ARTICLE AD BOX

- BONK breaks resistance with rising momentum, trading above moving averages and signaling trend strength with an RSI of 73.85.

- A planned 1 trillion BONK token burn and ongoing buybacks could create long-term deflationary pressure on supply.

The price of BONK suddenly skyrocketed today, July 15, 2025. In the last 24 hours, this Solana-based token recorded a 6.21% increase, breaking through the $0.000028 level. That’s not just a number, it’s its highest peak in the last 30 days. Looking back, its performance has increased by more than 92% in a month. So it’s natural that many are starting to ask: what’s really going on?

BONK Rallies as Traders Chase Post-Bitcoin High Hype

The key lies in two things: the Bitcoin market is heating up again, and BONK is building a surprise behind the scenes. This morning, Bitcoin briefly broke a new record at $123,000. The effect? The market immediately shifted into “risk-on” mode—meaning, traders are starting to venture into riskier assets, including memecoins like BONK. It’s like a moment when someone just won the lottery and then recklessly buys items at a discount store. The euphoria is contagious.

BONK is not just following the crowd, either. According to CoinMarketCap, it broke through the key resistance level at $0.00002434 on July 11th and has remained above all its major moving averages since. Its 7-day moving average (MA) is currently hovering around $0.00002398. Furthermore, its 14-day RSI has touched 73.85—already quite hot, but not yet a “fire.”

Token Burn Countdown and Trader Activity Heat Up

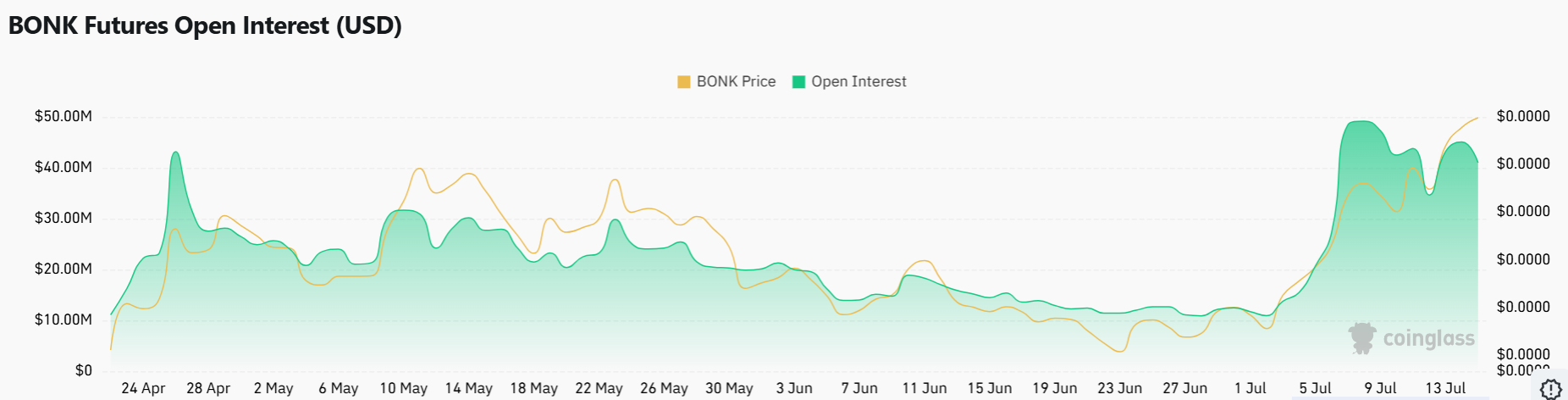

From a derivatives perspective, BONK trading volume rose by over 20% to $533 million. According to CoinGlass data, open interest (OI) also rose by 9% to $48 million. This means it’s not just casual traders entering, but also serious market players opening derivative positions. Rising volume and open interest together usually indicate real market excitement, not just mere hype.

Source: CoinGlass

Source: CoinGlassFurthermore, there’s a big plan in the pipeline, a 1 trillion BONK token burn. But this isn’t just a random burn. This action will only take place if the number of holders reaches 1 million wallets. Currently, it’s still at 943,000, so there’s only a little left. If this burn occurs, the supply will decrease by around 1.2%.

Furthermore, the BonkFun system also sets aside 35% of all fees for token buybacks. This kind of deflationary pressure usually increases market curiosity.

And there’s another agenda that’s quietly driving the price. The BONK token exchange program via Solana Saga mobile phones will close on July 31st. Of the total 20,000 tokens allocated, 17,599 have already been claimed. The rest? If not exchanged, they will be returned to the DAO Treasury.

Looking back, BONK has actually been building its foundation since last May. At that time, they partnered with the DeFi Development Corporation and shared validator nodes. This collaboration combined institutional strength with the appeal of the memecoin community. With the validator nodes they jointly manage, the staking ecosystem on the Solana network has also grown.

Furthermore, since early July, another factor has emerged that has fueled the price surge: ETF speculation. Tuttle Capital reportedly resubmitted its proposal for a 2x Long BONK leveraged ETF on July 1st.

While there’s no official green light yet, rumors like this alone are enough to stir up market activity. This is especially true at the same time as the staking and DeFi sectors in the Solana ecosystem are booming.

.png)

3 months ago

6

3 months ago

6

English (US)

English (US)