ARTICLE AD BOX

- Monero shot up 150% in eight weeks, briefly topping LTC and TON before cooling to $390.

- Speculation around exchange relisting, record hashrate, and major upgrade helped fuel strong, silent momentum.

Monero (XMR) started gaining in the April 2025 rally. Within a span of eight weeks, it rose 150% to reach a value of $420 by mid-May, a value not achieved since June 2021. The increase pushed Monero back to the top 23 cryptocurrencies by market capitalization, which jumped over $7.2 billion.

At the time, XMR surpassed Litecoin (LTC) and Toncoin (TON), but briefly, before a small correction dropped the value back to around $390. The increase went largely unremarked upon in larger crypto circles. There was little social media hype or analyst opinions, an odd silence given the coin’s aggressive move.

Monero’s price narrative comes at a time when digital privacy is gaining consideration. A noticeable uptick in Monero’s hashrate has been one of the strongest indications of sentiment shifts. Through data from CoinWarz in May, the hashrate was seen at 6.33 GH/s — the network’s record. That implies that there are increasingly more miners allocating resources to Monero.

Source: CoinWarz

Source: CoinWarzMajor Upgrade Could Make Monero Untraceable

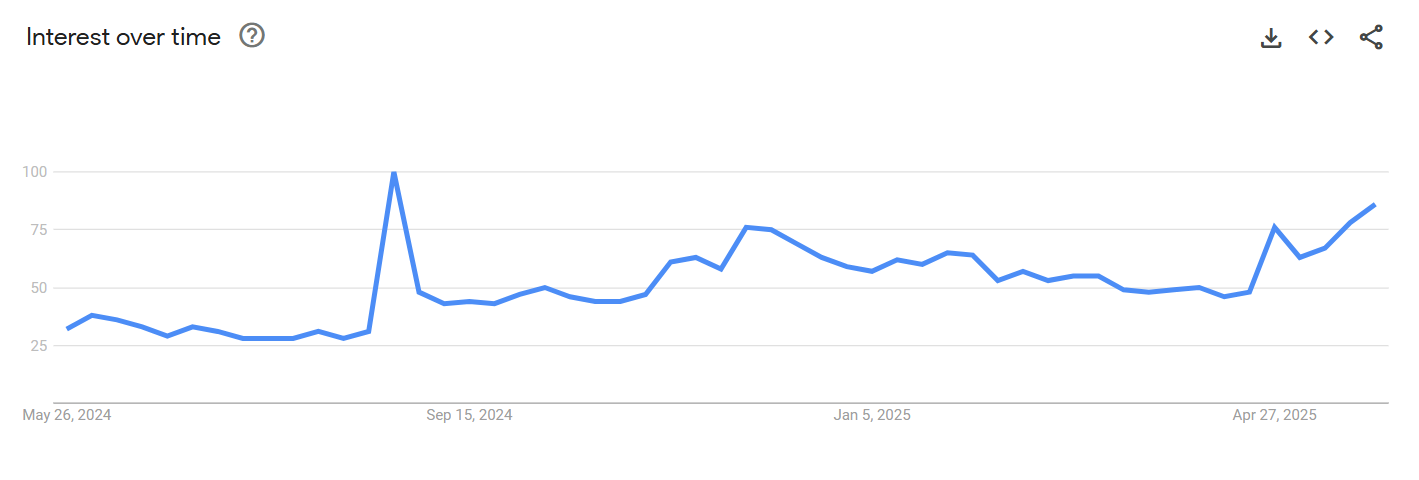

Google Trends provides another angle to the increased interest. The “Monero” search interest was steady throughout 2025 and never fell below the 50-point threshold. It jumped to 90 over the past two months — a value that hasn’t been seen since August of 2024. The increase in interest is credited partially to speculation that XMR will list once again on large exchanges.

Source: Google Trends

Source: Google TrendsA major update also seems to be firming up the confidence of the community. The Full Chain Membership Proofs (FCMP++) update also promises to introduce greater anonymity and even quantum resilience. Navio’s core member, CR1337, discussed:

Right now, Monero is facilitating ‘Ring Signatures’ to obscure the sender of each transaction and mixes the real input with a set of decoys (usually 16). FCMP++ will replace this with a new system which allows to prove that a spent output actually belongs to the entire set of outputs on-chain, potentially well over 100 million.

Illegal Use Still Fuels Controversy Around Privacy Coins

Even amidst the price rally and development momentum, negative news has plagued XMR. Hackers are reported to have laundered $330 million with Monero in April 2025 through a cyberattack. It happened to coincide with the start of the ensuing rally that lifted the coin to new levels above 2021.

A group affiliated with the Pakistan Province of the Islamic State published a poster inviting supporters to finance jihad with capital, requesting donations in Monero. These occurrences keep the coin under scrutiny, particularly from regulatory agencies concerned over how privacy tools are able to evade financial oversight.

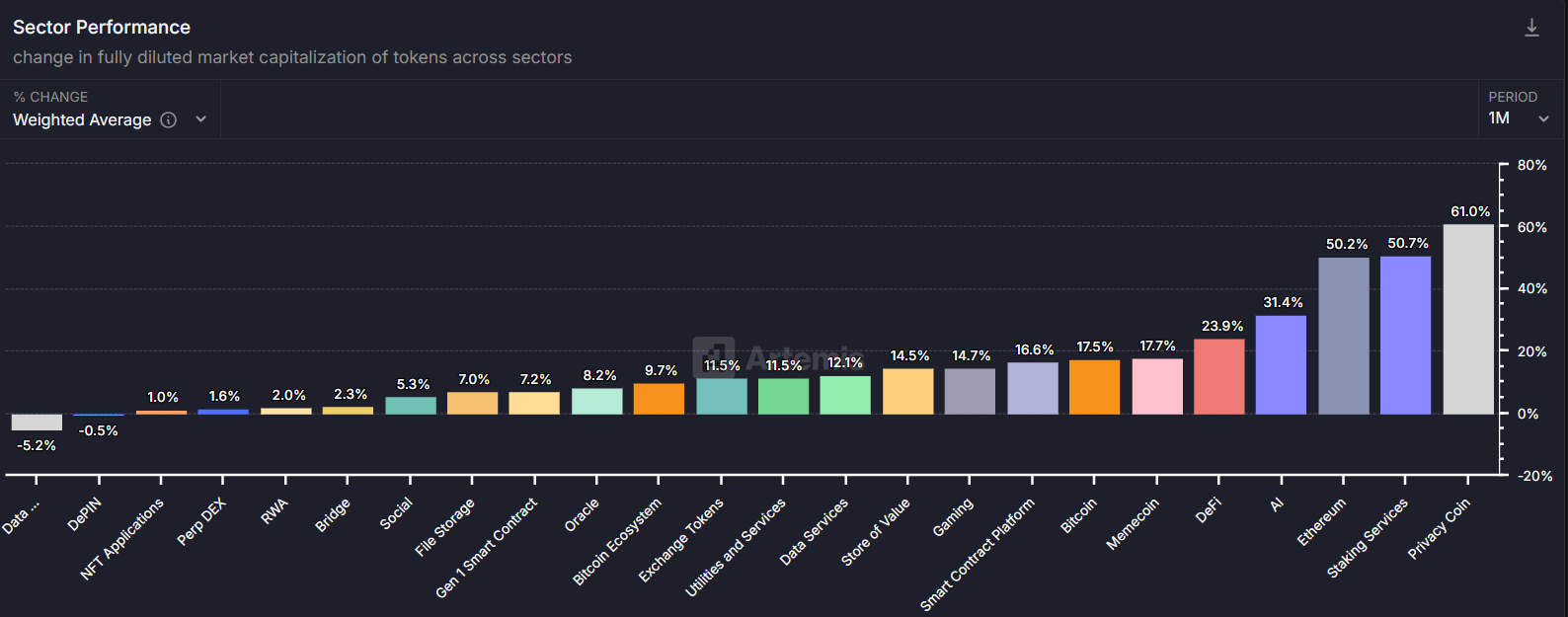

Source: Artemis

Source: ArtemisThe broader market has also seen a surge in interest in privacy assets. Privacy coins rose by over 61% on average over the previous month, according to Artemis data. As controversy persists over censorship, regulation, and financial surveillance, it points to continuing demand for digital assets that have untraceable transaction capabilities.

.png)

1 day ago

10

1 day ago

10

English (US)

English (US)