ARTICLE AD BOX

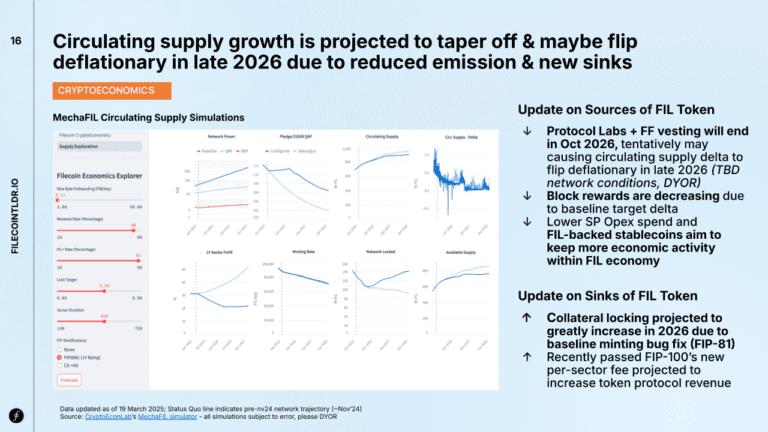

- By late 2026, FIL could experience a net decrease in available supply, pointing toward deflation.

- Protocol-level revenue under FIP-100 is set to increase, and much of that revenue gets burned, reducing FIL supply directly.

Filecoin is showing signs of a major economic shift. By late 2026, its native token, FIL, could experience a net decrease in available supply, pointing toward deflation. This potential change is tied to lower token issuance combined with mechanisms that lock up or remove FIL from circulation.

Several factors indicate that this supply pressure is easing. Token vesting, which has been a source of fresh supply, will end in October 2026. This includes allocations to Protocol Labs and the Filecoin Foundation.

FIL issuance through block rewards is also declining by design. More critically, the development of FIL-backed stablecoins such as USDFC is assisting holders in resisting the urge to sell by utilizing their tokens as collateral. USDFC was launched on FDS-6 in Toronto by Secured Finance recently.

On the demand side, FIL is being locked at a growing rate. Storage Providers will face higher collateral requirements starting in 2025. This stems partly from a fix introduced under FIP-81, which strengthens the locking mechanism. Meanwhile, protocol-level revenue under FIP-100 is set to increase, and much of that revenue gets burned, reducing FIL supply directly.

Source: State of Filecoin to Investors

Source: State of Filecoin to InvestorsUtilization Up 29% While Paid Deals Rise Across Sectors

Although the economic model is in transition, Filecoin usage metrics show steady growth. Storage usage in the network reached 29%, and paying clients in areas such as AI, identity, media, and research are increasing. Paid deals include Humanode via Storacha, astrophysics data from Cornell University via Ramo, and AI storage via Gaianet on Storacha.

The number of Storage Providers achieving successful data retrieval has increased by 388% over the past year. This marks a shift from offering large volumes of capacity to delivering dependable, paid storage. In earlier stages, Filecoin placed more emphasis on expanding supply. The focus has turned towards quality, customer success, and retrieval results as a clear performance metric.

Initiatives led by the Filecoin Foundation and the Ansa Research have strengthened business outreach. They have enabled the attraction of large-scale Web2 and DePIN customers who need both long-term archival and on-demand access storage. Enterprise customers managing over 1,000 TiBs are now using the network.

FIL Price Dips, But Demand Trends Could Change the Curve

As of now, FIL is trading near $2.79, showing a 1.61% drop over the last 24 hours. Trading volume is down 23%, currently at $295.53 million. Short-term price movements have been negative, but longer trends in the usage within the network indicate potentially tighter supply in the longer run.

Forecasts indicate paid storage could reach over 1 EiB by 2025. If that happens, most of the network’s capacity would be tied up in paid deals—well above current levels. Daily new deals rose by over 10% from Q3 to Q4 2024, reversing earlier declines.

When new token issuances taper off and more FIL is locked in anticipation of store requirements, the supply can begin contracting in the second half of 2026. That, in turn, will induce price dynamics and valuation in the network to shift in response.

.png)

3 months ago

5

3 months ago

5

English (US)

English (US)