ARTICLE AD BOX

- DOGE derivatives trading volume surged while spot markets saw large withdrawals from top exchanges.

- Users may be moving tokens to cold wallets despite rising trading activity.

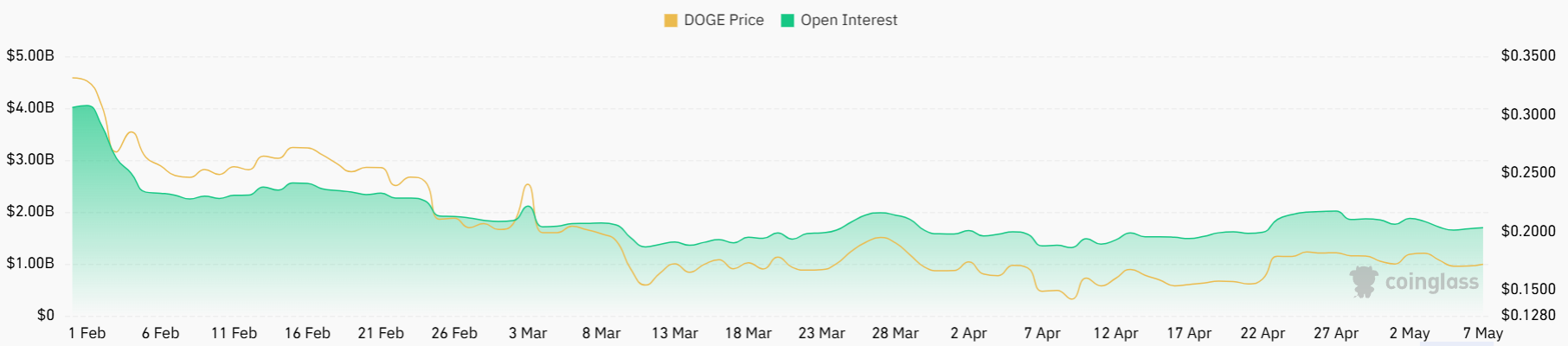

Dogecoin (DOGE) derivatives trading volume is booming. According to CoinGlass data, in a short time, the spike reached more than 26% and has now reached $2.59 billion. Open interest also increased, although not as drastically as volume, with a growth of around 2.6% and recorded at $1.70 billion.

Source: CoinGlass

Source: CoinGlassMeanwhile, the DOGE options market is also hot. Options volume has more than doubled, increasing by 139% to reach $123 thousand, and open interest has also increased by 37% to $227 thousand. Not only busy, but also deep. Traders seem to be playing their strategies deeply, either for short-term speculation or simply hedging.

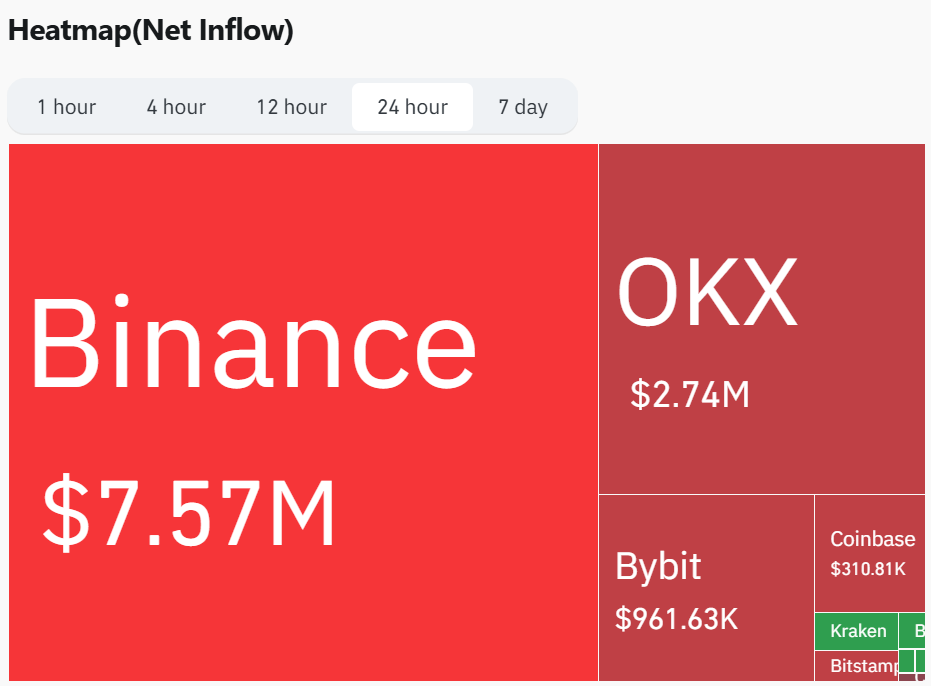

DOGE Gets Pulled From Exchanges Despite Market Heat

But the funny thing is, when the derivatives world is hot, data from the spot market actually presents another puzzle. There is a massive outflow from various exchanges. In the last 24 hours, Binance recorded a net outflow of $7.57 million, OKX around $2.74 million, followed by Bybit and Coinbase with almost $1 million and $310,000, respectively.

Source: CoinGlass

Source: CoinGlassImagine if you had several million DOGE and chose to withdraw from the exchange, instead of taking part in the surge in volume. What would you do? Store it in a personal wallet, perhaps?

The long/short ratio on Binance for the DOGE/USDT pair reached 2.3784, which means that the majority of accounts prefer long positions. Usually, this indicates that many traders anticipate a price increase. Strangely, though, with all the commotion DOGE holders are collectively transferring their holdings off the exchange.

They may think market circumstances are unstable, or vice versa—believe Dogecoin will keep rising, therefore they are better off keeping it in a cold wallet instead than being lured to sell fast.

When Tech Ambitions Collide With Traditional Finance

Furthermore, the development of the Dogecoin ecosystem has also stolen attention. Recently, DogeOS—a DOGE-based app development platform—raised $6.9 million in fresh funding. The funding came from an investment round led by Polychain Capital.

The targets are quite ambitious: from gaming to artificial intelligence to blockchain-based financial services. This means that DOGE is no longer just an internet joke. There is a real push to build on its technological foundation.

Looking back, in December 2024, Frankenmuth Credit Union in the United States added Dogecoin to the list of cryptocurrencies available on its banking portal. So if you’re an FCU member, you can buy and sell DOGE directly from your bank’s app. It’s like seeing two worlds—one meme world, one old financial institution world—meet halfway.

And don’t forget, there’s one more major event that’s bringing DOGE closer to the center stage. CNF previously reported that Nasdaq has officially filed an application with the SEC to list the 21Shares DOGE ETF. Although the process has not been approved, and Bitwise’s ETF is still pending until June 2025, this move is a strong signal that DOGE is increasingly being eyed by big players.

At the time of writing, DOGE was trading at about $0.1727, up 1.72% in the last 24 hours. Its daily volume is still active, reaching $865 million.

.png)

4 days ago

3

4 days ago

3

English (US)

English (US)