ARTICLE AD BOX

The post Why Crypto Market Is Down Today? DJT, S&P 500 & NASDAQ Slide Trigger Panic in Crypto appeared first on Coinpedia Fintech News

The global cryptocurrency market witnessed a broad downturn today, with total market capitalization falling by 1.68% to $3.39 trillion. Daily trading volume also dipped 5.27% to $133.81 billion, signaling cautious investor sentiment. The Fear & Greed Index currently sits at 61, still in the “Greed” zone, though edging downward as uncertainty clouds the outlook.

The decline follows a sequence of macroeconomic and political events that have rattled both crypto and traditional markets. Talking about Wall Street, the S&P 500 is down 0.27% at 6,022.24, DJT fell 1.87% to 20.52, NASDAQ dropped 0.50% to 19,615.88, and the Dow Jones slipped marginally by 0.0026% to 42,865.77.

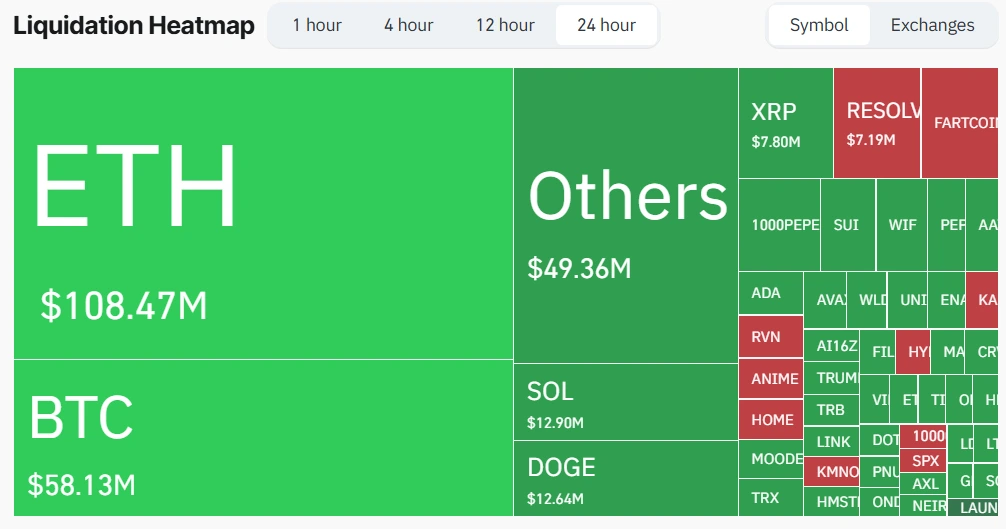

Liquidations Surge as Traders Get Caught Off Guard?

As price action turned against the bulls, liquidations began to mount. In the past 24 hours, 112,143 traders were liquidated, amounting to a total of $327.94 million wiped out across exchanges. The single-largest liquidation occurred on Binance’s BTCUSD perpetual pair, totaling $2.15 million.

Source: CoinGlass

Source: CoinGlassThe scale of the liquidations suggests that many traders were caught off guard by the rapid reversal in sentiment, especially those betting on a bullish continuation after the CPI dip. With leveraged positions wiped out across both long and short sides, volatility is expected to be present in the short term.

BTC & ETH in Red, Altcoins Hit Harder?

Bitcoin price is down 1.68% in the last 24 hours, now trading at $107,740.76. Its market cap stands at $2.14 trillion, with $53.99 billion in daily trading volume. Ethereum followed suit, dipping 1.11% to $2,760.10. Among the top altcoins, XRP dropped 1.87%, while Solana took a heavier bash with a 3.97% decline.

Top Gainers

- SPX6900: $1.68 (+6.63%)

- KAIA: $0.1695 (+3.14%)

- AB: $0.01167 (+2.64%)

Top Losers

- CRV: $0.6394 (-9.98%)

- JUP: $0.4553 (-9.39%)

- RAY: $2.26 (-9.38%)

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.png)

1 day ago

1

1 day ago

1

English (US)

English (US)