ARTICLE AD BOX

Exchange | ||||||

Rating | Winner Very good (5,0) | Good (4,8) | Good (4,6) | Good (4,4) | Good (4,2) | Good (4,0) |

Fees | 0,15% | 0,10% | 0,99% | 1,5% | 1% | 1% |

Cost per $1,000 | $1,50 | $1 | $9,90 | $14,90 | $10,00 | $10,00 |

Cost per $100,000 | $150 | $100 | $990 | $1,500 | $1,000 | $1,000 |

Fully licensed | ||||||

Security | ||||||

Details | Trusted by BlackRock | Super low fees | Big portfolio | Secure but expansive | Variety of Memecoins | Fast verification |

Link |

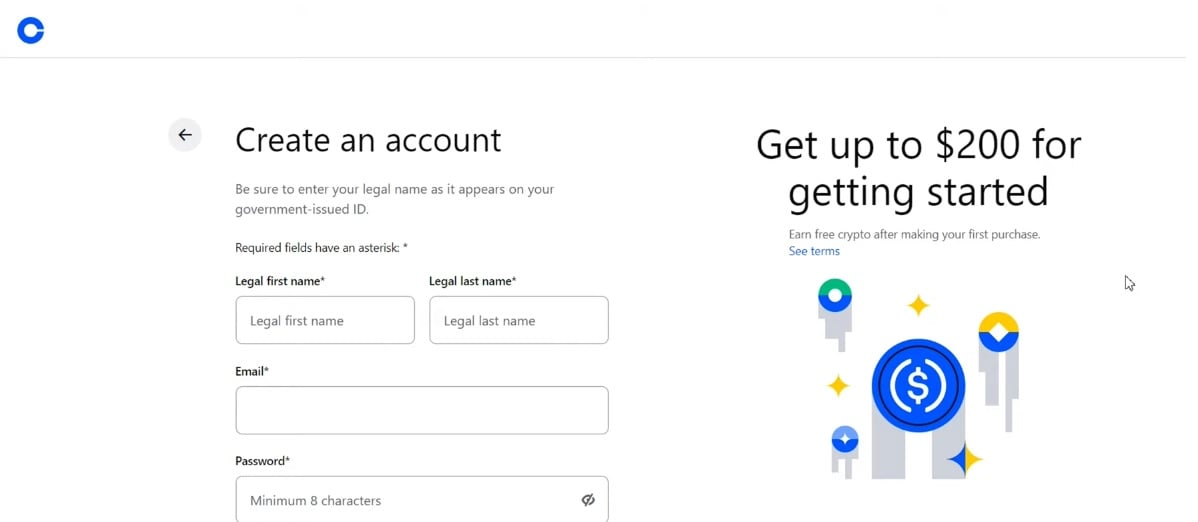

Buy Solana on Coinbase

Core Details about Coinbase

Coinbase stands as one of the most accessible platforms globally for trading Solana (SOL), offering extensive regulatory coverage. In the United States, the exchange is fully compliant, holding state money transmission approvals—including the BitLicense in New York—and registration with FinCEN. Internationally, Coinbase is also regulated in the UK and Germany.

Digital assets on Coinbase, including Solana, are protected with around 98% held in cold storage, significantly reducing exposure to cyber threats and hacks.

The user verification process is generally completed within 24–48 hours. At peak times, this may take longer and requires users to upload government identification and proof of address.

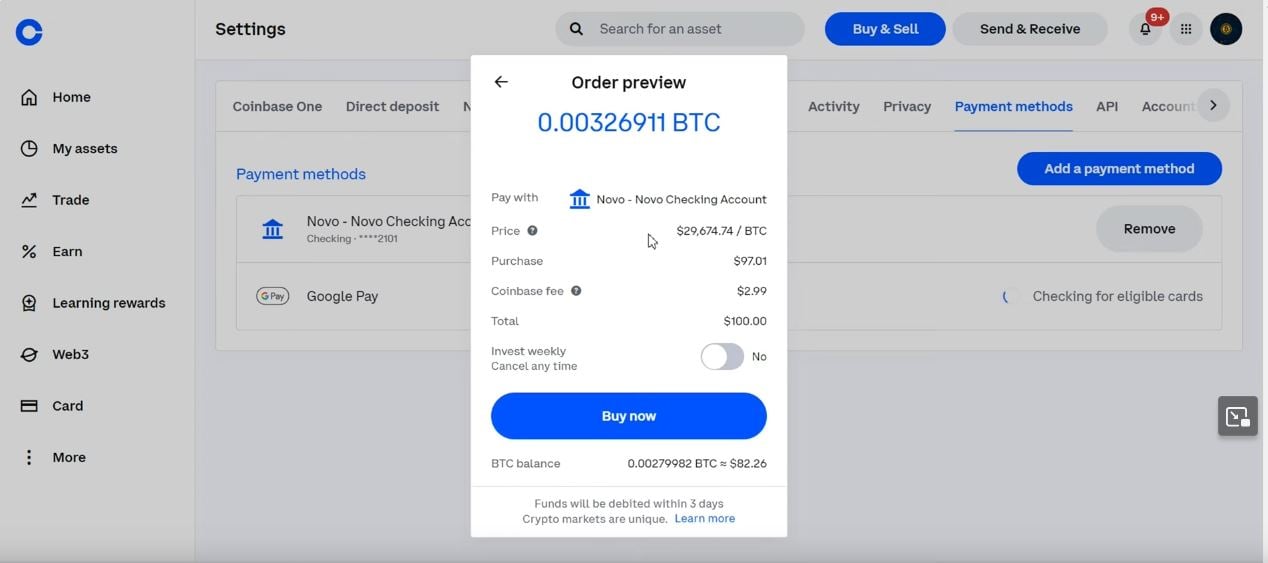

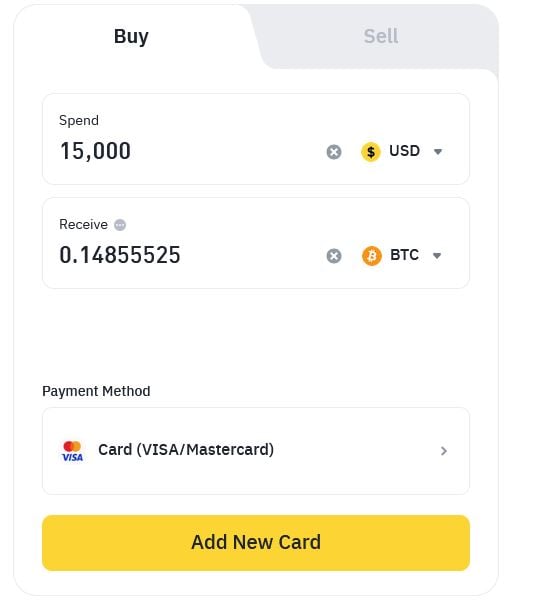

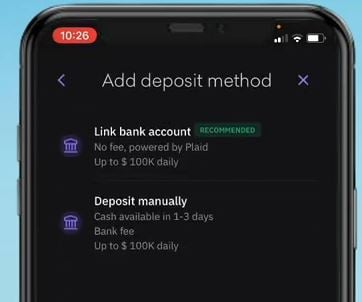

Coinbase provides multiple funding options, such as ACH transfers (no cost), wire transfers ($10 fee), debit cards (3.99% fee), and PayPal (2.5% fee).

Trading charges are volume-based on Coinbase Advanced:

-

For $1,000 transactions: 0.60% taker fee ($6), 0.40% maker fee ($4).

-

For $10,000 transactions: 0.40% taker fee ($40), 0.25% maker fee ($25).

-

For $100,000 transactions: 0.25% taker fee ($250), 0.15% maker fee ($150).

Support is available 24/7 via chat, email, and phone, but user satisfaction varies. Despite previous security incidents, there have been no significant losses of customer funds.

The table below presents the essential features:

Factor | Quick info |

License | US money transmitter, in S&P 500 since 2025 |

Fees | 0,15% |

Costs per $10.000 | $15,00 |

Support | 24/7 hotline & chat |

Security | ≈ 98% in cold storage. |

KYC Process & Limits | Video verification < 10 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Video Tutorial: How to Buy SOL on Coinbase

Why Buy Solana via Coinbase?

- Simple to Use: Designed for beginners and pros alike.

- Advanced Security: Two-factor authentication and insurance for stored crypto.

- Flexible Payments: Broad choice of deposit methods.

Buy Solana on Binance

Core Details about Binance

Binance is the leading exchange by trade volume, and is fully licensed—including a VASP authorization in Dubai and registrations in many EU nations—providing oversight by numerous regulators.

For institutional-grade security, Binance offers Ceffu, a custodial solution accredited under ISO 27001 & 27701 with SOC 2 Type 2. Users’ funds are safeguarded with cold storage and MPC key division, plus continuous risk analysis for extra peace of mind.

Binance users benefit from the SAFU insurance fund, currently worth about $1 billion, and receive monthly Merkle tree proof-of-reserves. Withdrawals require extra verification, and withdrawals are locked if account recovery is triggered.

Withdrawals are fast, and trading commissions start as low as 0.10%, dropping to 0.075% when paying with BNB, keeping Binance among the most affordable options.

With 24/7 support and both simple and advanced trading interfaces, Binance delivers a robust, flexible, and low-cost environment for Solana traders.

Key features in summary:

Factor | Quick info |

License | US money transmitter |

Fees | 0,10% |

Costs per $10.000 | $10,00 |

Support | 24/7 hotline & chat |

Security | ≈ 90% in cold storage. |

KYC Process & Limits | Video verification < 60 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Binance Video Tutorial: Trading SOL

Pro Tips for Solana Traders

- Leverage: Binance offers leveraged trading for those seeking greater exposure (note: this increases risk).

- Account Security: Always enable two-factor authentication and consider Binance’s insurance options.

How to Buy Solana on Kraken

Kraken Overview: Solana Trading

Kraken stands out as a global platform for trading Solana (SOL), holding multiple licenses—such as FinCEN Money Services Business and Wyoming SPDI bank status in the U.S., registration as a Restricted Dealer in Canada, FCA approval in the U.K., full VASP and EMI credentials in Ireland/EEA, AUSTRAC status in Australia, and a Bermuda digital asset license.

Security is a priority, with approximately 95% of all digital assets kept in air-gapped, multi-signature cold wallets. Kraken’s reserve audits prove this, and KYC for new users is typically cleared in under 30 minutes, with more complex checks resolved within a day.

Funding your Solana trades is convenient: SEPA, FPS, ACH, and Fedwire are free, while SWIFT costs $3–5; PayPal and crypto deposits have no fee, and card purchases are charged at 3.75% plus €0.25. Withdrawals, whether fiat or crypto, are competitively priced, with Lightning SOL transfers available for smaller transactions.

Kraken Pro’s fee model is transparent: starting at 0.25% for makers and 0.40% for takers. For SOL trades, this translates to roughly $4, $40, and $400 in fees on $1,000, $10,000, and $100,000 trades; active traders benefit from reduced fees at higher volumes.

Round-the-clock support is provided through chat, phone, and tickets. Chat responses are often instant, while email support times can fluctuate with demand.

No client asset has ever been lost due to exchange breaches: while a 2024 exploit resulted in a temporary $3 million exposure (since recovered), and social-engineering attacks in 2025 were neutralized before impacting funds.

Find the essential Solana trading facts in the table below:

Factor | Quick info |

License | US money transmitter and worldwide licences |

Fees | 0,16% |

Costs per $10.000 | $16,00 |

Support | 24/7 hotline & chat |

Security | ≈ 90% in cold storage. |

KYC Process & Limits | Video verification < 120 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Step-by-Step Video Guide: Buying Solana (SOL) on Kraken

Why Use Kraken to Buy Solana?

- Easy-to-Navigate Platform: Designed for both beginners and professionals for a smooth Solana trading experience.

- Best-in-Class Security: Includes cold storage, two-factor authentication, and insurance coverage for assets in custody.

- Competitive Fee Model: Kraken’s transparent and affordable fees help you keep more of your investment.

- Flexible Payment Methods: A variety of deposit and withdrawal options, including bank transfer, card, and wire, to match your needs.

How to Buy Solana on KuCoin

KuCoin: Solana Trading Essentials

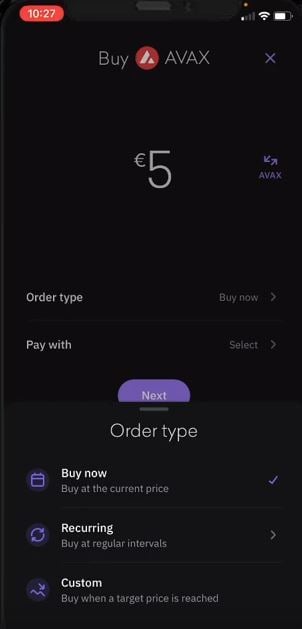

KuCoin is a Seychelles-registered platform, boasting a VASP license in India, ongoing MiCA licensing in the EU, and collaboration with Thai regulators. Note that KuCoin does not serve U.S. clients following its 2025 agreement to exit the American market for two years.

KuCoin’s Proof-of-Reserves always covers over 100% of user assets, with monthly reporting for SOL, BTC, ETH, and stablecoins. Most holdings are in secure, air-gapped cold storage.

Basic ID verification is rapid—often under 10 minutes—with advanced KYC available for greater withdrawal limits and fiat access.

Crypto deposits have no fee; SEPA Instant is priced at 0.08% plus €0.30. Peer-to-peer (P2P) trading is zero-fee; card transactions incur about 3.5%.

Spot trading fees for SOL start at 0.10% for both makers and takers, and can be discounted 20% by using KuCoin’s KCS token. Support is 24/7 via chat and ticket; most issues are resolved in under half an hour.

While KuCoin faced a $281M hot wallet breach in 2020 (with all client funds returned), there have been no subsequent losses due to enhanced security practices.

See the summary table below for the most important details:

Factor | Quick info |

License | US money transmitter and worldwide licences |

Fees | 1% |

Costs per $10.000 | $100,00 |

Support | 24h Hotline & Chat |

Security | ≈ 50% in cold storage. |

KYC Process & Limits | Video verification < 120 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Watch: Step-by-Step Tutorial for Buying Solana on KuCoin

Advantages of Buying Solana on KuCoin

- Beginner-Friendly and Advanced Features: KuCoin delivers an intuitive yet powerful trading environment for every skill level.

- Multi-Layer Security: From 2FA to cold storage, KuCoin prioritizes protecting your assets.

- Transparent, Low Fees: Base trading fees of 0.10%—and 0.08% with KCS—make trading cost-effective.

- Vast Payment Options: Choose from dozens of deposit and withdrawal channels globally.

Buy Solana on OKX

OKX Platform: Essential Details for Solana Buyers

OKX, with headquarters in Seychelles, provides Solana (SOL) trading to global users and operates under a crypto service provider registration at De Nederlandsche Bank (DNB) for European clients. As of January 2025, OKX was awarded a comprehensive Markets-in-Crypto-Assets (MiCA) licence, allowing seamless services across all 28 EEA member states from its Malta base.

In the United States, OKX agreed in early 2025 to significant regulatory settlements, including a $504 million penalty and third-party oversight through 2027. The US version is now isolated and operates under a new compliance framework, but OKX has no federal or state MSB/MTL authorisation.

OKX ensures transparency by releasing monthly Proof-of-Reserves audits, regularly showing over 100% asset coverage (as of May 2025: SOL and other major assets verifiably backed, $28 billion in holdings).

The KYC process is streamlined—entry-level verification with photo ID and selfie is auto-approved within a minute, rarely exceeding a day; advanced checks can take up to two business days during busy periods.

Crypto deposits for Solana are free. EUR SEPA, iDEAL, and Bancontact transfers incur zero platform fees (your bank may charge separately). Card purchases using Simplex or Banxa attract a 3.5% fee (minimum $10).

OKX’s spot trading for SOL starts at a 0.14% maker and 0.23% taker fee. Example: a $1,000 trade is $1.40/$2.30 in fees; $10,000 is $14/$23; $100,000 is $140/$230. Holding OKB tokens can lower fees by up to 40%.

The exchange provides 24/7 live chat and ticket support. Queue times are typically under 15 minutes, though overall service reviews average 2.7/5.

In late 2020, OKX temporarily froze withdrawals for five weeks due to security investigations, but all user funds were later released and no losses were reported since.

See all vital details in the summary table:

Factor | Quick info |

License | US money transmitter and worldwide licences |

Fees | 1% |

Costs per $10.000 | $100,00 |

Support | 24h Hotline & Chat |

Security | ≈ 50% in cold storage. |

KYC Process & Limits | Video verification < 120 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Step-by-step video tutorial: Buying Solana on OKX

Advantages of Buying Solana with OKX

- Intuitive Interface: OKX web and mobile apps are easy to use for both beginners and advanced Solana traders.

- Comprehensive Security: Multi-signature cold wallets, robust authentication, and real-time Proof-of-Reserves reports.

- Cost-Effective Trading: Transparent fees, with deep discounts available for OKB token holders and frequent traders.

- Extensive Payment Options: Over 100 global and local on-ramps for convenient and fast deposits and withdrawals.

Buy Solana on Anycoin

Solana Trading: Key Features on Anycoin

Licensing – Phoenix Payments B.V. operates as a Virtual Asset Service Provider registered with De Nederlandsche Bank (DNB) and has additional approvals in Austria and Germany. Anycoin does not accept U.S. clients and geo-blocks U.S. IPs.

Custody – Client SOL and other coins are safeguarded in dedicated cold wallets, with on-chain proof-of-reserves available at all times.

KYC – Digital identity and selfie checks are typically completed in less than an hour, or the next business day if submitted after hours.

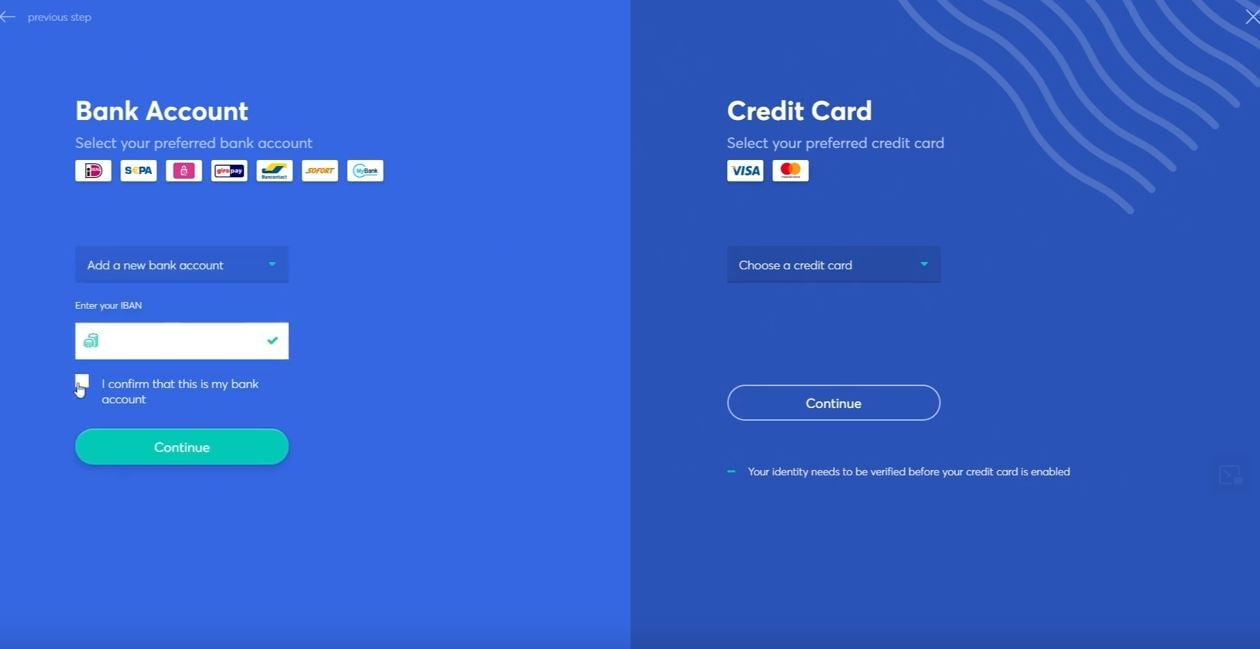

Deposits – EUR funding by SEPA, iDEAL, and Bancontact is free; Sofort, Giropay, or EPS charge about 1%; PayPal is around 1.5%; Visa/Mastercard purchases cost about 2.5% plus €0.25. Crypto transfers, including SOL, are free except for network costs.

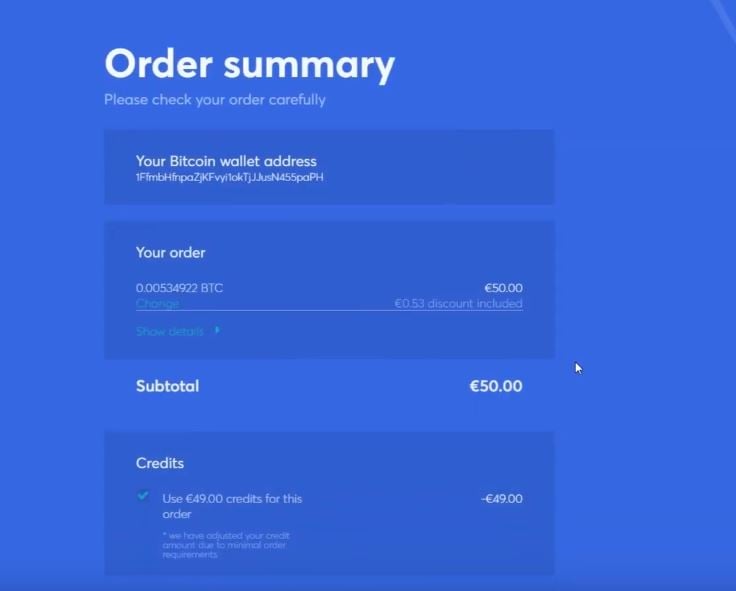

Trading fees – Anycoin applies a transparent 1% fee for all trades (2% for select high-volatility tokens). A $1,000 Solana buy costs $10, $10,000 is $100, and $100,000 is $1,000. Network withdrawal fees are charged at cost.

Support – Live-chat, email, and phone assistance are available around the clock, with typical response times under five minutes. Anycoin holds a 4.4/5 Trustpilot score.

Security record – Since its launch in 2013, Anycoin has never suffered a customer-fund loss or successful hack.

The main details are captured in the summary table:

Factor | Quick info |

License | US money transmitter and worldwide licences |

Fees | 1% |

Costs per $10.000 | $100,00 |

Support | 12h Hotline & Chat |

Security | ≈ 50% in cold storage. |

KYC Process & Limits | Video verification < 20 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Step-by-step video guide: How to Buy Solana on Anycoin

Why Choose Anycoin for Solana?

- Streamlined Experience: Simple and modern trading for everyone.

- Serious Security: High-level protection including cold storage and full transparency.

- Focused Coin Selection: Buy Solana and other leading cryptocurrencies with confidence.

- Reasonable Fees: Competitive and easy-to-understand costs on all trades.

- Quick Service: Fast verification, deposits, and withdrawals every day of the week.

Buy Solana on Bybit

Key Facts About Bybit for Solana Traders

Bybit is registered with Dubai’s Virtual Assets Regulatory Authority (VARA) and operates in the UAE with a provisional MVP license for custody and exchange. The platform is also licensed as a Crypto-Asset Provider in Cyprus, extending services across the European Economic Area. There is no U.S. license—residents of the United States are geo-blocked from Bybit access.

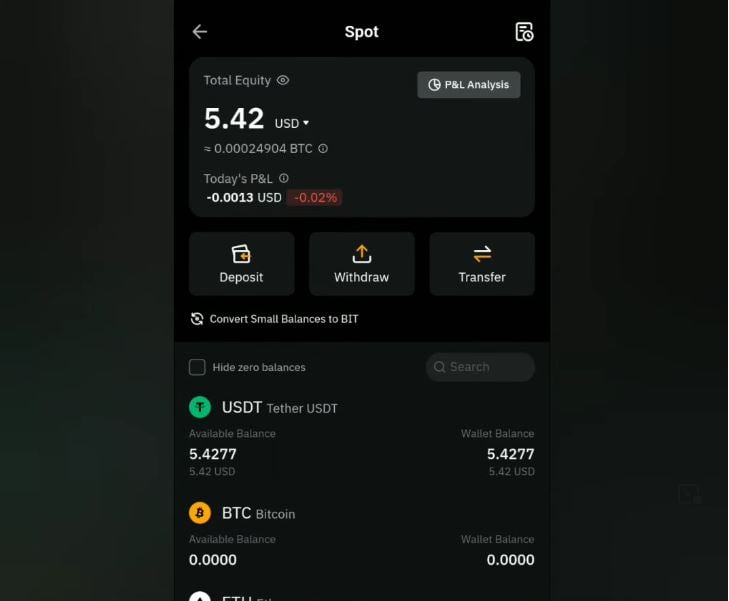

Digital assets—including Solana (SOL)—are held in secure, multi-signature cold storage, with only a small fraction kept online for withdrawals. Bybit publishes wallet addresses and independent attestation reports confirming 100% collateralization. ID and selfie KYC checks are typically approved within 30 minutes, and rarely take more than a day.

Deposits are flexible: crypto transfers (free), SEPA or Faster Payments via open banking (usually 0–1%), and credit/debit card top-ups (1.1–3.5% via partners like Banxa, MoonPay, or Simplex). A zero-fee peer-to-peer fiat marketplace is also available for direct currency exchanges.

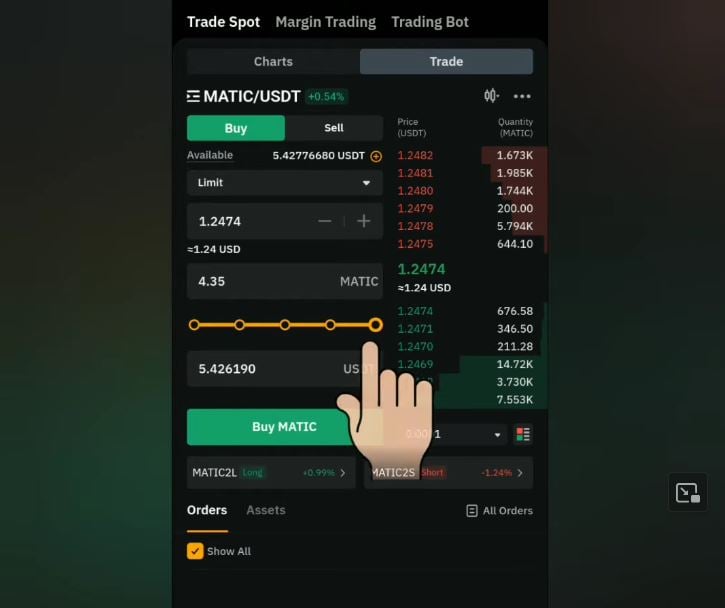

Trading Solana on Bybit is highly cost-effective, with spot trading fees starting at 0.10% for both makers and takers for VIP-0 users. For example, a $1,000 SOL trade costs $1.00 in fees, $10,000 is $10, and $100,000 costs $100. Higher-volume traders can unlock even lower rates—down to 0.06% (maker) and 0.075% (taker) through the Bybit VIP program.

Customer service is available 24/7 via live chat, support tickets, and Telegram. Typical wait times are under five minutes. Following a major security event in February 2025, where a phishing exploit briefly compromised some ETH cold storage, Bybit fully reimbursed users and implemented strict new controls for all digital assets including Solana.

Here’s a summary table with the most important details:

Factor | Quick info |

License | US money transmitter and worldwide licences |

Fees | 1% |

Costs per $10.000 | $100,00 |

Support | 24h Hotline & Chat |

Security | ≈ 50% in cold storage. |

KYC Process & Limits | Video verification < 120 min |

Tax & Reporting Tools | CSV/API exports, annual tax reports |

Video Guide: How to Buy Solana on Bybit

Advantages of Using Bybit for Solana

- Powerful Trading Tools: Bybit supports advanced features like margin and leveraged trading, plus a diverse selection of assets, ideal for both new and experienced Solana investors.

- Lightning-fast Execution and Deep Liquidity: Orders are filled rapidly, ensuring optimal prices even in volatile conditions.

- Security-First Approach: All user funds benefit from 2FA, robust cold storage protocols, and insurance coverage.

- Trade Anywhere: Bybit’s fully featured mobile apps keep you connected on the go.

- Minimal Fees: Low-cost trading means more of your investment goes into Solana, not fees.

- 24/7 Customer Support: Round-the-clock help is always available via live chat and other channels.

.png)

4 months ago

9

4 months ago

9

English (US)

English (US)