ARTICLE AD BOX

- Ethereum unstaking by validators led to short-term sell pressure with analysts saying the moves likely reflect restaking and operator rotation rather than fear-driven exits.

- 10x Research attributed the pullback to the unwinding of leveraged DeFi positions, which destabilized the stETH peg.

Ethereum (ETH) price has come under selling pressure, dipping over 5% earlier today and slipping all the way to $3,550 amid the surge in unstaking ETH from validators and investors as the altcoin trades at an 18-month high. This unstaking means that validators could be freeing up their asset for a potential sale and profit-booking.

Ethereum Price Corrects Amid Surge in Validator Unstaking

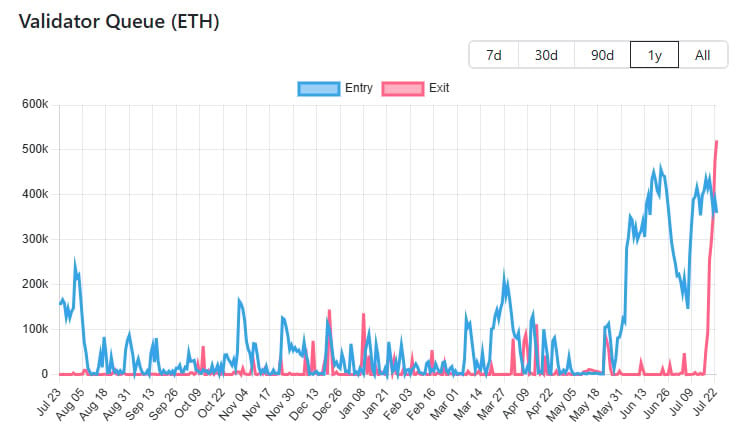

According to ValidatorQueue data, approximately 644,330 ETH, worth a massive $2.34 billion, is currently awaiting withdrawal, with an estimated wait time of 11 days. A comparable surge in the exit queue occurred in January 2024, when ETH prices declined by 15% in the latter half of the month.

Source: Validator Queue

Source: Validator QueueThe recent wave of ETH unstaking appears to reflect a strategic “shift” rather than panic or collapse. Many validators are likely exiting to restake, rotate operators, or optimize their positions, not to abandon Ethereum. Despite the large exit queue, around 390,000 ETH, worth approximately $1.2 billion, is currently waiting to be staked. This brings the net ETH outflow to just 255,000 ETH.

At the same time, some investors and holders may be taking profits. This suggests a portion of the unstaked ETH could be intended for sale, potentially introducing short-term sell pressure and triggering a price correction.

But as per Bitwise report, the structural demand for Ethereum remains intact, which suggests that the correction could be short-lived. ETH price has already bounced back to $3,650 from the intraday lows of under $3,550.

What Led to the ETH Price Drop

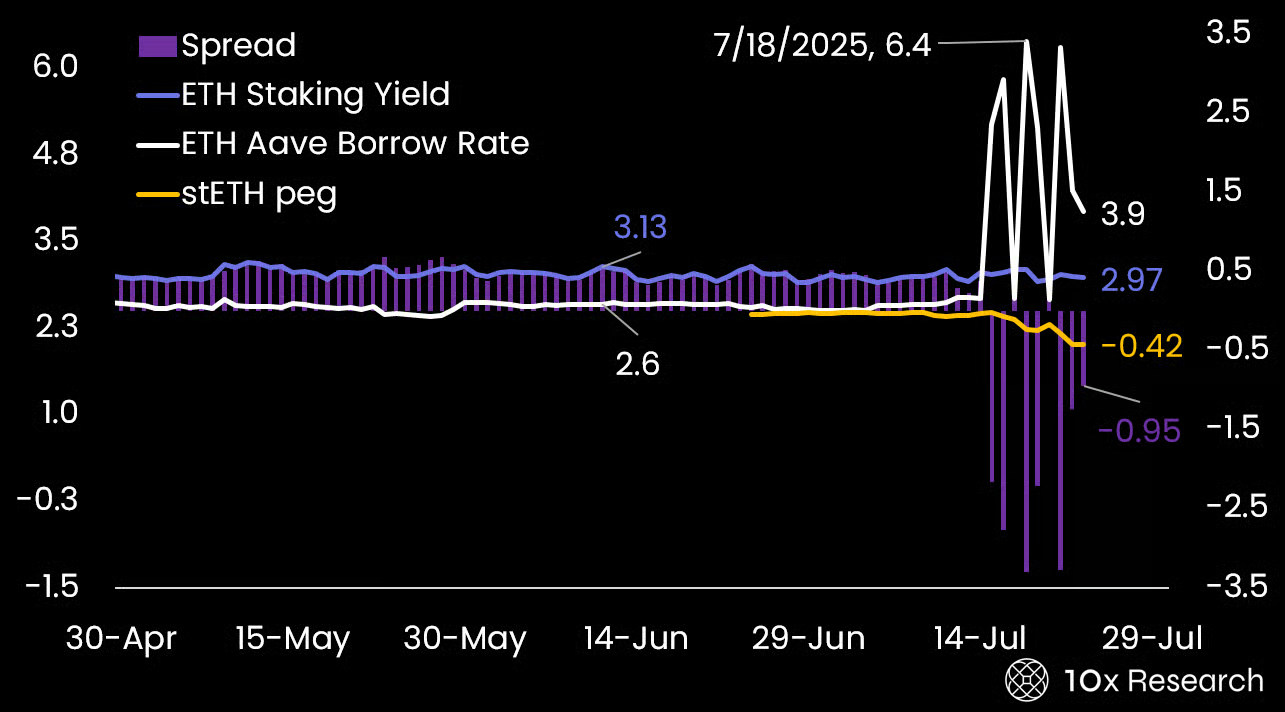

According to a new report by 10x Research, Ethereum’s recent price surge was not purely momentum-driven but triggered by a major deleveraging event across the DeFi ecosystem. The firm notes that one of DeFi’s most leveraged trades began to unwind as borrowing costs spiked and large liquidity providers withdrew capital.

This triggered a cascade of liquidations that destabilized the stETH peg and added pressure to ETH’s price structure. At the same time, technical indicators signaled extreme overbought conditions, with retail enthusiasm peaking.

The report highlights that a combination of on-chain dynamics, ETF fund flows, and broader macroeconomic indicators will now play a crucial role in shaping the next Ethereum price move. BitMEX co-founder Arthur Hayes recently said that he expects the ETH price to shoot to $10,000 by year-end. He said that the Trump administration can provide a huge liquidity pump by expanding the credit line.

Inflows into spot Ethereum ETF have continued to remain at a strong pace. On Wednesday, the net inflows across all US ETF issuers were $332 million, of which BlackRock’s ETHA alone contributed $324 million of inflows.

.png)

3 months ago

5

3 months ago

5

English (US)

English (US)