ARTICLE AD BOX

- Dogecoin holds near $0.18 as ETF anticipation builds, backed by SEC leadership shift and strong institutional engagement.

- Despite $1.22M long liquidations signaling short-term pressure, RSI and EMA levels still hint at bullish potential.

Dogecoin remained firm near $0.18 on Friday, in line with a wider crypto market rally recently. The price sets up major recovery from the April 7 low of $0.13. The momentum is sustained by increasing speculation about approval of Dogecoin spot Exchange Traded Funds (ETFs), potentially funneling a large influx of new capital into the market.

The Securities and Exchange Commission (SEC) is in the process of considering applications filed by large fund managers such as 21Shares, Bitwise, and Grayscale to launch DOGE spot ETFs. Importantly, Nasdaq has filed Form 19b-4 to list shares in the 21Shares Dogecoin ETF.

The proposals for DOGE ETFs picked up momentum when Paul Atkins, who is pro-crypto in nature, was elected to serve as chair of the SEC. His tenure has generated optimism among investors that the regulator will approve DOGE ETFs in the near future, with Bloomberg analyst Eric Balchunas giving it an 80% chance.

Dogecoin ETF Gains Credibility, Traders Turn Optimistic

The recent data indicates increasing optimism among investors and traders. The latest market update by market insight firm Santiment indicates collaboration between the Dogecoin Foundation and 21Shares through the House of Doge has lent legitimacy to the proposed ETF. Santiment said:

The partnership between 21Shares and the Dogecoin Foundation (via the House of Doge) to promote the ETF has added credibility to the project, sparking stronger engagement from both longtime DOGE supporters and traditional investors looking for new opportunities,

Social sentiment has also turned in a positive direction. Dogecoin is finally viewed more and more as more than a simple meme token and a real investing opportunity drawing institutional attention. Santiment charts highlight increasing social activity even as the SEC prolonged its review period for the DOGE ETF to June.

Dogecoin Bulls Squeezed—$1.22M Longs Liquidated

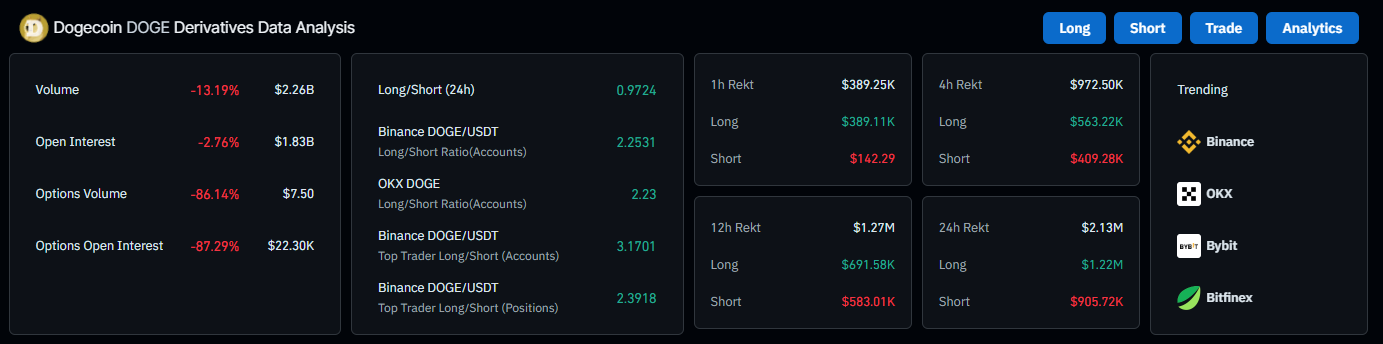

Even in a positive sentiment environment, open interest dropped by 2.76%, indicating interest is waning among traders. Though a long-to-short ratio remaining somewhat above one indicates more traders are anticipating upward price movements in anticipation of this token’s near-term potential.

Source: CoinGlass

Source: CoinGlassOver the last 24 hours, Dogecoin witnessed a short position worth $905.72K getting liquidated against merely $1.22 million in long ones. The long position liquidation indicates the market was probably declining for so short a time. This is a long squeeze when buyers with a bullish attitude are compelled to close their positions with a loss.

The daily chart of Dogecoin is seen moving around $0.180, just above its 50-day Exponential Moving Average (EMA) of $0.1771. If DOGE is able to breach this point on a daily closing basis, it will test resistance near its 100-day EMA of $0.1734 and potentially its 200-day EMA of $0.1728 in the near future.

Source: TradingView

Source: TradingViewThe Relative Strength Index (RSI) is at 55, well above the midpoint, supporting a positive outlook. If RSI continues to move in an upward direction towards overbought levels, increasing momentum will strengthen even more, raising expectations of a long-term rally.

.png)

14 hours ago

1

14 hours ago

1

English (US)

English (US)