP is certainly no exception, although technically its chart can show a different nuance.

On the other hand, XRP derivative activity is also busy. According to CoinGlass data, XRP derivatives trading volume has jumped 8.73% in the past 24 hours and is now at $5.09 billion. This could be a reflection that traders are actively speculating—either up or down.

Source: CoinGlass

Source: CoinGlassHowever, open interest data actually decreased by 3.17% to $4.15 billion. This means that many positions were closed or liquidated. This could be a sign that the market is starting to hesitate or is starting to lose the courage to stay in open positions.

Furthermore, there was a quite striking spike in XRP options volume. It increased by 25.08%, although the value is still small, only $1,140. But this small number should not be underestimated.

In some cases, an increase in options volume can be a sign that traders are starting to think about protecting their positions or even preparing for volatility. If we compare it, this is like starting to wear a raincoat before it actually rains—anticipation before the storm.

Volume Spikes but Price Action Refuses to Follow

Meanwhile, on exchanges like Binance, the ratio of accounts holding long positions for the XRP/USDT pair is recorded at 2.6088. This means that more than twice as many accounts are choosing to buy than sell. On the one hand, this can be read as optimism, but on the other hand, such a high number could actually be a time bomb.

If the market suddenly corrects and mass liquidation occurs, long positions could backfire. It’s like too many people are hoping in the same direction, so when the direction changes, the impact can be severe.

CNF also recently reported that the transaction volume on the XRP Ledger network has jumped more than 1,300% to 4.11 billion XRP. This increase looks spectacular, but it is not always in line with the price. In fact, when transactions swell, the price actually corrects. In the last 24 hours, XRP has fallen 1.57% and in the last 30 days, it has corrected 10.60%. Currently, the coin is changing hands at about $2.26.

Other analysts, such as Dark Defender, have indeed projected a potential breakout above $2.33 by relying on signals from indicators such as RSI and Ichimoku Cloud. However, in conditions of weak volume and technical patterns like now, it sounds like guessing the weather while looking at a cloudy sky—there is hope, but you still have to have an umbrella ready.

Master Ananda also closed his analysis with a note of caution. He said that a major correction might indeed need to happen now if XRP really wants to go higher by the end of 2025. But for now, he thinks the best step is to wait.

.png)

23 hours ago

2

23 hours ago

2

English (US)

English (US)