ARTICLE AD BOX

- Weekly close above EMA13 in July 2025 mirrors past bullish impulses seen in 2023 and 2024.

- Technicals confirm DOGE is in a full bullish zone, a breakout toward $1.10 could follow the recent EMA13 crossover.

Dogecoin has once again captured the market’s attention after various technical indicators gave strong signals that its uptrend has just begun. According to crypto analyst Master Ananda, Dogecoin is now fully bullish.

He pointed to the weekly 200-day moving average (MA200), which remains well below the current price, around $0.135. Ananda stated that this line has now been left far behind by DOGE’s candles, indicating that the consolidation phase has passed.

DOGE Signals a Rebound with Familiar Technical Setups

However, the main focus is on the weekly 13-day moving average (EMA13). When DOGE successfully breaks through and maintains above this indicator, history shows a price surge. A similar event occurred in October 2023 and again in September 2024. In both instances, DOGE triggered a bullish impulse and set higher highs.

Source: Master Ananda on TradingView

Source: Master Ananda on TradingViewAnd now, Dogecoin just closed above the 13-day moving average again last week—in early July 2025. Ananda hinted at a simple but convincing point: a new bullish wave will soon propel Dogecoin to even higher levels.

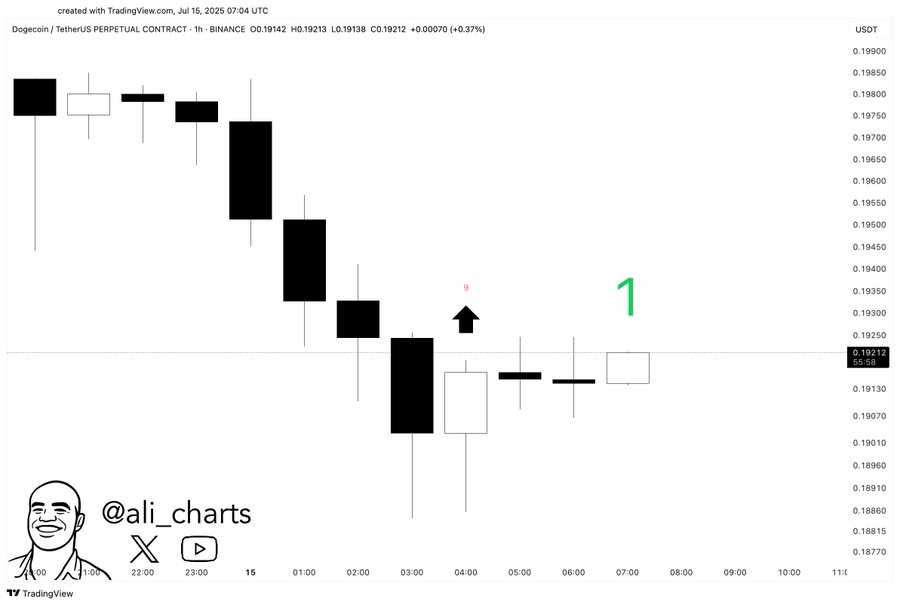

Meanwhile, on-chain analyst Ali Martinez echoed this optimism. He noted that the TD Sequential indicator on the DOGE/USDT hourly chart had shown a buy signal. He believes this could be the start of a rebound, especially if buying pressure begins to re-emerge in the near future.

Source: Ali Martinez on X

Source: Ali Martinez on XDogecoin Trading Slows in Derivatives

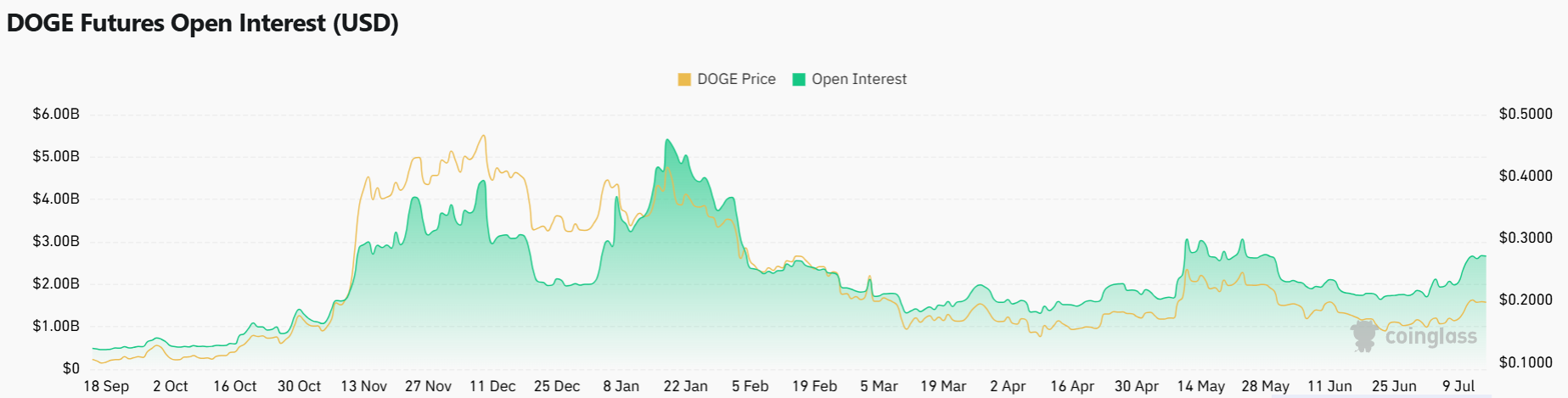

While technically promising, the Dogecoin derivatives market has recently shown a slowdown. The latest data from CoinGlass reveals that DOGE derivatives trading volume has fallen sharply in the past 24 hours—down around 10.25%, with total volume reaching $6.44 billion.

Furthermore, Open Interest also dropped 7.79% to $2.61 billion. Typically, a decline in Open Interest indicates that many positions are being closed or a lack of interest in opening new ones.

Source: CoinGlass

Source: CoinGlassMore strikingly, DOGE options trading volume has plummeted by 55.94%, remaining at just $389.74 million. This signals that institutional investors or large speculators appear to be waiting for a more definitive moment, especially considering that volatility has not yet fully “exploded.”

However, also from CoinGlass, DOGE/USDT data on Binance shows a fairly extreme long-to-short position ratio: 2.9124. This means almost three times as many accounts are buying than selling. Furthermore, spot volumes also heated up last June. CNF reported that Dogecoin trading volume surged 51% to $1.71 billion—especially during the 13th and 14th hours of the trading session, which are often associated with movements by Asian retail traders.

So, even though the derivatives market is holding its breath, buying from the spot market and retail optimism continue to flow strongly. It’s like someone who’s quiet on the outside but passionate on the inside. The next explosion could be just a matter of time.

.png)

3 months ago

8

3 months ago

8

English (US)

English (US)