ARTICLE AD BOX

- The Senate Bill (SB 21), which seeks to establish a strategic Bitcoin reserve in Texas, is expected to undergo its third reading today.

- The bill is reported to have been amended to ensure that assets under consideration successfully maintain their market cap above a specific threshold for 24 months.

In a recent update, CNF discussed the Senate Bill (SB-21) introduced by Texas Representative Giovanni Capriglione to establish a strategic Bitcoin reserve. According to that report, the Texas Senate Business and Commerce Committee voted unanimously to approve it, setting it up for further deliberation on the Senate floor.

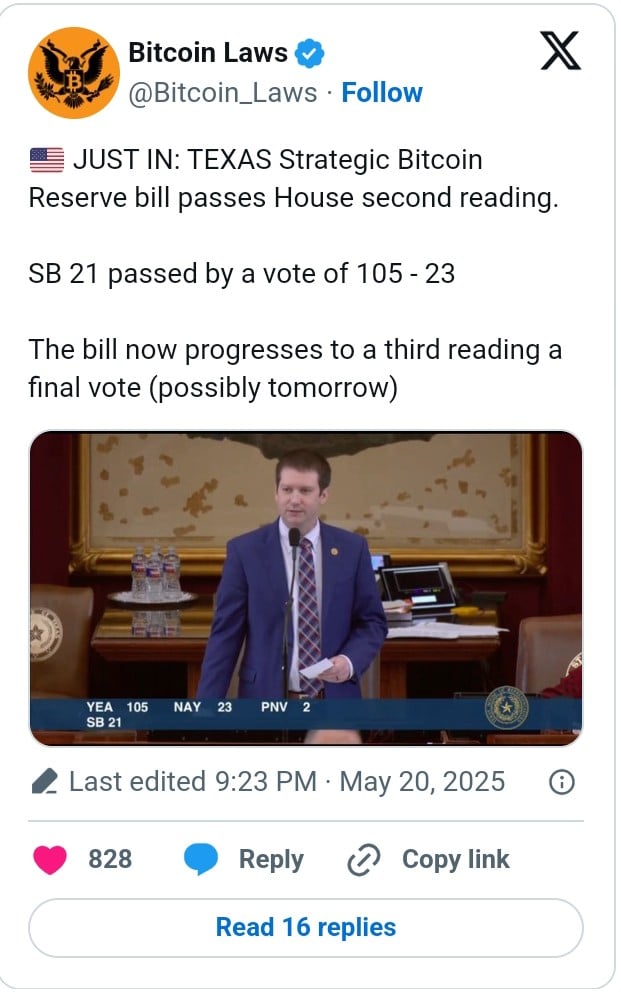

Today, the bill nears its final approval after passing the second reading in the House with a strong vote of 105 – 23. According to the information disclosed by a crypto Watchdog, the third reading has been scheduled for today, May 21.

Meanwhile, the bill has been amended to increase the length of time the market cap of a crypto asset could be strictly monitored for inclusion, from 12 months to 24 months. In other words, an asset would have to sustain its valuation above a minimum threshold to stand a chance of qualifying.

While the ongoing legislative process marks a huge milestone and a significant advancement for this development, it does not represent a complete victory. According to experts, the legislative session will end on June 2. This implies that the bill will have to pass a final vote by then.

More on the Texas Bitcoin Reserve Bill

Speaking to members on this jaw-dropping initiative, Capriglione, is noted to have pointed out that the bill is a forward-thinking measure that ensures that digital assets are recognised as strategic opportunities rather than a mere trend. According to him, its implementation would strengthen the federal fiscal resilience, positioning the state in a leading role as far as the evolution of the digital economy is concerned.

Under the rule of the state, Gov. Greg Abbott has until 10 days to make a decision, either to sign the bill, veto it, return it, or let it become a law without appending his signature. Interestingly, this particular bill is reported to reflect the legislative priorities of the State as mentioned in our previous news brief.

The strong voting by the House, according to experts, implies that the bill could possibly escape a veto. While this appears to resonate with the majority of the members, the few who voted “No”, including Rep. Ron Reynolds, D-Missouri City, believe that the SB-21 offers little oversight. According to him, the bill could only favour wealthy private investors and encourage risky investments.

So I thought it was probably too volatile for us to really be doing it based on the taxpayers’ expense, and at the risk of the general public.

Currently, no specific amount has been quoted in the bill. According to reports, this could be clarified in a Senate budget in the coming weeks or months.

The establishment of a strategic Bitcoin reserve has recently been a major move by most States, with New Hampshire becoming the first to establish the fund, as detailed in our earlier news story. According to our earlier publication, 20 states had proposed a Bitcoin reserve bill as of February 2025. Fascinatingly, the Montana House of Representatives voted against it, as also noted in our previous discussion.

.png)

6 hours ago

2

6 hours ago

2

English (US)

English (US)