ARTICLE AD BOX

The post Ripple News: XRP Trading Volume Hits $16B But On-Chain Metrics Fall appeared first on Coinpedia Fintech News

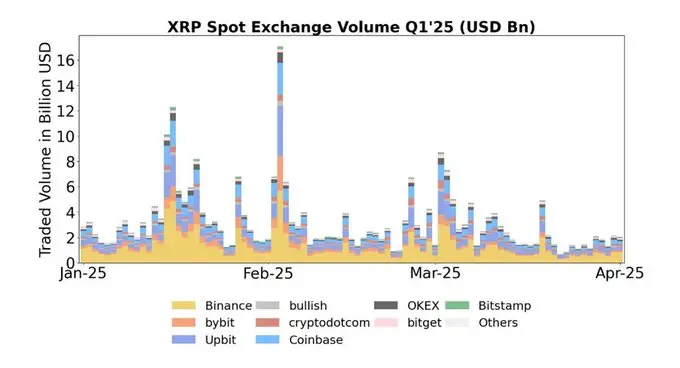

XRP is witnessing a strong comeback in early 2025, with average daily spot trading volumes reaching $3.2 billion and spiking over $16 billion during peak periods in January and February. Despite this impressive momentum, concerns are rising over a sharp decline in on-chain activity — suggesting a growing disconnect between market hype and actual blockchain utility.

XRP Price and Trading Trends in Q1 2025

Source: Ripple Pundit X Post

Source: Ripple Pundit X PostOver the past year, XRP has delivered a stunning 298.8% gain, including a 26.9% jump in the last 30 days alone. Notably, between January 10 and 17, XRP surged by 44.89%, hitting a local peak of $3.4 on January 16. As of today, XRP is up 2.5%, trading around $2.14.

The spike in trading volume reflects strong interest from both institutions and retail traders. Investment products tied to XRP have also attracted $214 million year-to-date — a clear sign of growing investor confidence.

Growing Role of USD and Stablecoins

A post from Ripple Pundit highlights that fiat and stablecoin trades involving XRP rose from 25% to 29%, indicating increased interest in regulated, fiat-linked trading pairs.

But Network Fundamentals Are Weakening

Source: Ripple Pundit X Post

Source: Ripple Pundit X PostWhile market activity is strong, XRP’s on-chain metrics are deteriorating. XRP Ledger transactions have fallen 37.06%, while new wallet creation dropped over 40.28%. In addition, daily trading volume has declined by over 86% in the last six months, signaling possible short-term fatigue or profit-taking.

SEC Exit and ETF Hopes Keep Bulls Confident

Investor optimism remains buoyed by positive regulatory developments. The U.S. SEC has dropped its appeal against Ripple, opening the door for a possible settlement. Meanwhile, speculation is building around a potential XRP Spot ETF approval in the near future — a move that could fuel another major rally in 2025.

.png)

13 hours ago

1

13 hours ago

1

English (US)

English (US)