ARTICLE AD BOX

- From February to June 2025, Polygon saw a 67% rise in micropayments volume outpacing top rivals like Solana, Ethereum, Base, Arbitrum, Optimism, Avalanche, and Gnosis.

- It also leads in peer-to-peer USDC micropayments with 3.4 million transactions, an 82% year-to-date increase.

Polygon CEO Sandeep Nainwal recently stated that instead of placing greater emphasis on wider adoption, they are focusing on two major problems currently plaguing the crypto payments industry: speed and fees. He shared some notable milestones that the blockchain network has achieved in the micropayments niche, outperforming top players such as Ethereum, Solana, Arbitrum, and Avalanche.

Polygon Foundation Focuses on Speed, Fees for Crypto Payments

In a recent X post, Polygon co-founder Sandeep Nailwal shared a clear report on how the network had flourished in the first half of the year 2025. He highlighted the network’s competence to work out small and medium-scale transfers most of the time. “Polygon isn’t chasing adoption. We are earning it [by]solving two problems that payments care about: fees and speed,” Nailwal wrote.

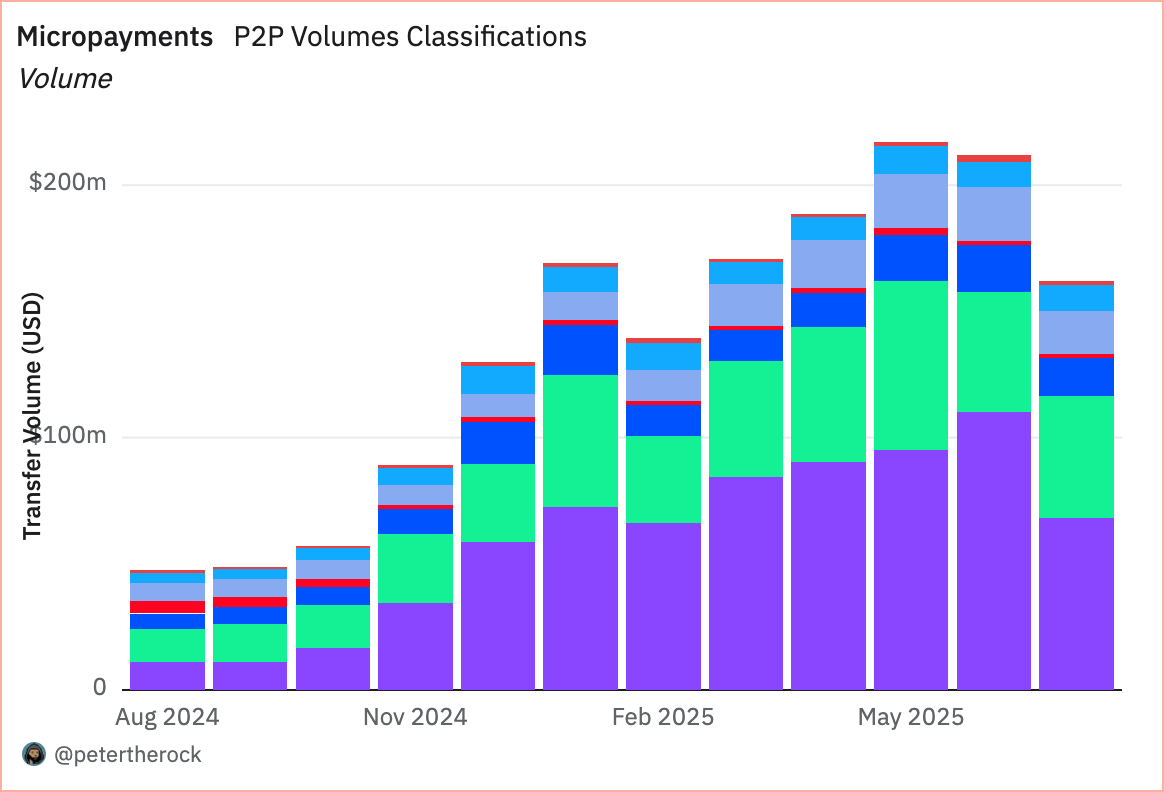

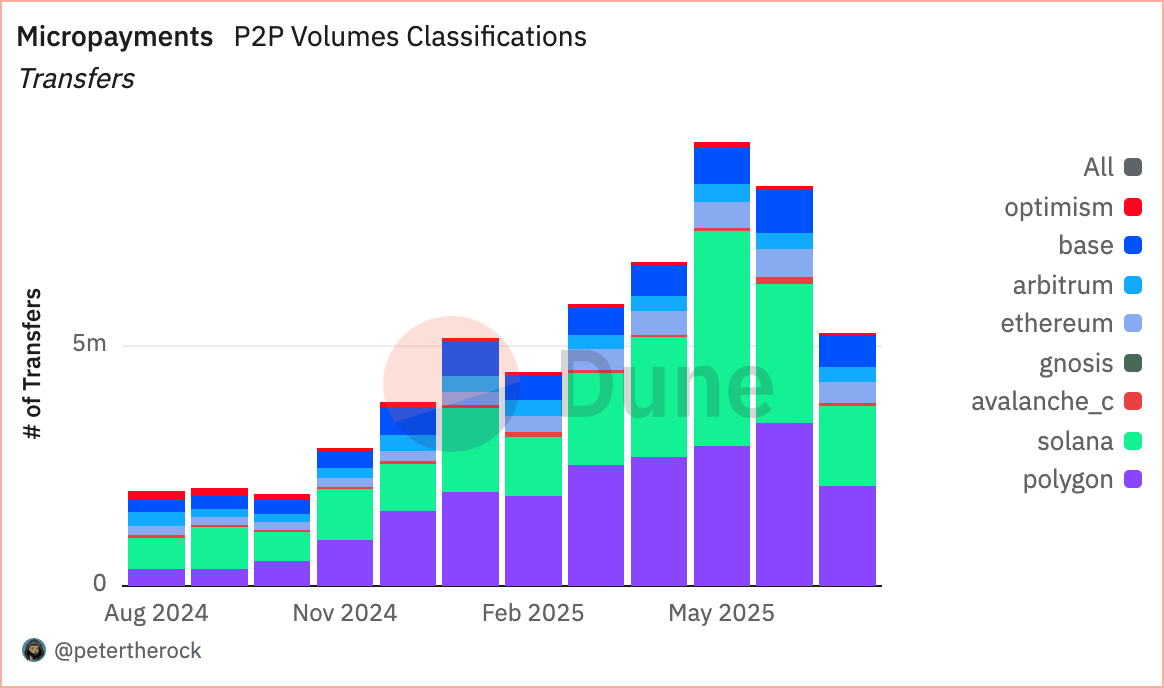

The update based on statistics also shows considerable increases in three significant payment ranges: micropayments ($0.50–$100), small payments ($100–$1,000), and medium-sized transfers ($1,000–$10,000). It further confirms the leading position of Polygon in the area of value transfer to the chains.

Source: PetertheRock

Source: PetertheRockThe amount of micropayments performed on the network by processing upsurged by 67%, growing within February and June to a total of $66 million up to $110 million. Remarkably, Polygon now leads in peer-to-peer USDC transfers in this category, registering a total of 3.4 million transactions, marking an 82% rise since the start of the year.

This gives Polygon a market share of more than 50% in micropayment volume. Consequently, it has successfully outpaced rival networks, including Solana, Ethereum, Base, Arbitrum, Optimism, Avalanche, and Gnosis.

Source: Dune Analytics

Source: Dune AnalyticsPolygon’s Growing Share in Small Payments Segment

The same is true about the small payment segment. Polygon’s transaction volume in this range jumped by 190% within the same time frame, reaching $563 million. According to Nailwal, “only on Polygon and Gnosis did small payment volume actually increase in Q2,” while other blockchains saw declines. This changed in May when Polygon surpassed Solana in this category, having followed the latter in the previous six months.

By June, the share of Polygon had increased to 42%, a figure that is almost twice as much as Solana, which averages at 23%. For mid-sized P2P transactions between $1,000 and $10,000, the story remains consistent. Volume on Polygon climbed from $159 million in February to $378 million in June, reflecting a 137% increase. The network has also occupied the first place in this category with 31% of all similar transactions on traceable chains.

Recently, Polygon has been hitting major milestones with the Heimdall v2 upgrade debuting on the mainnet earlier this month, per the CNF report. The POL price is up 37% on the monthly chart and has moved closer to $0.25 amid recent developments.

.png)

1 day ago

1

1 day ago

1

English (US)

English (US)