ARTICLE AD BOX

- Ethereum open interest on Binance jumped 41% in 30 days, highlighting increased futures activity and institutional involvement.

- Major ETH outflows from exchanges suggest reduced sell pressure and growing long-term holder confidence.

There is something interesting about Ethereum’s recent movement and it’s not just about the drastic price increase. According to CryptoQuant, in the last 30 days, Ethereum’s open interest (OI) on Binance has skyrocketed from $3.6 billion to $5.1 billion, a 41.6% jump.

Source: CryptoQuant

Source: CryptoQuantBinance, which now holds around 30% of the total global Ethereum OI (around $17 billion in total), has once again shown its position as a major player in the crypto derivatives arena. But wait, this increase is not just about numbers. It implies something much deeper that the increase in ETH’s price is not just due to spot market euphoria. There is a big push from the futures market that supports it.

If we look at the price of ETH, in the last 30 days its value has skyrocketed by 49.07% and swapped hands at about $2,669.23. But not only that, this increase is accompanied by dense volume and positions that appear to be driven by institutional players.

Ethereum Exchange Flows Reveal Bullish Accumulation Trend

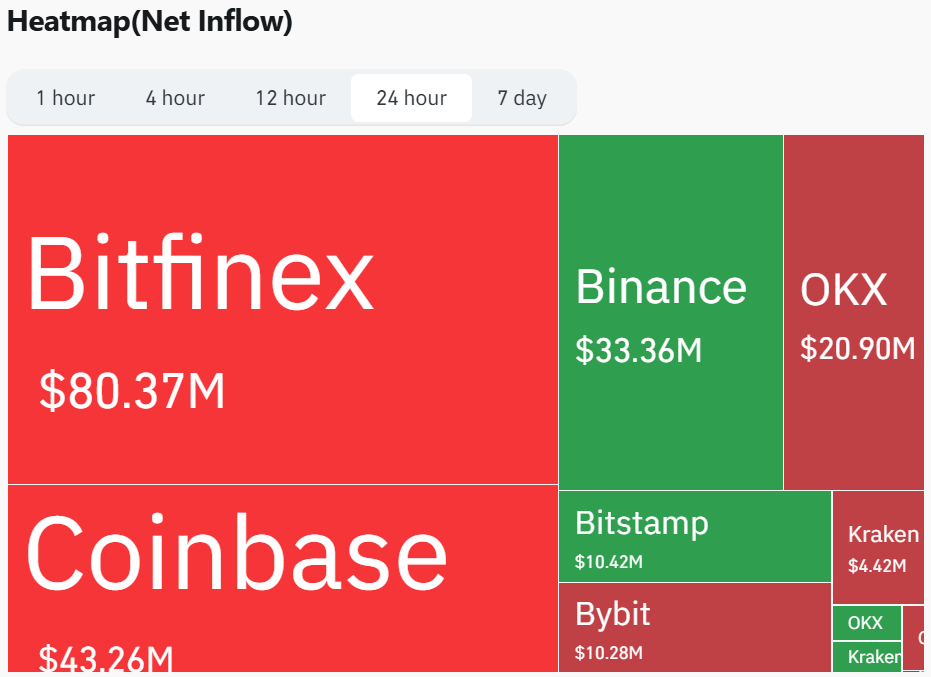

Furthermore, data from CoinGlass shows that there is an interesting pattern in the flow of Ethereum on major exchanges. Bitfinex recorded the largest ETH outflow, around $80.37 million. Coinbase followed with $43.26 million, then OKX with $20.90 million.

This indicates one important thing, where many investors are withdrawing ETH from trading platforms, likely to store in personal wallets or use in DeFi protocols.

Source: CoinGlass

Source: CoinGlassWhat if someone withdraws money from their bank account and stores it in a personal vault, it usually means they don’t want to sell anytime soon. The same thing happened here. When ETH exits the exchange, selling pressure is reduced. What does it mean? A bullish signal.

However, Binance recorded an inflow of $33.36 million. Bitstamp also recorded an inflow of $10.42 million. This could indicate that Binance is now the main destination for advanced trading activities or even participation in derivative products.

Meanwhile, exchanges like Bybit and Kraken also experienced outflows, further strengthening the narrative of Ethereum accumulation by long-term holders.

Is This the Beginning of Altcoin Season?

If we look back a little and see the pattern, Ethereum is often the trigger for altcoin season. When ETH rises strongly and steadily, altcoins usually follow suit. So, it is not impossible that we will see other coins start to move, following in ETH’s footsteps. But of course, it all depends on whether this momentum can be maintained or not.

On the other hand, there is less pleasant news from the Ethereum network update itself. CNF previously reported that the Pectra update faced security issues, especially in the EIP-7702 smart account feature. Several vulnerabilities emerged when users tried to activate this feature, prompting developers to urge only using official plugins.

.png)

5 hours ago

1

5 hours ago

1

English (US)

English (US)