ARTICLE AD BOX

- Crypto investment products see continuous inflows for 11 weeks, signaling rising institutional confidence.

- Bitcoin and Ethereum lead the charge as most inflows target major crypto assets.

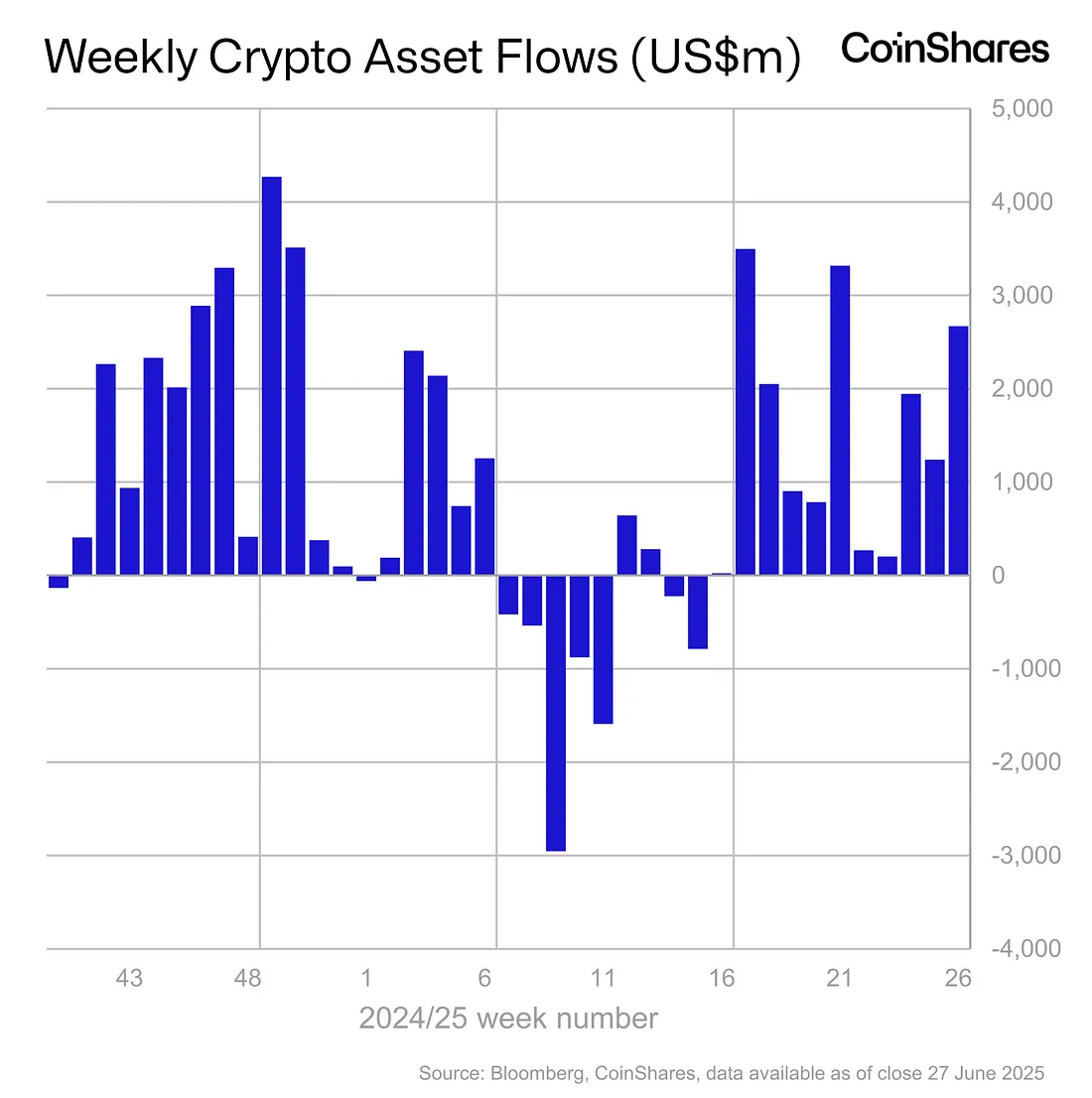

For eleven consecutive weeks, the inflow of funds into crypto investment products has shown no signs of slowing down. According to a CoinShares report, in the last week alone, the value has reached $2.7 billion.

If added up from the beginning of this trend, the total is already $16.9 billion. This large figure is certainly not the result of mere retail investors trying to buy Bitcoin. The majority of it actually comes from large institutions, especially in the United States.

Source: CoinShares

Source: CoinSharesUncle Sam’s country is indeed the center of attention this time, contributing around $2.65 billion in just one week. Meanwhile, Germany and Switzerland also joined in with $19.8 million and $23 million, respectively.

On the other hand, Canada, Brazil, and Hong Kong actually recorded outflows, although the values were relatively small: $13.6 million, $2.4 million, and $2.3 million. So even though there are still some weak points, the global flow continues to show a one-way trend—incoming.

Bitcoin Becomes a Magnet, But Pressure Remains

Another interesting fact is that more than 83% of the total inflow last week went to Bitcoin-based products. Ethereum followed with an additional $429 million, although it still couldn’t get close to Bitcoin’s figure.

However, as we previously reported, there is something that makes analysts raise their eyebrows: Bitcoin Apparent Demand is actually decreasing. This means that the supply from miners and long-term holders cannot be fully absorbed by new buyers. At this point, the market can become somewhat fragile.

Not only that, our report also noted that some long-term holders have started selling their holdings. This can be considered a weak signal, although it cannot be called panic. But still, when investors who have been known to be “resilient” start to release assets, the market will recalculate.

However, there is some quite reassuring news. Amid the geopolitical tensions that are increasingly being felt in several regions, Bitcoin funding rates are still stable in positive territory. This means that sentiment in the derivatives market remains inclined towards optimism.

In fact, data from CNF states that the Bitcoin spot ETF managed to absorb more than $1 billion in a week. So, even though pressure from the on-chain side appears, the institutional side still looks confident.

Crypto Investment Products Begin to Rival Gold in Institutional Appeal

Is this a sign that Bitcoin is moving up to become a major asset like gold? It could be. The reason is, the inflow to the Bitcoin ETF even exceeded the flow to the gold ETF in the same period. There are reports that the gold ETF actually lost around $1 billion, in contrast to the Bitcoin situation.

In practice, this can be likened to people starting to choose electric vehicles over gasoline cars. The reason is not merely because of the trend, but because they see efficiency, long-term opportunities, and encouragement from the system. Likewise with large investors—they see crypto not only as an alternative, but as part of the future asset map.

Furthermore, as long as this trend continues, it is not impossible that the inflow figure will continue to increase. As long as global volatility does not make the market too panicked, crypto investment products will likely continue to be flooded with capital. One thing is for sure, if institutions continue to enter, retailers who are late may only get crumbs.

.png)

4 hours ago

2

4 hours ago

2

English (US)

English (US)