ARTICLE AD BOX

- A legal document has spotted an economic link between Ripple Labs’ profit and XRP.

- Despite the landmark court ruling, the XRP security status ruling is now under question.

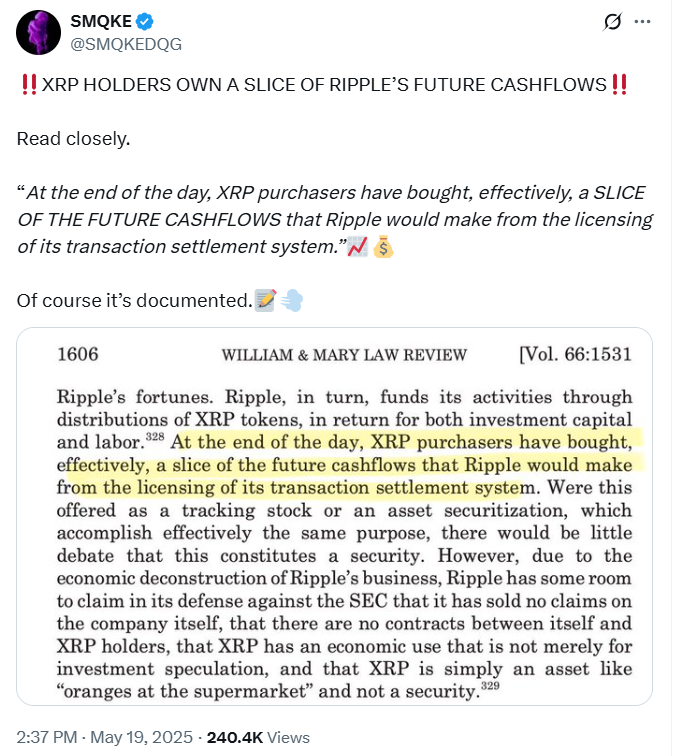

Market analyst and researcher SMQKE has spotlighted a legal commentary pointing to an economic link between XRP and Ripple Labs. The post suggests that XRP holders may have acquired some of Ripple’s anticipated future cash flows by licensing its transaction settlement technology.

The Link Between Ripple’s Business Model and XRP

The legal commentary, an excerpt from a William & Mary Law Review article (Vol. 66:1531), points to a link between Ripple’s business model and XRP.

The excerpt quoted by SMQKE reads, “At the end of the day, XRP purchasers have bought, effectively, a SLICE OF THE FUTURE CASHFLOWS that Ripple would make from the licensing of its transaction settlement system.”

Based on the commentary, Ripple funds its activities through XRP distributions in exchange for investment capital and labor. This statement implies XRP could be seen as a security tied to Ripple’s profits, contradicting the 2023 SEC vs Ripple ruling.

Image Source: SMQKE on X

Image Source: SMQKE on XThe judge determined that XRP sales on exchanges did not constitute an investment contract, meaning they did not meet the legal definition of a security. This outcome led to partial regulatory clarity around XRP, implicating how crypto assets are categorized under U.S. securities laws.

The excerpt also compares tracking stocks and asset securitizations, stating that such instruments serve effectively the same economic function. However, the document also acknowledges the complexity of categorizing XRP. It noted that Ripple Labs’ business is structured in a way that gives it room to argue against the classification of XRP as a security.

The text mentions that Ripple can claim no direct contractual rights between the company and XRP holders. The blockchain payments firm says its business model focuses on real-time cross-border payments using XRP as a bridge currency.

This description supports the document’s claim that XRP is tied to Ripple’s transaction system. However, the SEC ruling highlights a legal distinction between economic use and security classification.

Implications for XRP

The legal document suggests a deeper economic linkage between XRP ownership and Ripple’s licensing revenue.

The implications of such a view could reignite debates over the nature of cryptocurrencies and their classification under securities law. This is particularly in light of recent and ongoing litigations in the digital asset space.

We previously explored that Ripple Labs is now free from the SEC’s lawsuit, which began in December 2020. As featured in our recent coverage, the US SEC settled with Ripple, reducing its earlier penalty from $125 million to $50 million.

This legal victory has helped restore confidence in XRP, driving a 9.9% price surge over the past month. XRP rose as high as $2.45 before plummeting to the current price of $2.33. XRP proponents are optimistic about a potential 5x rally for the coin, citing favorable technical indicators.

Beyond the end of the Ripple and SEC lawsuit, other ecosystem events like potential XRP ETF products are also driving optimism.

.png)

7 hours ago

2

7 hours ago

2

English (US)

English (US)