ARTICLE AD BOX

- Solana’s SOL/ETH pair broke key support, a wedge pattern hints at a 40% drop by July.

- Memecoin slowdown and Ethereum layer-2 growth weaken Solana’s traction with developers and traders.

Solana‘s extended rally against Ethereum is set to end. On May 29, the SOL/ETH pair confirmed a bearish breakout from a rising wedge pattern that had resisted for months. This trend, evident in the long-term charts, signals a forecasted decline to 0.037 ETH in July, which is 40% down from current levels.

Source: TradingView

Source: TradingViewThe rising wedge pattern has a reputation among analysts for signaling substantial downward moves, and Solana’s current path fits that historical pattern. The 50-week exponential moving average sits near 0.06286 ETH, acting as the last notable support before further declines.

The rising wedge pattern is well known to analysts as a precursor to big declines, and Solana’s trajectory thus far is in line with that pattern of the past. The 50-week exponential moving average is close to 0.06286 ETH, the last meaningful support before more declines.

If SOL closes below that average, it may confirm a prolonged fall. There is some chance of a bounce back if prices recover the lower end of the wedge, but that would only delay rather than reverse the broader picture. A decisive breakout above the top line of the wedge would be needed to completely cancel the crash setup.

Memecoin Cooling Accelerates Solana’s Downturn

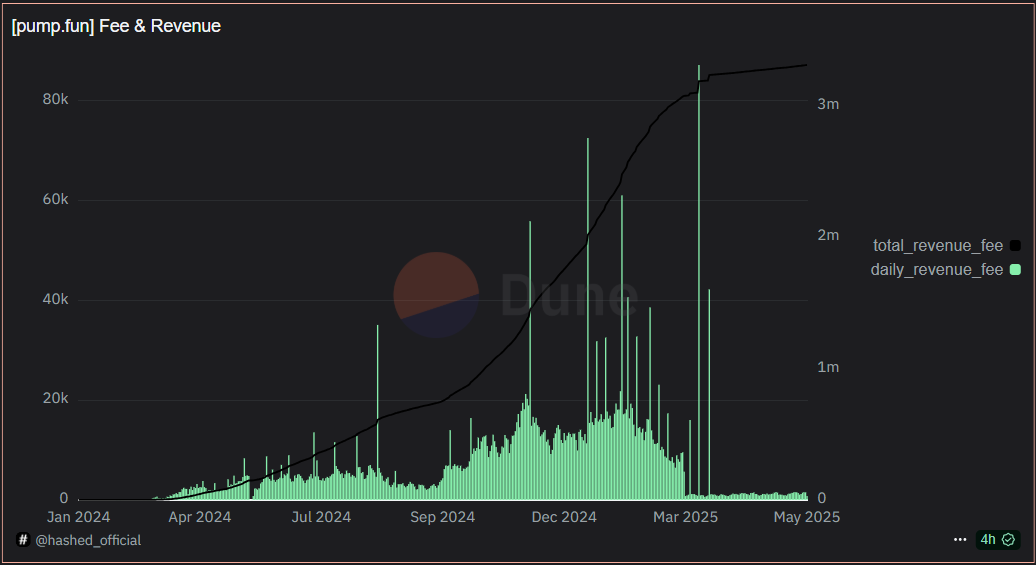

A steep drop in memecoin-related activity has added pressure. Pump.fun, the leading launchpad for such tokens on Solana, has seen daily fee revenues drop sharply since early April. According to Dune Analytics, fees that once surged during the first quarter of 2025 are now hovering near yearly lows.

Source: Dune Analytics

Source: Dune AnalyticsFrom December 2024 to March 2025, this platform drove a large part of Solana’s revenue gains, with total cumulative fees exceeding 3 million SOL during that stretch. That momentum has reversed in the months since, pulling away one of the key sources of demand on the chain.

With speculation fading, Solana is now under scrutiny from analysts and institutional watchers. A recent report dated May 27 from Standard Chartered issued a warning, suggesting Solana’s heavy reliance on memecoins could turn into a long-term weakness if not addressed soon.

Ethereum Gains as Solana Falters

Meanwhile, Ethereum appears to be gaining ground with scalable layer-2 networks. These upgrades provide comparable transaction fees but offer more infrastructure for practical applications beyond speculation. This contrast has raised concerns about Solana’s staying power among serious developers and investors.\

Chart analyst Alex Clay stated, “Ethereum outperformance season has already arrived,” and pointed to the same wedge breakdown pattern on the SOL/ETH chart as confirmation. His view adds weight to the possibility that Solana’s decline may not be temporary.

Other altcoins have shown stronger technical behavior in recent weeks. Tokens like SUI, TAO, and XMR have managed to retrace back above key levels and have shown consistent strength after breakout efforts. In comparison, Solana has failed to maintain those same thresholds and faltered quickly after making new highs.

.png)

1 day ago

3

1 day ago

3

English (US)

English (US)