ARTICLE AD BOX

- XRP has what it takes to compete against Ethereum and Solana in the DeFi sector.

- With its design for speed and trust by banks, it stands out as a protocol to watch.

Ripple Labs’ backed XRP could outperform Ethereum (ETH) and Solana (SOL) in the Decentralized Finance (DeFi) sector. In a series of X posts, a famous XRP community member, All Things XRP, explained why the XRP Ledger (XRPL) remains a DeFi powerhouse.

Can XRP Win the DeFi Race Against Ethereum and Solana?

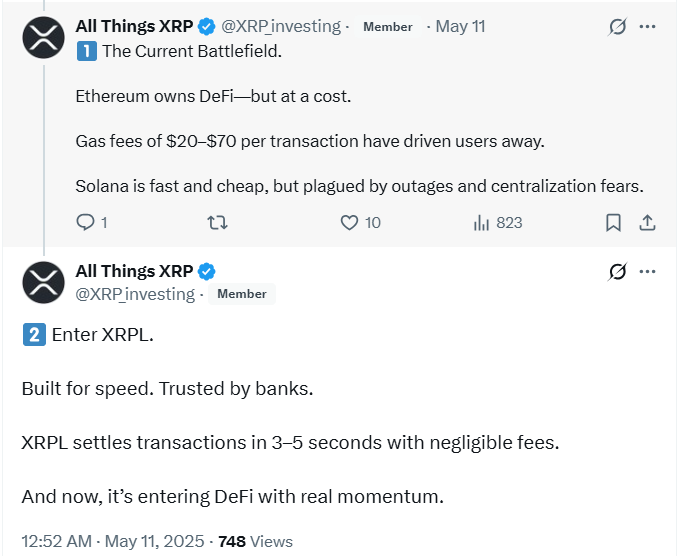

It is important to note that Ethereum and Solana have consistently ranked as the top blockchains for DeFi. Other protocols rely only upon Ethereum and Solana for their DeFi needs. However, All Things XRP claims XRP could win the DeFi race against Ethereum and Solana due to their inherent challenges.

The XRP community figure highlighted that the Ethereum gas fee is high, approximately between $20 and $70 per transaction. According to him, this high transaction cost has resulted in users moving away from the network.

Solana, on the other hand, although cheaper and faster, is burdened with network outages and fears of centralization over the years. However, All Things XRP perceives XRPL as the new DeFi force. He highlighted some of XRPL’s features, which make it a close rival to Ethereum and Solana.

According to him, the XRPL is built for speed and is trusted by banks. Compared to Etherem, XRPL settles transactions between 3 and 5 seconds with negligible fees. He added that, unlike traditional smart contracts, the XRPL Hooks will offer lightweight programmable transactions. With the introduction of Hooks, decentralized lending, yield farming, and automated payments will become fast and cheap.

Image Source: All Things XRP on X

Image Source: All Things XRP on XSome benefits of Hooks include security, efficiency, and simplicity. All Things XRP thinks these attributes make XRPL suitable for DeFi operations. Per the community figure, Hooks would enable users to run decentralized lending, yield farming faster, and make automated payments cheaper on the network.

The XRPL is already receiving real-world traction even without Hooks. For instance, CryptoTradingFund, built on XRPL, successfully processed $2.23 million in transactions during its beta phase. Major e-commerce companies like Amazon and Walmart are reportedly among its vendors.

Institutional Power Backing XRPL

All Things XRP further pointed out that XRPL has strong support from institutions like banks. As noted in our earlier post, SBI Holdings has integrated Ripple’s technology into various financial services, especially for cross-border payments. In addition, XRPL is bridging TradFi and DeFi by introducing Ripple’s stablecoin RLUSD and XRP ETF proposals.

Moreover, according to the expert, XRP has more global positioning than Ethereum. He highlighted that XRPL has received favorable regulatory treatment in the UAE and EU. The community figure thinks this regulatory edge boosts XRPL’s DeFi prospects globally.

Besides these developments, the XRPL has launched exciting updates. As we covered in our latest report, it recently introduced its compliance toolset with the “Deep Freeze” feature. The aim is to increase compliance and security and attract institutional trust.

In addition to the significant advancement on XRPL, the blockchain has focused on enhancing its stability and security in the past two years.

.png)

3 hours ago

1

3 hours ago

1

English (US)

English (US)