ARTICLE AD BOX

Ethereum is trading at a critical level after reclaiming the $2,400 mark, showing resilience in the face of market-wide volatility. Bulls have managed to defend key support levels following a recent fakeout below $2,200, but momentum remains fragile as ETH struggles to establish a clear trend. Despite attempts to push higher, price action is consolidating near the mid-range, suggesting indecision among traders. However, fundamental strength continues to build beneath the surface.

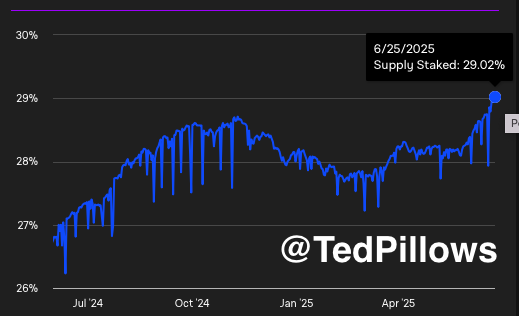

Top analyst Ted Pillows highlighted a major on-chain development: the percentage of Ethereum supply being staked has reached a new all-time high. This milestone signals rising confidence among long-term holders and validators, who are increasingly locking up ETH to secure the network and earn yield. Elevated staking levels historically coincide with lower active supply and reduced sell pressure—an encouraging sign for bulls anticipating a breakout.

As macroeconomic uncertainty and geopolitical risks persist, Ethereum’s price behavior at this level could determine whether the broader altcoin market finally ignites. For now, ETH sits at a technical and psychological crossroads, with both bulls and bears preparing for the next major move. All eyes are on staking data and price structure to guide what comes next.

Ethereum Builds Bullish Momentum As Staking Hits All-Time High

Ethereum has climbed 75% from its April lows, showing strong recovery and resilience in a volatile market. Despite this impressive rebound, ETH remains nearly 98% below its all-time high, leaving significant upside potential. Many analysts believe Ethereum could be gearing up for a rally that may trigger the long-awaited altseason. However, caution still lingers in the market due to ongoing global risks and macroeconomic uncertainty, including rising interest rates and geopolitical tensions.

The growing optimism is supported by improving on-chain fundamentals. Ted Pillows highlighted a key metric showing that the percentage of Ethereum supply staked has reached a new all-time high of 29.02%. This steady increase in staked ETH reflects strong long-term conviction from holders, who are choosing to lock up their assets to support the network and earn yield rather than sell during market turbulence.

Historically, high levels of staking reduce active circulating supply, which can ease sell pressure and fuel bullish price movements. Combined with technical strength and growing confidence among long-term investors, Ethereum appears well-positioned for a breakout, provided bulls can hold current levels and reclaim resistance zones.

ETH Reclaims Key Level But Faces Resistance

Ethereum (ETH) is showing renewed strength after bouncing from its April 2025 lows and reclaiming the $2,400 level. On the weekly chart, ETH is up over 10% this week, closing firmly above the 200-week simple moving average (SMA) at $2,437.52 — a key threshold that previously acted as both resistance and support in past cycles. Reclaiming this level is a bullish sign and shows that buyers are stepping back in after months of selling pressure.

However, Ethereum now faces significant resistance around the $2,625–2,660 zone, where the 100-week and 50-week SMAs converge. This zone has historically served as a pivot for major price action, and a clear break above it would likely trigger a broader rally targeting the $2,800–$3,000 range.

Volume has also picked up, signaling renewed interest, though it remains below early 2024 levels. This indicates cautious optimism among traders, especially as global macro uncertainty and geopolitical tensions continue to weigh on markets.

Featured image from Dall-E, chart from TradingView

.png)

3 hours ago

2

3 hours ago

2

English (US)

English (US)