ARTICLE AD BOX

- Traders await the implications of Jerome Powell’s speech, PCE data, and Initial Job Claims on crypto prices.

- Bitcoin volatility continues, with the price now pegged at the $101,000 level.

Crypto traders and investors are examining three US economic trends that could shape the market this week. Given the ongoing price volatility, they are particularly interested in the implications for Bitcoin (BTC).

According to Lisa Abramowicz, co-host at Bloomberg Surveillance, the US Economic Surprise index has turned the most negative this year. Also, several economic indicators are becoming weaker than analysts initially expected. Against this backdrop, Jerome Powell’s speech, PCE data, and Initial Job Claims could shape crypto prices this week.

Jerome Powell Speech

Federal Reserve Chair Jerome Powell will address the House Financial Services Committee on Tuesday, June 24, 2025. The speech is part of his semiannual commitment to give Congress the Federal Reserve’s monetary policy report.

Jerome Powell will testify before the House Financial Services Committee and the Senate Banking Committee on the US economy, inflation, monetary policy, and employment. The Fed Chair will also have a question-and-answer session with lawmakers. This session will provide clarity on future Fed policy and can influence financial markets.

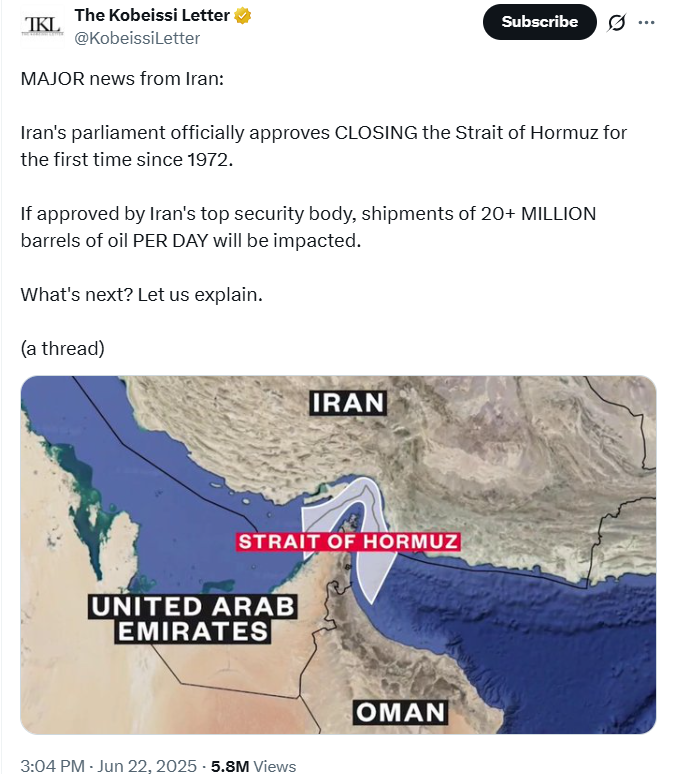

Powell’s testimony is particularly important given the US role in the ongoing geopolitical tension in the Middle East. Iran’s parliament has reportedly approved closing the Strait of Hormuz for the first time since 1972. This decision threatens about 25% of global oil flow and spurs energy risk.

Image Source: The Kobeissi Letter on X

Image Source: The Kobeissi Letter on XThus, Powell’s comments on rate policy responding to energy shocks are crucial, particularly for crypto. As we discussed earlier, the crypto market is already experiencing volatility as the geopolitical tensions between the U.S. and Iran intensify.

Meanwhile, the Fed recently decided to leave interest rates unchanged despite political pressure from President Donald Trump. Powell’s hawkish speech may lead to a further price downtrend for Bitcoin. On the other hand, a dovish tone, hinting at rate cuts, could boost the price of Bitcoin.

Personal Consumption Expenditures (PCE)

This week, another US economic indicator with crypto implications is Personal Consumption Expenditures. It measures the average price change for goods and services consumed by US households.

The Fed prefers to use PCE to measure inflation due to its broad scope and ability to account for consumer substitution. In April, the PCE indicator rose 2.1% year-over-year, with core PCE at 2.5%. According to MarketWatch data, economists project the May PCE to rise to 2.3%, while core PCE is forecasted to reach 2.6%.

If the PCE exceeds expectations, it could signal persistent inflation, weakening the dollar. Considering the Middle East tensions, it could also pressure the Bitcoin price. However, a lower PCE may boost Bitcoin by raising hopes for a rate cut.

As of this writing, Bitcoin price was trading at $101,344, down 1.3% over the past day.

Initial Job Claims

Finally, the crypto market will watch the initial jobless claims this week. Notably, the US labor market is progressively becoming a formidable macro factor for Bitcoin and the broader crypto market.

US citizens filing for unemployment insurance for the week ending June 14 reached 248,000. The claims are unchanged from the week prior and above expectations of 242,000. Ongoing claims hit their highest level since November 2021.

Rising claims could signal economic shifts, potentially boosting Bitcoin as traders anticipate Fed rate cuts. However, lower claims may strengthen the dollar, pressuring crypto prices.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)