ARTICLE AD BOX

- Ethereum (ETH) hits the accumulation phase as 230K tokens move from centralised exchanges on a single day.

- Holders of between 10k and 100k ETH aggressively accumulate, purchasing 520k ETH on a single day.

The momentum of Ethereum (ETH) has just subsided after printing impressive gains to hit a monthly high of $2,700 from the $1500 level. According to our market data, the asset has declined by 5% in the last 24 hours to trade at $2,486. Meanwhile, its market cap has reached $300 billion, making up 9% of the total market share.

Ethereum’s (ETH) On-chain Analysis

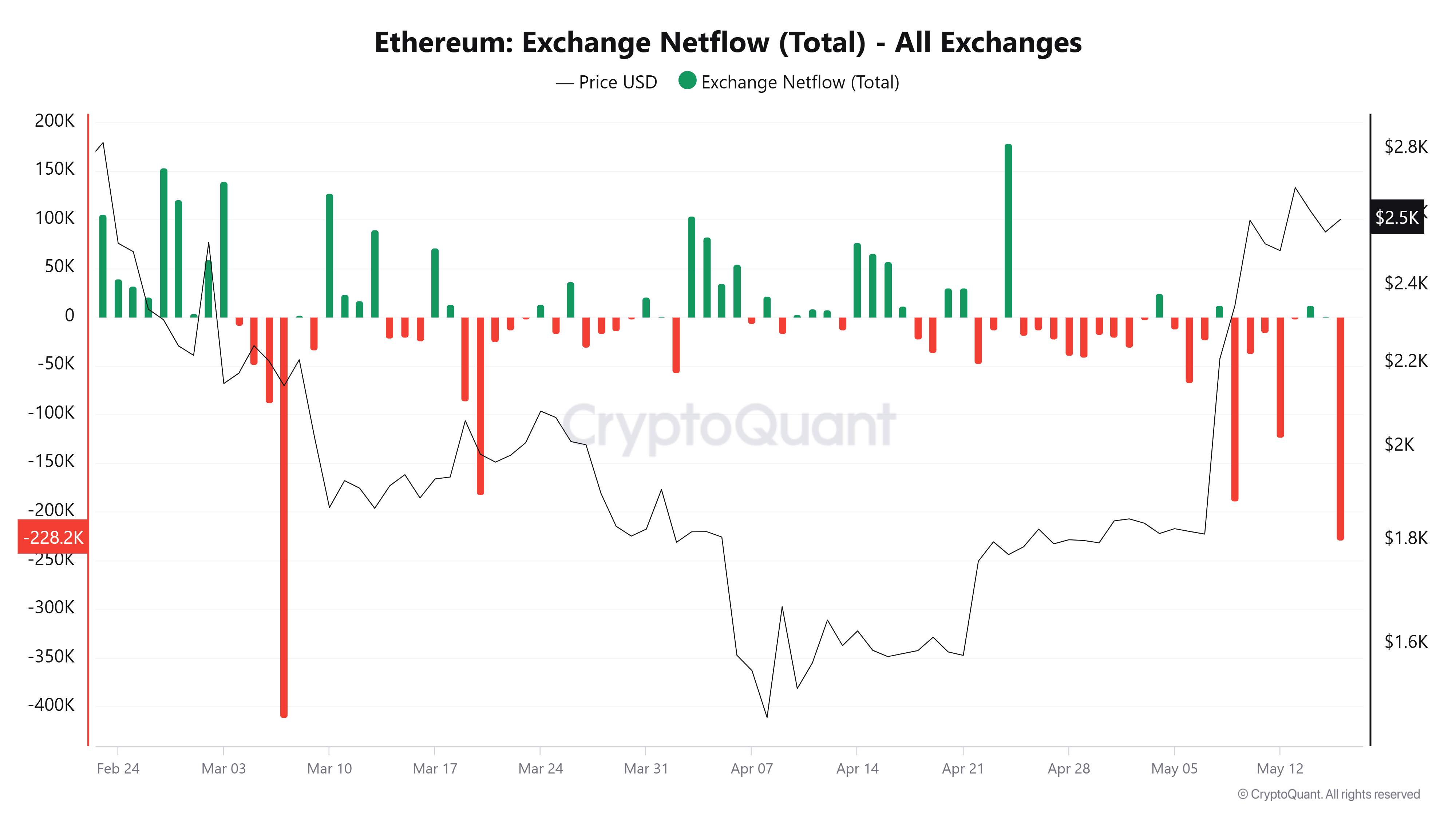

Ethereum is currently preparing for an upsurge as spot-based investors return to the market. According to our research, a net exchange outflow of 230K ETH was recorded on Friday, May 16. Fascinatingly, this is the largest single-day movement witnessed since March 7.

Source: CryptoQuant

Source: CryptoQuantExplaining this situation, our analysts highlighted that the exchange outflow shows the rate of movement in and out of crypto exchanges. In the current scenario, the move out of the exchanges superseded the inflow, indicating a rising buying pressure.

According to data, digital asset firm Abraxas Capital emerged as the main contributor of the net ETH outflow, withdrawing a significant amount of 278,639 ETH on May 7.

Further exploring the data, we found that the buying pressure on exchanges was facilitated by holders with between 10K and 100K ETH. On Wednesday alone, this set of holders accumulated 520K ETH. Looking at the trend, we discovered that most of these accumulated assets likely moved to staking protocols.

Confirming this move, Nansen data has highlighted that smart Money activities have recorded a significant surge. As detailed in our previous news brief, the holdings have increased from 86,709 ETH to 123,615 ETH, marking the highest since February 2025.

More on the Ethereum Analysis

Delving into the recent rally, the Pectra upgrade executed on May 7 was said to be a catalyst for the massive growth of the network. As highlighted in our previous blog post, this upgrade has increased the amount of ETH that could be staked by validators, from 32 ETH to 2,048 ETH.

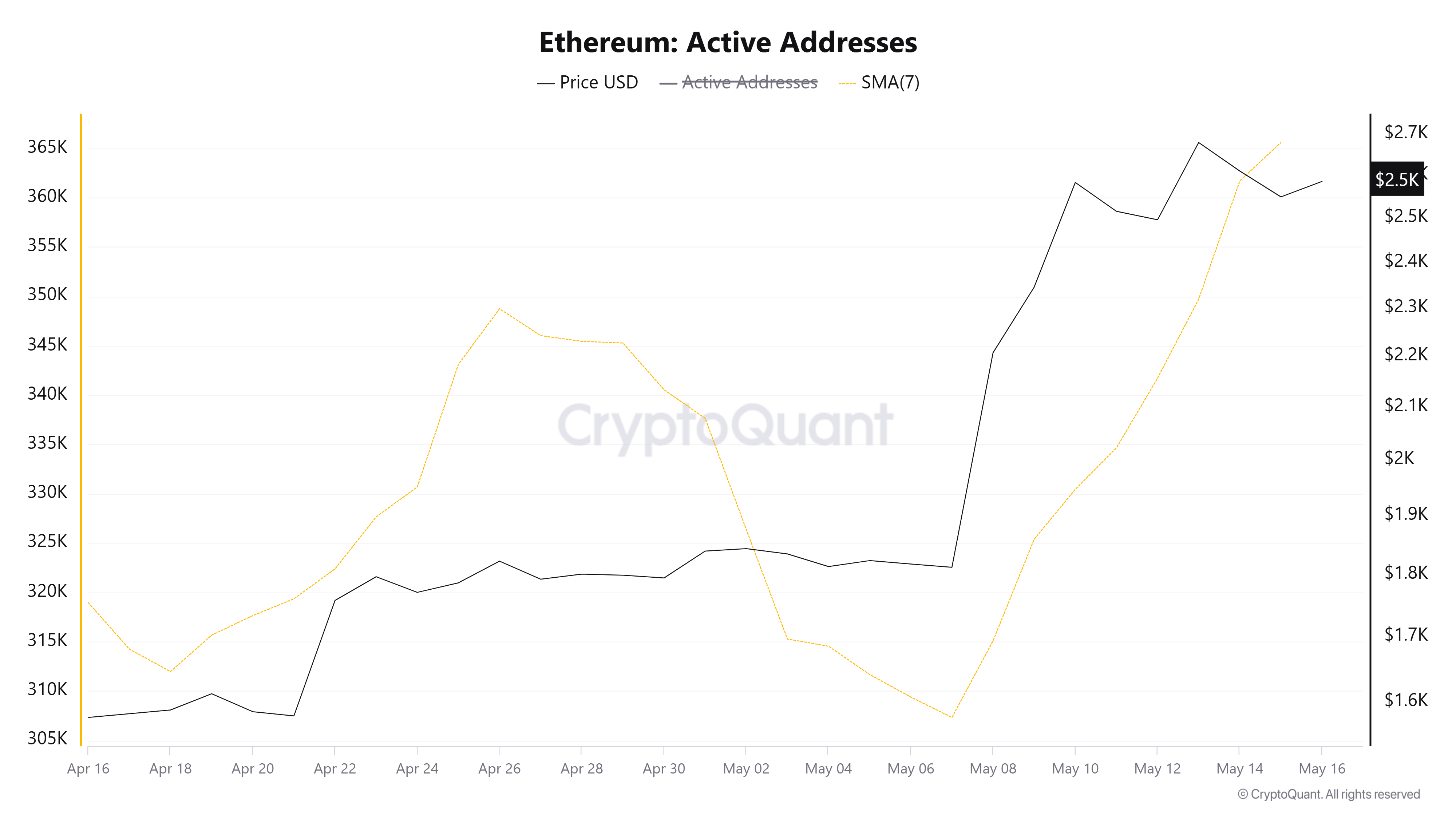

Source: CryptoQuant

Source: CryptoQuantSince that time, the active addresses on the network have continued to grow. In the medium term, the price is expected to breach the $3000 level and target its all-time-high price.

For now, the market is reacting to the $1.5 billion in profit realised from the recent rally. Data shows that $53.65 million in futures have been liquidated in just 24 hours. Out of this, $27.01 million was long and $26.68 million was short. As discussed earlier, retail investors have been exiting the market for the past weeks as whales aggressively accumulate every dip.

Currently, ETH is reported to have a resistance level at $2,750. Breaking this level could send the price to $2,850. However, failure to reclaim the $2,530 support level could see the asset declining to $2,260 and subsequently to $2,100.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)