ARTICLE AD BOX

- The crypto market liquidation increased to $500 million after Iran reportedly breached the “ceasefire” announced by US President Donald Trump.

- An analyst, however, believes that the recent pullback is healthy as it presents a “perfect opportunity to accumulate.”

U.S. President Donald Trump recently announced that the 12-day war between Israel and Iran has finally come to an end after both parties agreed to a ceasefire.

Officially, Iran will start the CEASEFIRE and, upon the 12th hour, Israel will start the CEASEFIRE and, upon the 24th Hour, an Official END to the 12-Day WAR will be saluted by the World.

Confirming this, Iran’s security body, the Supreme National Security Council, stated that Israel has been forced to “unilaterally accept defeat and cease fire.”

Meanwhile, the prime minister of Israel, Benjamin Netanyahu, pointed out that the country has achieved its goal after launching an attack on June 13 in a bid to destroy Iran’s nuclear program and missile capabilities. At that time, over $1 billion was liquidated in the crypto market in just 24 hours. According to Coinglass data, $422.97 million in long positions were wiped out in the Bitcoin market, as noted in our earlier post.

Crypto Market Reacts to the Ceasefire

Reacting to the ceasefire, the cryptocurrency market staged a quick rebound, with Bitcoin (BTC) hitting the $106,000 resistance level from its daily low of $99,000.

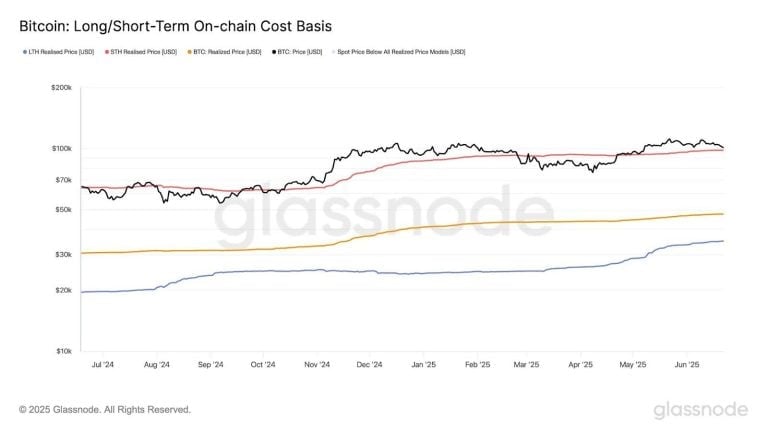

As highlighted in our recent discussion, Bitcoin’s “short-term holder realized price” (STH RP) was just hovering around $98k.

Source: Coinglass

Source: CoinglassWithin the same period, Ethereum (ETH) experienced a notable comeback, rising from $ 2,191 to $ 2,446. As indicated in our recent blog post, whales aggressively accumulated the asset before this surprising U-turn.

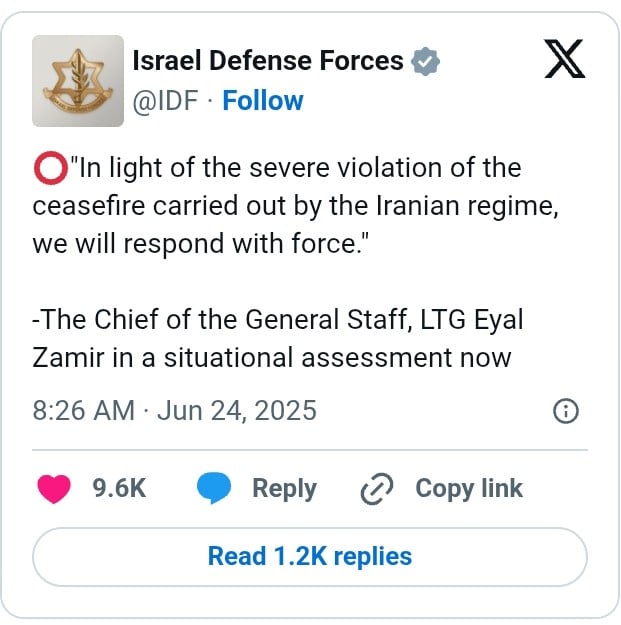

Unfortunately, the moment was short-lived as multiple reports disclosed that Iran had breached the ceasefire declared by the president of the United States. With this, Israeli Defence Minister Israel Katz ordered Israel’s military to resume “high-intensity operations targeting assets and terror infrastructure in Tehran.”

This, however, was denied by Iran. According to the Security Council, “any further aggression would be met with a decisive, firm, and timely response.” Following this report, liquidation in the crypto market increased to $500 million. Bitcoin (BTC), for instance, declined to $105k while ETH also fell to $2,400. Meanwhile, both whales and retail investors exhibited similar behavior by refusing to send assets to exchanges, as mentioned in our previous news story.

Commenting on the current market behavior, analyst Michael Van de Poppe highlighted that this pullback is healthy as it presents the best opportunity to buy.

It’s uptrending now, after we’ve had a massive liquidation crash taking place to sub $100K. It broke through $103K and hit the next resistance. Time to be buying the dip, so if we get to $103K, that’s the area you’d want to accumulate.

Similarly, another analyst called Cas Abbé has observed that the On-Balance Volume (OBV) of Bitcoin is rising, and could push the asset to between $130,000 and $135,000 by the third quarter of 2025 (Q3 2025). As detailed in our last news piece, Bitget CEO Gracy Chen has predicted that the asset could reach a maximum of $190k and a minimum of $126k this year.

.png)

4 months ago

6

4 months ago

6

English (US)

English (US)