ARTICLE AD BOX

- Over the past five years, 15.3 million ETH have been removed from exchanges, with 1 million ETH withdrawn in the last month alone.

- Whales have also significantly increased their holdings, adding 450,000 ETH since April, pushing the 20 largest ETH wallets’ collective balance to a record 40.75 million ETH.

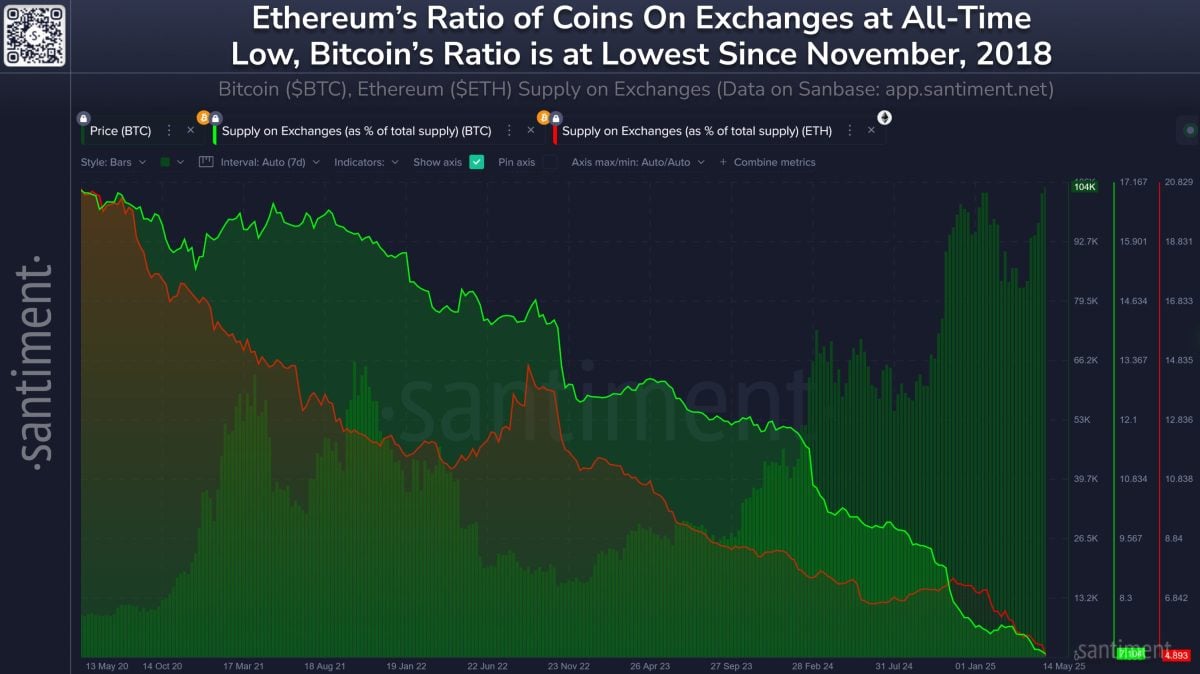

Ethereum’s presence on centralized exchanges has reached its lowest level in more than a decade, as long-term holders and institutional players continue to stockpile ETH. A recent report by Santiment found that Ethereum had reached a new record on May 19, with only 4.9% of its supply on exchanges.

Ethereum Exchange Supply Plunges Significantly

Santiment has reported that during the past five years, 15.3 million ETH that was on centralized trading exchanges has been removed. As per figures released by CryptoRank.io, the rate of exchange pullback is rising, as over 1 million ETH was taken out in just the past 30 days.

Source: Santiment

Source: SantimentMore people are choosing to hold on to their ETH instead of actively trading it. According to CryptoRank.io, “users are increasingly choosing to accumulate Ethereum rather than trade it.” This statement highlights a trend of rising confidence in ETH’s long-term prospects.

Whales in the Ethereum market are playing a bigger role as they become active. According to statistics, wallet addresses with 10,000 or more ETH have added over 450,000 ETH to their balances since April. By May 10, the 20 largest ETH wallets owned 40.75 million ETH, the greatest amount since March.

Further, a growing number of institutions are now showing interest in Ethereum. In the past month, SoSoValue noted that U.S.-based Ethereum spot exchange-traded funds (ETFs) saw $30 million flow in. This situation is in contrast to the past, with major outflows in the beginning. The total amount managed by BlackRock’s Ethereum ETF has reached more than $2.9 billion.

Further, Adriano Feria, a crypto analyst, wrote on May 12: “ETH remains the most natural choice for institutional diversification… It’s the only crypto asset with ETF access, regulatory clarity, and built-in yield potential.”

Recent advancements have improved Ethereum’s network structure. The Pectra upgrade, implemented on May 7, boosted Ethereum’s ability to process data. As a result of this update, Layer-2 networks built on top of Ethereum are being used more often. According to L2Beat, Base handled a large volume of transactions in the past month, and the overall usage of Layer-2 has gone up by over 20%.

ETH ETF Staking Decision & Latest Price Action

Moreover, investors are keen to know whether the U.S. Securities and Exchange Commission will allow Ethereum ETFs to engage in staking activities. If the June 1 approval is given, institutions will be able to put their ETH into staking, which could increase ETH demand.

As of writing, the Ethereum price stood at $2,521.72, up by 5.16% in the intraday session on Tuesday, May 20. Whilst the market cap was at $304.21 billion. On the other hand, despite the surge, the 24-hour trading volume for ETH plummeted by $22.36% to $25.41 billion

.png)

4 hours ago

6

4 hours ago

6

English (US)

English (US)