ARTICLE AD BOX

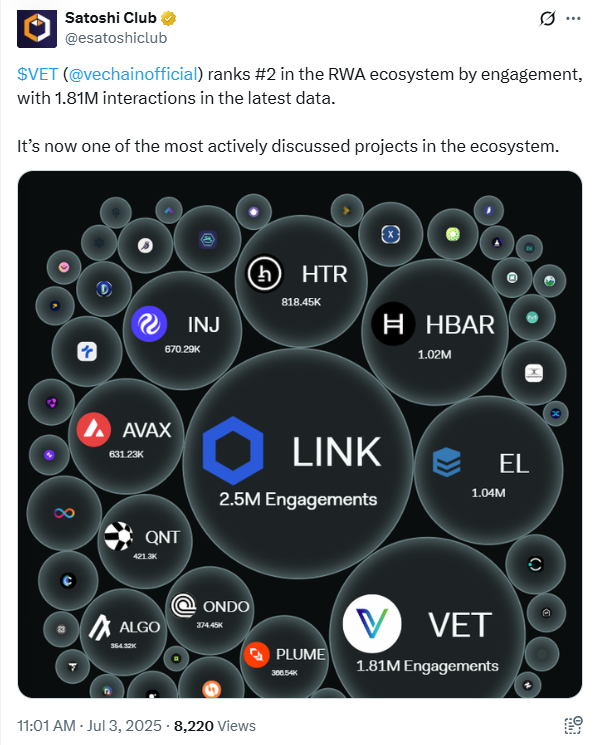

- Chainlink saw 2.5 million interactions as more people talked about its role in real-world asset projects.

- VeChain followed with 1.81 million interactions, largely driven by its work in supply chain use cases online.

Chainlink (LINK) and VeChain (VET) are attracting heavy attention in the Real-World Asset (RWA) space. Data shows that they have recorded millions of user engagements, signaling strong community interest. However, market participants are wondering if this growing interest will translate into actual price growth for these two digital assets.

LINK Leads with 2.5 Million Interactions as RWA Conversations Surge

According to a recent post on X, Chainlink is drawing the most attention in the real-world asset ecosystem, recording a total of 2.5 million interactions. It is worth noting that this puts it ahead of other top projects in the space.

Its high engagement shows just how important it has become in connecting blockchain systems to real-world data. This is a feature that continues to give it an edge. Notably, the strong numbers are not just a sign of popularity but a reflection of the growing trust in its services.

In addition, VeChain (VET) follows closely with 1.81 million interactions, ranking second in the ecosystem. Similarly, much of this interest is driven by its supply chain applications and consistent updates from the Vechain official account. These real-world use cases may be one reason behind its steady rise in community discussion.

It is worth noting that other tokens, such as Hedera (HBAR) and Avalanche (AVAX), are also gaining traction, with 1.02 million and 631,000 interactions, respectively. While they are not yet at the level of LINK and VET, they still show signs of potential. Tokens like INJ and QNT recorded 670,000 and 421,000 engagements, showing that the space is becoming more competitive.

RWA Social Interactions Chart | Source: Satoshi Club on X

RWA Social Interactions Chart | Source: Satoshi Club on XThis spike in interactions shows that people are not just watching from the sidelines. A steady conversation is building, especially on social platforms like X, which suggests increased community involvement. However, the market often moves based on real financial activity, not just online excitement.

To complement this unfolding event, CNF reported that Spiko Finance has integrated Chainlink CCIP to enable compliant and seamless cross-chain access to tokenized money market funds. Similarly, as noted earlier, VeChain has announced the launch of the StarGate platform, with a whopping 5.48 billion VTHO committed to reward early participants.

Can LINK and VET Convert Engagement into Market Gains?

Since the update, Chainlink, according to MarketCap, is trading at $13.76, up by 4.7%. Its market capitalization has also risen to $9.33 billion, with trading volume increasing by 80%.

Meanwhile, VeChain was trading at $0.02218, reflecting a 6.45% rise. Its trading volume has jumped by 21.85%, now sitting at $36.91 million.

If anything, the attention Chainlink and VeChain are receiving is clear, and it has already translated into price movement. However, while engagement is a strong indicator of interest, higher prices still depend on more stable factors such as investor confidence, liquidity, and broader market conditions.

LINK’s top ranking in engagement may suggest future strength, but without a corresponding rise in buying activity, it may not be reflected in the charts. VET’s consistent push into real-world applications offers a solid base, yet this too will need market support to reflect in its value.

For now, the spotlight is firmly on these tokens. As the RWA narrative evolves, many investors will be closely watching to see if this attention can translate into solid gains. The days ahead may give more clarity.

.png)

7 hours ago

1

7 hours ago

1

English (US)

English (US)