ARTICLE AD BOX

- Large Bitcoin outflows and inflows of stablecoins suggest whales are regaining confidence as risk appetite returns to the crypto market.

- Despite volatile liquidations, Bitcoin holders stay firm, signaling trust in the long-term outlook amid shifting risk sentiment.

One thing that can’t be ignored this week: the risk appetite of the big players seems to be starting to return. Whale activity on Binance is becoming more visible, and not on a small scale. Amr Taha, an on-chain analyst at CryptoQuant, noted that there was a withdrawal of almost 4,500 BTC from Binance in just one incident on June 16.

An amount that large doesn’t happen every day, and it’s not usually a random action either. Interestingly, this moment coincided with two stablecoin inflows worth more than $400 million each, in just three days.

Source: CryptoQuant

Source: CryptoQuantBitcoin Withdrawals and Stablecoin Inflows Signal Market Readiness

If we draw a common thread from this incident, there is a pattern that looks quite clear. Most likely, this is a form of risk appetite returning—where big investors are preparing to pour funds into the crypto market, especially Bitcoin. Large Bitcoin withdrawals tend to thin the supply on exchanges. This means that selling pressure is reduced because the BTC is stored elsewhere, most likely in cold wallets.

Now, when the price of Bitcoin also seems to be starting to rise slowly, this action actually makes the bullish signal even stronger.

Furthermore, large stablecoin inflows are often an early sign of big buying intentions. In the crypto world, stablecoins are like gasoline that is ready to be used to speed up. If $400 million has flowed into Binance twice in a short period of time, it’s no coincidence.

It’s likely that it’s ready-to-fight capital to buy crypto assets, especially Bitcoin. So while BTC is leaving exchanges, digital cash is coming in—a combination that could send prices exploding if everything clicks.

As of press time, BTC is trading at about $105,957.53, down 1.06% over the last 24 hours and 3.17% over the last 7 days.

Derivatives Markets Are Volatile, But Holder Confidence Remains Strong

But it’s not just whale activity that’s making the Bitcoin story more interesting. CNF previously reported that both whales and retail investors have pulled back from depositing Bitcoin into Binance in recent weeks. BTC inflows have fallen to their lowest levels since the start of this cycle.

But, oddly enough, derivatives trading volumes have skyrocketed. This suggests that many traders are looking to profit from short-term speculation, while holders are sticking to their positions.

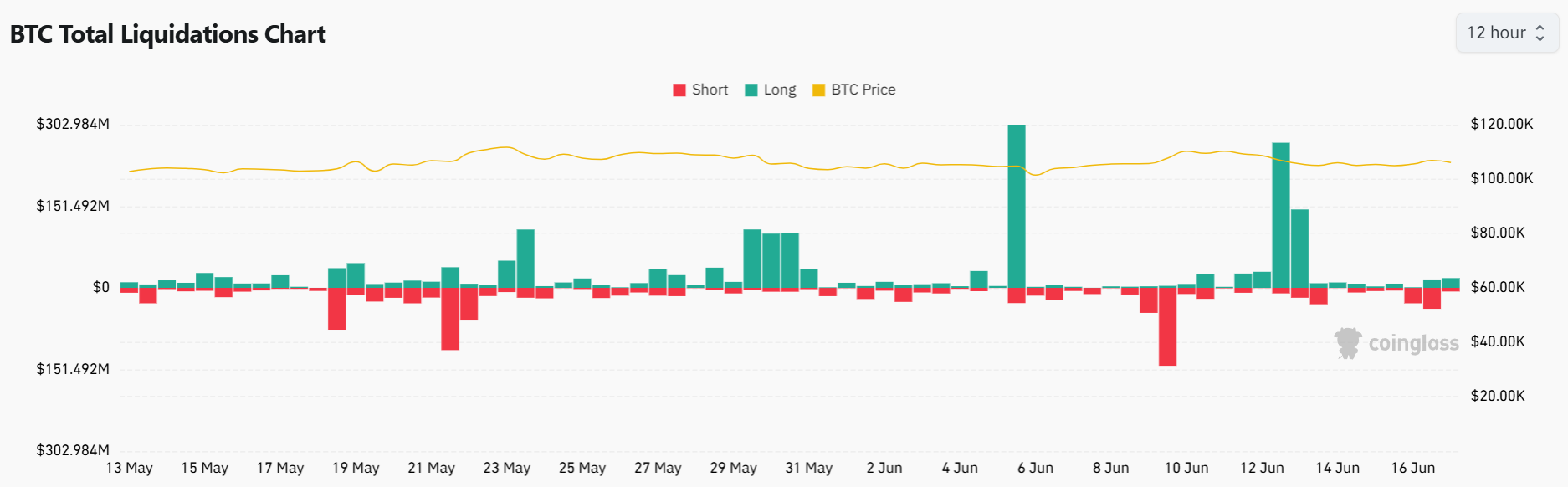

Data from CoinGlass backs up this story. Between May 13 and June 16, 2025, there was a series of massive liquidations in the Bitcoin derivatives market. On June 5, over $300 million worth of long positions were liquidated as the price suddenly dropped. This scenario repeated itself on June 12—traders’ high optimism was crushed by a sudden correction in the market.

Source: CoinGlass

Source: CoinGlassHowever, the story turned around on June 9, when short positions were liquidated. Bitcoin prices rose sharply, and many traders who had held short positions ended up losing big. The value reached almost $150 million. This condition shows that no position is completely safe when volatility is high.

Not only that, the chart also shows a series of small liquidations that have been ongoing since mid-May. The market looks like it is going nowhere, but it is still deadly for those who use too much leverage. It is like skating on thin ice—smooth, looks calm, but if you make a wrong move, the fall can be fatal.

Despite the turmoil in the derivatives market, long-term holders remain confident. They choose to stay put and hold on to their assets, even when the market looks like a game of chance for leveraged traders. Now, with selling pressure easing, capital starting to come in again, and bullish signs emerging from the whales, many eyes are now turning back to Bitcoin.

.png)

4 hours ago

2

4 hours ago

2

English (US)

English (US)