ARTICLE AD BOX

Crypto analyst Cyclop has made a potentially significant statement, claiming that the ongoing crisis between Israel and Iran may inadvertently boost the performance of digital assets.

Despite recent volatility, which saw a sell-off of approximately $140 billion in the crypto market, Cyclop’s long-term analysis reveals a more optimistic outlook for the broader digital asset industry.

Analyst Predicts Bullish Trends For Crypto Amid Conflicts

In a recent post on X (formerly Twitter), Cyclop pointed to historical patterns that suggest geopolitical tensions often lead to bullish trends in cryptocurrency.

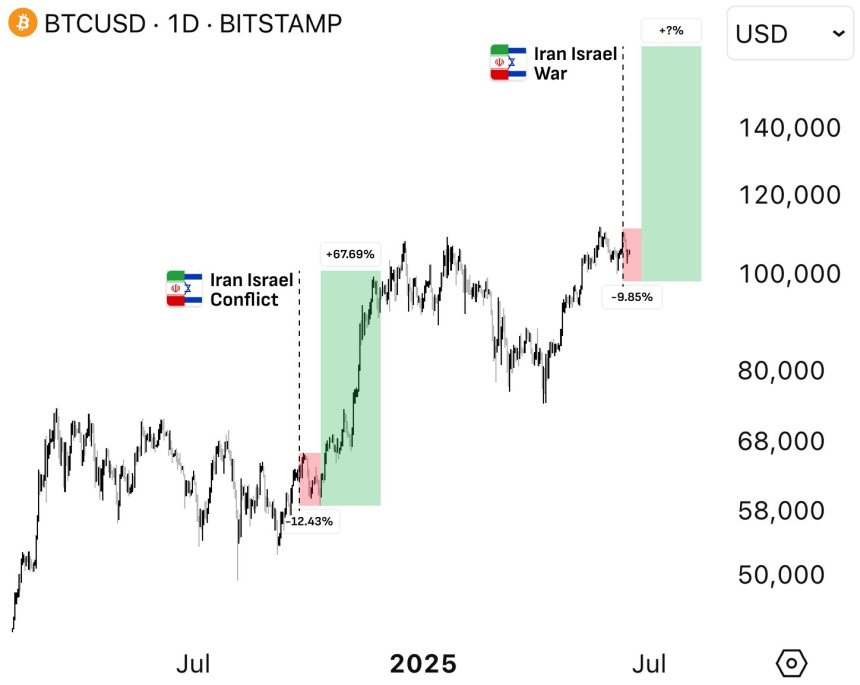

Citing specific instances from April and October 2024, he noted that Bitcoin (BTC) experienced an initial decline of 18% and 10% respectively during these conflicts, only to rebound with impressive gains of 28% and 62% shortly thereafter.

This trend, he argues, indicates a recurring cycle where war-related dips in crypto prices eventually transform into significant growth, as can be depicted in the chart below shared by Cyclop.

The analyst explains that while such conflicts can trigger short-term bearish movements, the overarching impact tends to be favorable for cryptocurrencies.

As wars ignite fears of inflation and instability, Cyclop has noted that many investors for the traditional finance arena turn to crypto as a hedge against weakening fiat currencies.

Unlike traditional bank accounts, cryptocurrencies are not subject to freezing, he said, making them appealing during times of geopolitical unrest. Increasingly, digital currencies are being viewed as a form of “digital gold,” a safe haven in tumultuous times.

Favorable Macroeconomic Factors

The current market dynamics echo previous events, such as the Russia-Ukraine conflict and US-Iran tensions in 2020, which similarly resulted in temporary dips followed by recoveries. Cyclop remains confident that the present situation will yield similar outcomes, despite the typical summer slowdown that often affects market activity.

Supporting this bullish sentiment are favorable macroeconomic factors. Recent developments indicate that the US and China have reached a compromise, easing tariffs and aiming to stabilize global supply chains. This move is expected to help cool inflation and restore investor confidence.

Moreover, President Donald Trump’s decision to delay new tariffs has contributed to a more risk-friendly environment, allowing liquidity to flow back into crypto markets.

Further aiding this positive outlook is the latest Consumer Price Index (CPI) report, which showed a modest increase of just 0.1% month-over-month, slightly below forecasts.

With year-over-year inflation at 2.4%—down from an expected 2.5%—the Federal Reserve (Fed) is now anticipated to cut interest rates twice by the end of the year. Historically, such rate cuts have been bullish for cryptocurrencies, as they often lead to increased liquidity in the markets.

While the immediate aftermath of the Israel-Iran conflict may present challenges, historical data suggests that cryptocurrencies have the potential to thrive in such environments.

Featured image from DALL-E, chart from TradingView.com

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)