ARTICLE AD BOX

- The price of Starknet (STRK) recorded a sudden surge to its weekly high of $0.21 before declining to $0.1596 at press time.

- An analyst has noted that the connection between Starknet and Zcash transcends their technical capabilities, as they have the same co-founder.

The native token of Starknet, STRK, is currently taking the market by storm as it steadily climbs up the rankings to become the 85th largest crypto by market cap.

Market data shows that STRK has lost 12% of its value in the last 24 hours. However, its massive surge over the past few days is evident on the weekly price chart, where 55% of the gains remain intact.

Looking into its price movement in the past few days, we found that STRK made a 35% surge on Monday when its trading volume was hovering around $500 million. Today, its daily trading volume has moved to $731 million. Interestingly, this is a drop from the $832.16 million recorded earlier.

According to CoinMarketCap, STRK has surged by 38% over the last 30 days and 13% over the last 90 days. The price was also hovering around $0.1594 at press time after declining from its weekly high of $0.21.

Reason For the Sudden Upsurge of STRK Price

Investors are reported to have realized that Starknet has many similarities with Zcash and is even the next evolution of the privacy coin. According to reports, Starknet can verify the same Zcash proof on-chain.

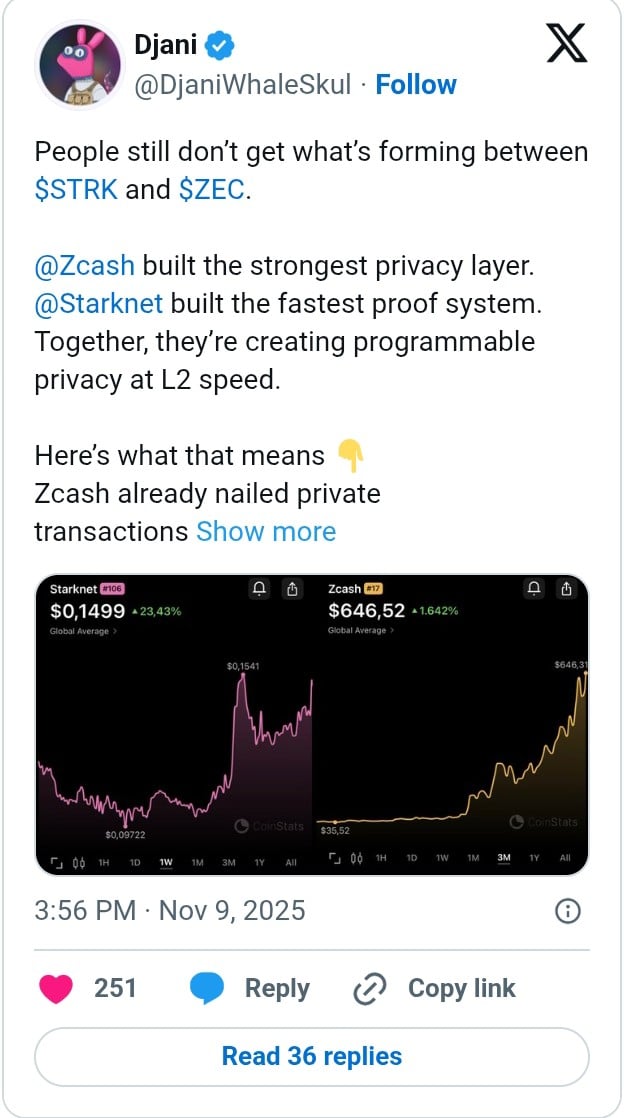

Explaining this, an analyst known as Djani noted that these two projects are on course for massive transformation, with Zcash building the strongest privacy layer and Starknet building the fastest proof system.

Today, it is one of the most actively developed blockchain projects within the industry, as mentioned in our earlier discussion.

Zcash already nailed private transactions through zero-knowledge proofs. You can shield your transactions. Starknet can now verify those same proofs directly on-chain. That means you could move ZEC into Starknet and use it privately across DeFi, perps, agents, or games all while staying shielded.

According to Djani, Starknet has become the fastest programmable layer, while Zcash still remains as the encrypted vault. Fascinatingly, the most interesting aspect of these projects is the fact that they were both co-founded by Eli Ben-Sasson.

As detailed in our previous news brief, Ben-Sasson built StarkWare to scale Ethereum and Bitcoin using ZK-STARKs.

Apart from this jaw-dropping development, Starknet has teamed up with Bitcoin research firm Alpen Labs to develop a highly secured and trust-minimized bridge to connect its network to that of Bitcoin. Technically, this would ensure that Bitcoin holders on the Starknet platform have access to advanced Decentralized Finance (DeFi) capabilities.

It is important to note that this type of collaboration has been mentioned in the broader “BTCFi on Starknet” initiative and first outlined in March 2025.

With all of these happening, analysts expect another rally for the price of STRK. According to analyst Captain Faibik, the next move could see the asset recording a 300% surge. As noted in our previous analysis, Faibik believes that STRK could reach the $0.62-$0.65 range in the future.

Zcash is also expected to follow suit as BitMex co-founder Arthur Hayes reveals that it is the second-largest liquid asset in the Maelstrom family office portfolio, behind Bitcoin, according to our recent update. As indicated in our earlier publication, this asset has surged by more than 700% since September.

.png)

7 hours ago

2

7 hours ago

2

English (US)

English (US)