ARTICLE AD BOX

- California has decided to include crypto under its Unclaimed Property Law, according to a recent report.

- The State’s latest initiative follows its earlier decision to amend its Money Transmission Act.

California advances its interest in the crypto space as its Assembly votes 69-0 to pass AB1052. According to our research, this decision marks an attempt to bring crypto into the Unclaimed Property Law.

Meanwhile, this law has been in existence for some time. In 2022, the authorities instructed companies in California to report unclaimed properties or financial assets left inactive by the owner. At that time, the State had emerged as the most crypto-inquisitive state in the US, as mentioned in our previous news article.

Details of California’s Unclaimed Property Law

An official definition of unclaimed property is anything owed by a business to stakeholders that has passed its period of abandonment.

Under the existing law, the types of properties that can be reported as unclaimed include uncashed or voided payroll checks, Unclaimed securities or equity, Accounts receivable credits or deposits, Refunds and rebates, among others.

Under the current system, exchanges that fail to establish contact with clients for more than three years could liquidate their assets. What happens is that exchanges clean up their books after the period to delegate any subsequent problems to the State.

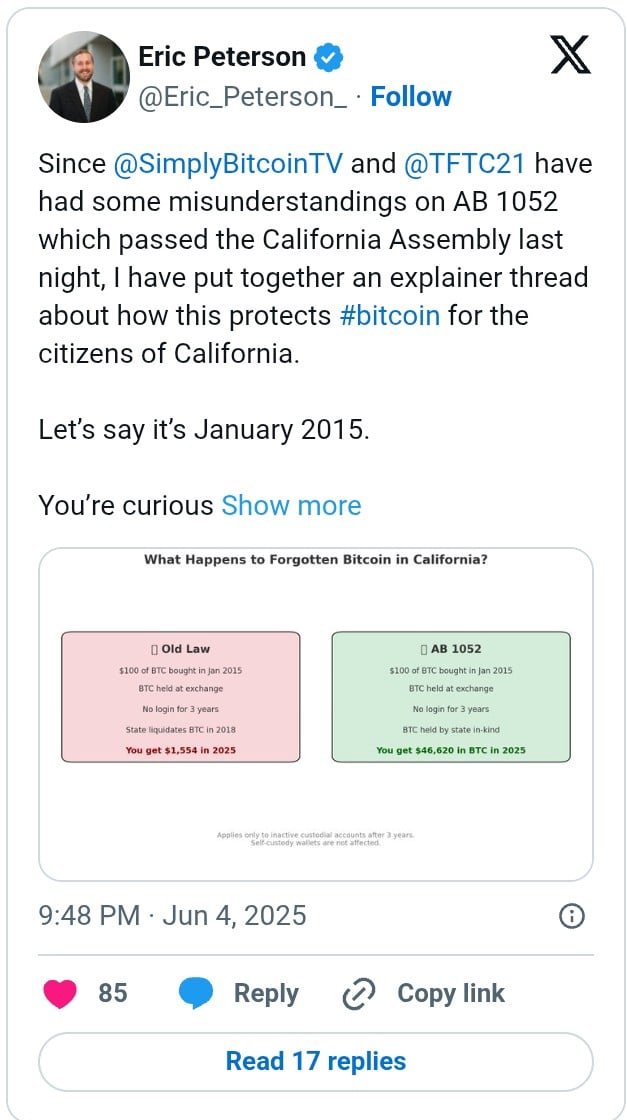

Shedding more light on the proposed system, the author of the bill, Eric Peterson, pointed out that unclaimed Bitcoins would stay as Bitcoins and would not be liquidated. This implies that owners would not lose their gains to early liquidation as the redemption is in-kind.

In a different post, Peterson detailed that the proposed system protects consumers by maintaining the value of their assets in the changing market valuation.

For instance, a user who purchased $100 worth of BTC for $225, getting 0.444 BTC in 2015, could get the same 0.444 BTC in 2025 under the unclaimed property site. This implies that such a user would get $46,620 if the Bitcoin market price increases to around $105k.

Meanwhile, that is not the case under the existing laws. According to Peterson, the present system demands that the unclaimed BTC be liquidated at the time of the report, as stated above.

Instead of selling your Bitcoin after 3 years of inactivity, custodians must transfer your actual BTC to a licensed custodian selected by the state. The Bitcoin is held in native form, not converted to dollars. So in that same story: In 2025, you go to claim your property. But this time, you get your original 0.444 BTC back. Now worth $46,620.

Recently, CNF highlighted in an update that California is amending its Money Transmission Act to recognise digital assets as legal payments. Meanwhile, similar decisions have been taken by different states to embrace the fast-rising digital industry.

As indicated in our recent discussion, Arizona has already added Bitcoin to its reserve. Also, over 20 states are reported to have proposed a Bitcoin reserve bill, as discussed earlier.

.png)

1 day ago

1

1 day ago

1

English (US)

English (US)