ARTICLE AD BOX

- Crypto sentiment sinks to yearly lows while fear readings push traders into retreat.

- Some analysts see fading retail supply as a setup for a sharp rebound soon.

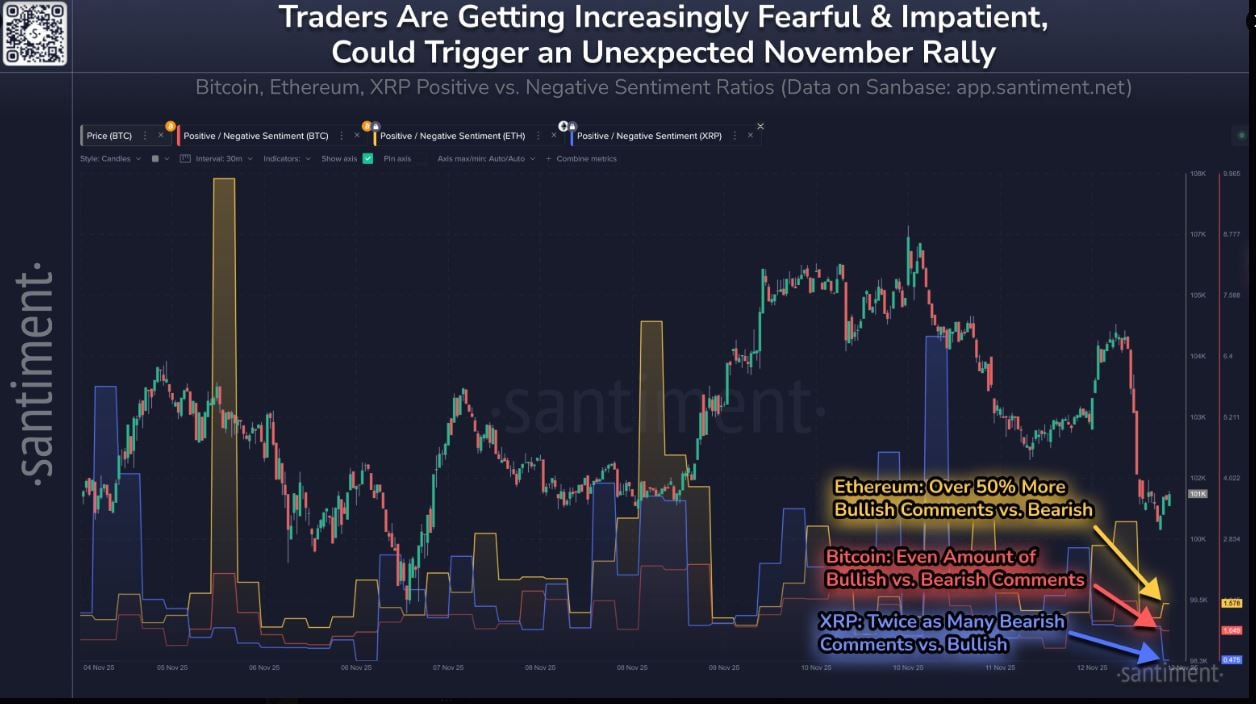

Crypto markets are facing heavy caution in mid-November as trader sentiment around Bitcoin, Ethereum, and XRP reaches its lowest point of 2025. Data from Santiment revealed that Bitcoin discussions on social media now split evenly between positive and negative remarks.

Ethereum recorded just over 50% more bullish than bearish comments, both figures lower than usual.

Ripple’s XRP saw less than half of social media mentions leaning bullish, placing the token in what analysts are calling one of the most “fearful moments of 2025.”

Source: Santiment

Source: SantimentThe overall market mood mirrors that slump. On Thursday, the Crypto Fear & Greed Index hit 15 out of 100, a reading categorized as “extreme fear.” That was the weakest level since March, showing the broader market has turned defensive.

Joe Consorti, head of Bitcoin growth at Horizon, said the current mood feels much like the market of 2022 when Bitcoin traded near $18,000. Data from Glassnode backs that similarity, indicating that traders’ attitudes are repeating patterns seen before earlier rebounds.

Negative Crowd Mood Sparks Rebound Setups

Despite the growing unease, history could work in favor of patient investors. Santiment noted that when crowd sentiment turns negative toward major cryptocurrencies, it often signals a period of capitulation, leading to accumulation by stronger holders. Santiment said,

When the crowd turns negative on assets, especially the top market caps in crypto, it is a signal that we are reaching the point of capitulation. Once retail sells off, key stakeholders scoop up the dropped coins and pump prices. It’s not a matter of if, but when this will next happen.

That idea finds support in market history. CoinGlass data shows Bitcoin has averaged a 41.78% gain during November since 2013, raising hopes that a repeat could occur.

Crypto trader Dave Weisberger said Bitcoin’s fundamentals remain strong and noted that the broader setup looks very constructive compared with past cycles, placing the asset near the bottom of its range relative to other financial markets. His view reflects growing confidence that the market could be near a rebound phase.

Bitcoin Analysts Eye Late-November Surge

Crypto analyst Carl Runefelt said earlier in the week that “November will turn green again for Bitcoin soon.” He pointed out that the market might see “big green candles” before the month ends. The sense of cautious optimism is also shared by trader AshCrypto, who said he remains “still bullish.”

November will turn green again for #Bitcoin soon.

Those big green candles are coming.  pic.twitter.com/BibLHF77bT

pic.twitter.com/BibLHF77bT

— Carl Moon (@TheMoonCarl) November 10, 2025

Adding to that perspective, Samson Mow, founder of firm Jan3, said the recent wave of selling likely came from newer market participants who entered the market over the past 12 to 18 months. According to Mow, they are now taking profits out of fear that the cycle has peaked. He explained,

These are not Bitcoin buyers from first principles, but rather speculators that follow the news.

Mow said this group has mostly run out of coins to offload, while steady holders have already absorbed the supply. In his view, that shift sets the stage for stronger conditions ahead, and he expects 2026 to deliver a strong phase for the market.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)