ARTICLE AD BOX

- The upcoming SRv3 upgrade will shift Lido’s validator model from fixed 32 ETH units to dynamic balances, enabling easier validator management.

- SRv3 will feature a smarter stake allocation system based on validator performance and risk, integrated into Lido’s core architecture.

Following the Ethereum Pectra hard fork in May 2025, the Lodo decentralized autonomous organization (DAO) is undergoing a major technical shift. With the Pectra upgrade allowing better validator management, Lido will now consolidate multiple validators into a single larger unit, while improving rewards and cutting down on network load.

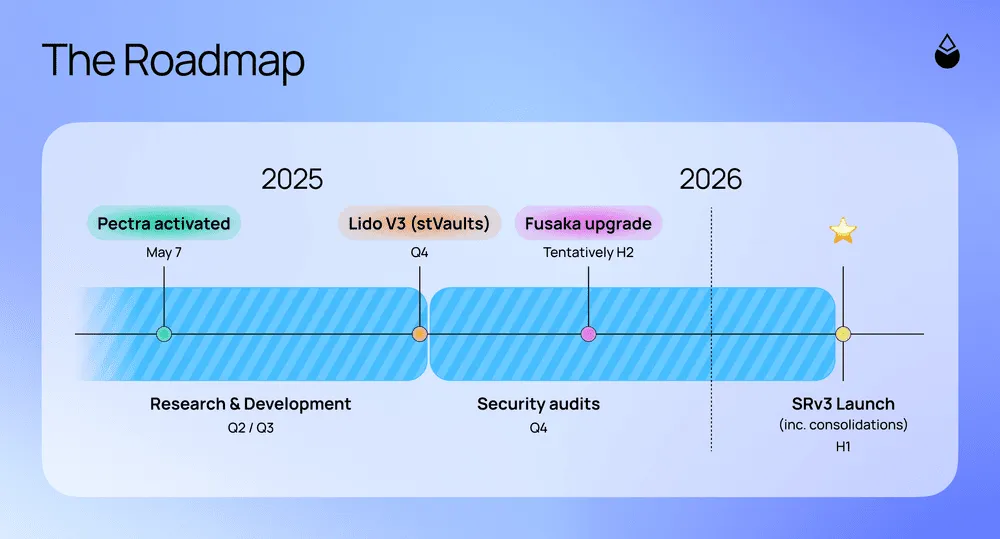

In order to support this transition, the Lido network has outlined a two-phase rollout beginning with its upcoming V3 upgrade. The changes will build on the Staking Router, which functions as the protocol’s core coordination layer.

The Router connects user deposits to different modules within the staking architecture. Introduced in 2024 with SRv2, it replaced Lido’s earlier model with a more modular design, now featuring Curated, Community Staking, and SimpleDVT modules.

This move with validator consolidation reflects Lido’s broader strategy to align with Ethereum’s evolving roadmap while maintaining its own resilience and operational efficiency.

Lido to Upgrade Staking Architecture With SRv3 Upgrade

As per reports, Lido is currently working on SRv3, the third version of its Staking Router, expected to launch sometime in mid-2026. This upgrade will introduce support for large validators and enable validator consolidation, while marking a significant step beyond a typical software update.

A central feature of SRv3 is its shift to a balance-based accounting system. Unlike the current unit-based model that treats validators in fixed 32 ETH increments, the new system will allow the protocol to manage validators as dynamic balances. This change will streamline validator merging and improve scalability, as mentioned in the blog post.

Moving to this model will require substantial updates across the protocol’s handling of deposits, withdrawals, and reward distribution. However, the anticipated benefits include greater flexibility, enhanced efficiency, and a more seamless user experience.

Additionally, the SRv3 upgrade will also introduce direct deposit functionality, enabling new stake to be routed directly into validators through the protocol. Initially, this feature will be limited to approved participants, with the potential for broader access over time.

Validator consolidations will be managed via EasyTrack, Lido’s governance tool for executing secure and efficient on-chain actions. This makes it well-suited for overseeing this critical upgrade.

SRv3 Upgrade Will Boost Efficiency and Flexibility

In addition to validator consolidation and direct deposits, SRv3 will introduce a more sophisticated stake allocation system. It will enable the network to distribute stake based on validator performance and risk profiles. Elements of this approach have already been tested through the Community Staking Module v2 and will now be integrated into the core protocol.

The development roadmap prioritizes validator consolidation, along with improvements to stake onboarding, and implementing optimized allocation strategies. These changes are designed to enhance Lido’s resilience, lower operational costs for node operators, and mitigate stake concentration risks.

Source: Lido

Source: LidoWith development already in progress, the launch of SRv3 represents a major advancement toward a more efficient, secure, and scalable staking infrastructure for the Lido ecosystem.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)