ARTICLE AD BOX

- Bitcoin’s failure to break $98,000 keeps bulls nervous as traders aggressively book profits near $95,000, fueling caution.

- High selling pressure with 86% of supply in profit raises correction risks, despite ETF inflows keeping some bullish sentiment alive.

Bitcoin moved into the critical phase during the last week after it did not surpass the resistance at $98,000 on May 2. The daily candles since taking off on April 22 reached as high as $93,000 and as low as $97,900, but no close higher than $97,440 has occurred, leaving bulls under tension. The range-bound movement avoids the clear trajectory for leading cryptocurrency.

Source: TradingView

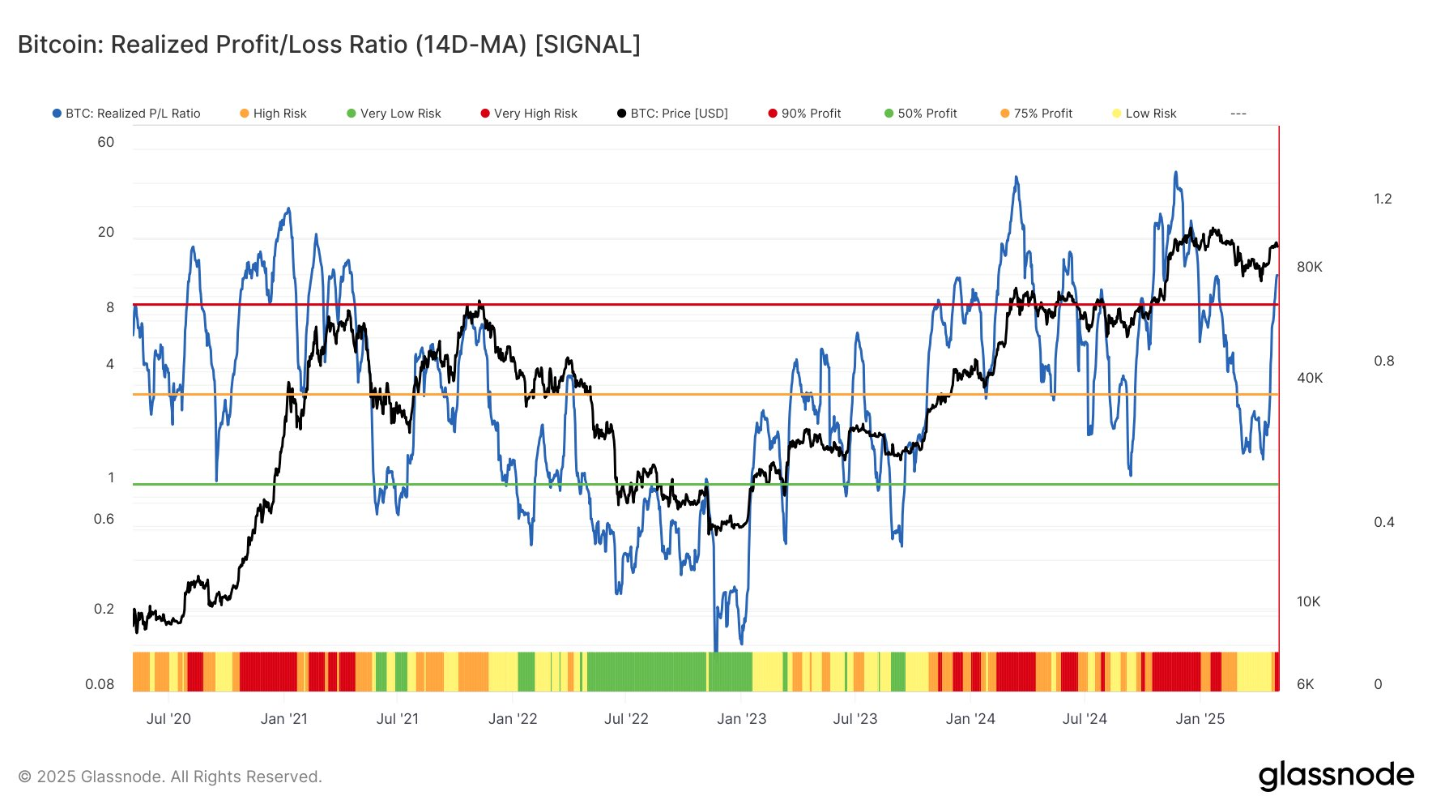

Source: TradingViewThe market has witnessed increased profit-taking in the last few days, particularly at the level of about $95,000. Traders were quick to make gains, and selling pressure was evident as a result. The cryptocurrency’s realized profit/loss ratio has increased, affirming that most of the action is about booking profit at higher prices instead of buying the strength.

Risk of Correction as Supply in Profit Hits 86%

CryptoVizArt.₿, Glassnode’s senior researcher, noted that the breakout into the $93,000–96,000 range has led to the profit-taking volume being higher than the statistical range. This tells us there are greater numbers of Bitcoins being sold at a profit than is normally the case. The trend occurs at market tops and can precede correction phases as long as it continues.

The figure shows that for each dollar earned in loss, there has been an excess of greater than $9 booked in terms of profit. CryptoVizArt.₿ noted:

The fact that the price is still above $93,000 is very surprising, which in my humble opinion is also risky.

With 86% of the supply of bitcoins in profit, there is history to imply that there is an unstable balance: though the figure is one to be bullish about, high levels tend to induce active profit-taking by short-term speculators.

Source: Glassnode

Source: GlassnodeAnalyst Checkmate observed that Bitcoin is at a crucial decision moment, emphasizing that breaking decisively beyond the recent range is vital. Anything short of an upward close at or above $95,000 risks sending Bitcoin into the broader correction phase. True enough, on May 4, the price of BTC plunged below $95,000 after spiking to $97,000, as investors continued to take out cash.

Bulls Eye ETF Flows, Bears Watch $90,000 Floor

Optimism for the Bitcoin spot ETFs may provide the bulls with the energy they are looking for. The ETFs were reportedly on the receiving end of $1.8 billion of inflows last week, something that may provide the boost to buying sentiment. The midweek Federal Reserve interest rate decision is also another potential catalyst for market direction.

Bears, on the other hand, seek to keep the pressure on by defending the resistance at $98,000. Their objective is to move prices downwards towards $92,000 and perhaps further. If the cryptocurrency falls below that level, the next resistance is at $90,000, an important level at which the 100-day and 200-day simple moving averages meet.

Any breakdown below the level of $90,000 would transfer focus to the range of $85,000–$75,000, which would in effect nullify the gains accumulated since the 90-day tariff reprieve.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)