ARTICLE AD BOX

- The launch of XRP futures ETF on May 22 has also attracted huge demand from institutions.

- Analysts expect growth to continue, leading to a 580% rise in XRP.

This marks a major development for institutional crypto products as the first XRP Futures ETF called XRPI is launched. XRP-based Volatility Shares debuted on May 22, 2025, and offers exposure to XRP without requiring direct token ownership. This is expected to dramatically change the XRP market, opening up regulated access that is attractive to hedge funds and asset managers.

VolatilityShares is launching the first-ever XRP futures ETF tomorrow, ticker $XRPI.. yes there is a 2x XRP already on market (this is first 1x) and it has $120m aum and trades $35m/day. Good signal that there will be demand for this one. pic.twitter.com/rCooyNZgu0

— Eric Balchunas (@EricBalchunas) May 21, 2025

It comes at a time as XRP open interest is on the rise, having surpassed $4.96 billion, a 25% jump. The trading volume has also risen 59% in the last 24 hours to $6.59 billion. “This is a positive sign that demand from traders and institutions is increasing,” said Bloomberg ETF analyst Eric Balchunas.

Similarly, ProShares and Teucrium are expanding their offerings in XRP ETFs, with Teucrium overseeing about $120 million in assets through its 2x leveraged product. In line with the trend of rapid institutional integration, ProShares filed for an additional three leveraged XRP ETFs. Regulators are responding to demand and market watchers expected further filings.

Price Targets Reach $15 as Historical Trends Resurface

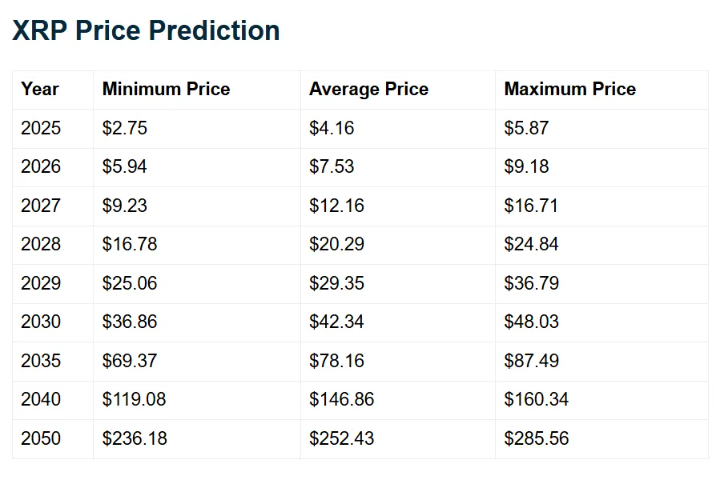

Renewed bullish outlooks are fueled by mathematical and technical projections. According to Telegaon analysts, the XRP will hit a minimum of $6.94 by 2026. If history repeats, we’d be looking at XRP rallying to as high as $15, according to more aggressive forecasts, with the XRP price increasing 580% from $0.50 to $3.40 by 2024.

Source: Telagoan

Source: TelagoanOn a technical analysis level, the charts that read XRP are sporting bull flag patterns which in history has been a precursor to a 500% continuation rally. That would be consistent with the broader predictions of explosive growth. Ripple’s continued trend of releasing escrowed assets while keeping supply controlled supports this outlook.

XRP community researcher Rob Cunningham predicted short-term targets of $5 to $15 based on increased ETF exposure and Ripple’s expanding utility. At least nine spot ETF applications, including ones from Franklin Templeton, are still awaiting action from the SEC.

Legal Resolution and ETF Momentum Could Unlock Breakout

While the number of legal hurdles are mounting for XRP, analysts believe that regulatory clarity is the biggest catalyst for an XRP surge. Until the battle between Ripple and the SEC is dealt with, the price breakout will occur upon arrival.

After legal setbacks, XRP retraced from $2.60 to $2.35. However, it still has support around $2.30. Traders are expecting a consolidation phase, which could break out strongly if some positive news comes out.

XRP ETF approval in 2019 has an over 80% chance of approval, according to data from Polymarket. JPMorgan also predicts that inflows into ETF products in the twelve months following approval will exceed $8 billion, putting a significant upward pressure on XRP’s price.

.png)

5 hours ago

1

5 hours ago

1

English (US)

English (US)