ARTICLE AD BOX

- Chainlink whale transactions spiked over 3,373% in 24 hours, totaling $762.7 million, indicating strategic repositioning and hinting at a potential local bottom.

- CoinGlass data reveals significant long hedges at $12.55 and short positions near $13.35, suggesting LINK’s price movements.

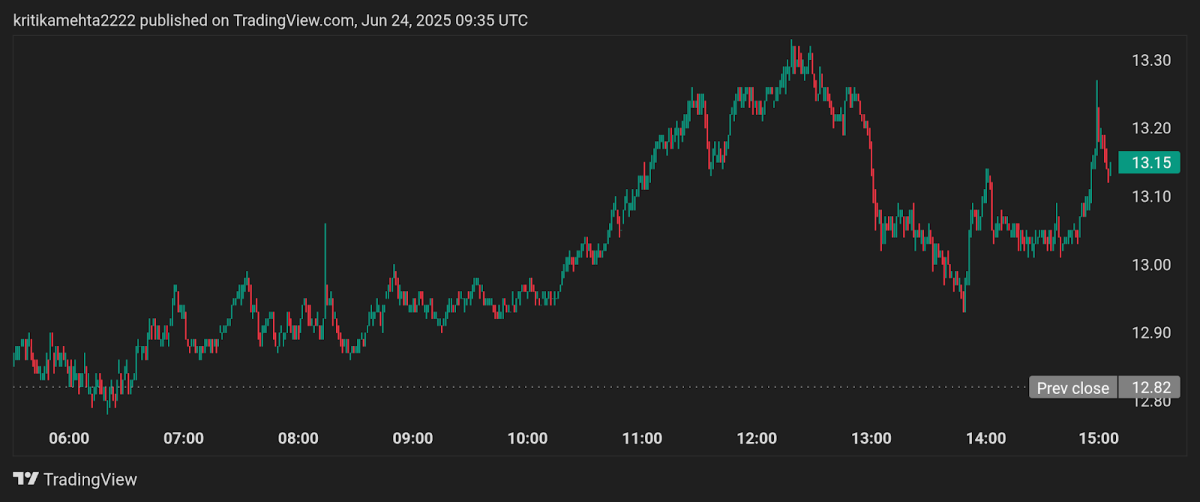

ChainLink is one of the cryptocurrencies that are on the rise, with LINK climbing above the $13 price mark after it fell significantly over the weekend, owing to the U.S. intervention in the Iran-Israel war.

On Tuesday, June 24, the LINK price gained 9.63% to $13.04 as U.S. President Donald Trump announced a ceasefire between Iran and Israel.

Chainlink Price Analysis Today

Despite a 22% decline in the LINK price previously, a surge in high-value transactions has reignited speculation of a potential reversal, which appears to have already begun. Whale movements, which typically involve large transactions made by institutional or high-net-worth investors, have spiked dramatically, suggesting a strategic repositioning.

According to data monitoring of on-chain activity, whale transactions of LINK skyrocketed by over 3,373% in 24 hours, totaling a staggering sum of $762.7 million. One of the most remarkable transfers was the unlocking and locking of 17.875 million LINK worth about $149 million to Binance. This splurge of liquidity was coupled with a general market occurrence that liquidated crypto positions worth $458 million.

These timely transactions, especially during a significant sell-off, are drawing the attention of both analysts and traders. Typically, whale activities are regarded as bullish indicators, suggesting that a crypto asset may be approaching a local bottom. Moreover, the recent movements point to the idea that Chainlink price has reached a local bottom as well.

The market opinion is mixed, though. Data on CoinGlass shows that the market is highly concentrated on the bets in the options market, as the long hedges amount to $9 million at the $12.55 mark. In the meantime, the short positions amounting to $3 million opened on the range of prices around $13.35.

Should LINK manage to rise into this price range, both bullish and bearish traders stand to see major outcomes play out, as reported by CNF earlier.

Link Price Faces Heat Amid Iran-Israel War

Source: TradingView

Source: TradingViewAccording to market analysts, once the LINK price surpasses its resistance at $13.35, it will be on its way to reaching the $14 level and beyond. However, wider economic measures are still an obstacle.

The current interest rate decisions of the U.S. Federal Reserve have brought some amount of surprise into crypto markets. Additionally, expectations of rate cuts may have provided even a more bullish push to LINK and other cryptocurrencies. That hope now shifts to the Fed’s next policy meeting in July.

Nonetheless, despite a minor bounce, technical indicators still flash caution. The short-term perspective of Chainlink is undefined. CoinCodex analysts are more subdued, as their prediction claims that by July 22, 2025, Chainlink price will trade at $11.88. They also labeled the current trend as “bearish.”

Although LINK is currently trading above the price target, its future price action depends on how it carries through with the recent whale-led excitement.

.png)

4 months ago

5

4 months ago

5

English (US)

English (US)