ARTICLE AD BOX

The post Ethereum Price Prediction: Staking Boom Could Push ETH To $6,000 But Remittix May Deliver Bigger Returns appeared first on Coinpedia Fintech News

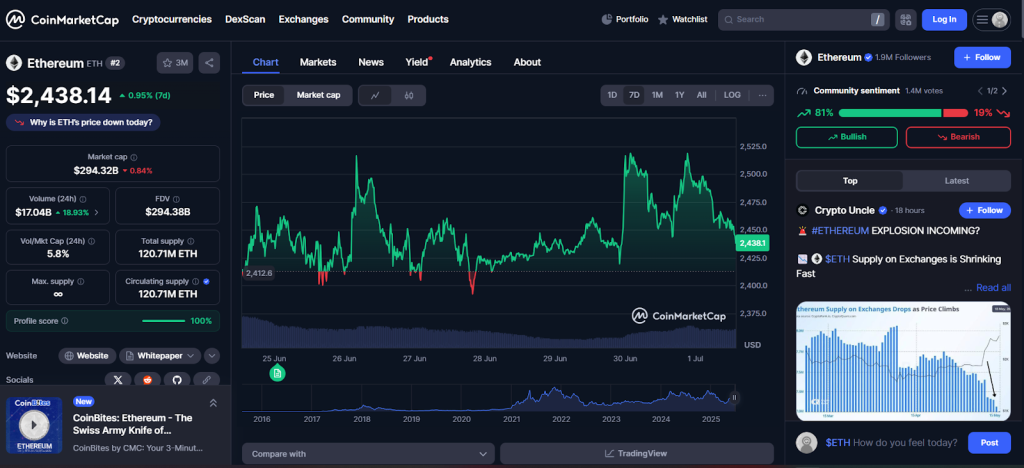

Over 35.2 million ETH nearly 30% of supply is now locked in staking contracts, shrinking exchange float and rekindling a bullish ETH price prediction of $6,000. CoinShares registered $429 million of fresh inflows to Ether funds in the last seven days, lifting 2025’s tally to $2.9 billion and amplifying the squeeze.

Meanwhile, presale newcomer Remittix (RTX) has vaulted to $0.0811 after moving 537 million tokens and pulling in $15.9 million, offering a percentage-gain runway that could outpace even an optimistic move in ETH.

ETH: Staking Heat Turns Illiquid Supply Into a $600 Spark

Over 35 million ETH about 28% of the circulating supply now sits in proof-of-stake contracts, locking away nearly $84 billion in 24 months. Fewer coins on exchanges mean thinner order books; one good catalyst and price sprint.

That catalyst might be the $429 million that flowed into ether ETFs last week alone, pushing year-to-date inflows to $2.9 billion, while Robinhood’s new Arbitrum-based L2 shouts “Main-Street adoption”.

Each time ETH orbits that resistance, buyers remember the post-Merge burn rate, the Pectra validator consolidation and those staking yields hovering near 3%. Put plainly, ETH price prediction chatter has a real on-chain backbone this cycle.

Remittix: PayFi Upstart Poised to Outrun the ETH Price Prediction Crowd

ETH is big-league, yet big games don’t always pay the wildest multiples. That’s where Remittix (RTX) enters. Still in presale at $0.0811, with 536 million tokens sold and $15.9 million already raised, Remittix tackles the very fees my cousin in Lagos complains about whenever he invoices U.K. clients.

This PayFi lane matters because the remittance market north of $190 trillion yearly demands speed, not DeFi jargon. Unlike Stellar’s broader B2B pitch or Hedera’s enterprise focus, Remittix picks one pain point and slices it clean. As more freelancers and migrant workers feel that difference, token velocity shifts from hype to revenue participation.

A 10-fold move from presale to parity with smaller payment tokens puts RTX around $0.75 already trumping a conservative ETH price prediction of $6k in percentage terms. Long-shot? Yes, but asymmetric upside is the lifeblood of crypto portfolios.

Grab a seat in the presale or explore the white paper on Remittix and watch how quickly practical utility wins hearts, especially when gas fees spike on bigger chains.

Why RTX Tops the 2025 Playbook

Staking is tilting supply-and-demand math in ETH’s favor and every fresh analyst note shouts the same refrain: ETH price prediction at or near $6 k looks plausible once illiquidity and ETF demand collide. Yet the road from $2,500 to $6000 is a 140 % hop. Remittix, still a penny-sized PayFi rookie, needs far less absolute movement to hand investors a 10×.

If one more latte-length transaction saves a few dollars for a freelancer, the word-of-mouth loop alone could let RTX sprint far beyond what any ETH price prediction can offer.

.png)

11 hours ago

2

11 hours ago

2

English (US)

English (US)