ARTICLE AD BOX

- Cardano (ADA) continues to struggle as its daily active addresses remain steady while its Development Activities decline by 30%.

- Analysts, however, expect a rebound to be triggered by the upcoming Leios upgrade and the much-anticipated ADA Exchange Traded Fund (ETF) launch.

Cardano (ADA) is moving within a tight range on the 24-hour time frame, surging from its daily low of $0.51 to $0.54. According to CoinMarketCap data, the asset has declined by 0.6% in the last 24 hours, extending its weekly fall to 15%. However, its daily trading volume has surged by 30% as $1 billion changes hands at press time.

Historically, ADA was trading at $0.57 in April 2025. As of mid-May, the asset had surged to $0.8. However, this level was not sustainable as the price declined to $0.65 before staging another rebound to $0.72 earlier this month.

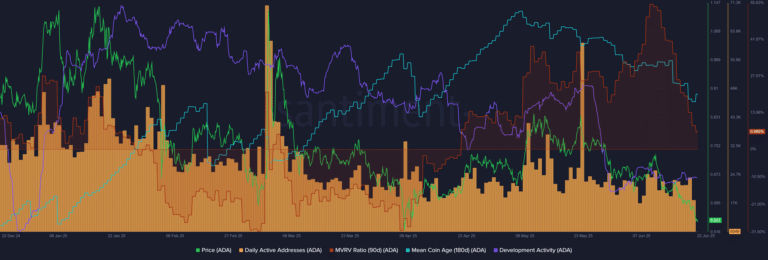

Cardano’s (ADA) On-Chain and Price Activities

Analyzing Cardano’s on-chain data, we found that the current bearish trend is supported by the number of daily active addresses, which have remained steady for some time now. Meanwhile, its development activities have been declining since February 2025. In the last 30 days, it has fallen by 30%. Apart from this, Cardano’s Total Value Locked (TVL) has also recorded a daily decline of 3.7% to $231.5 million.

Source: Santiment

Source: SantimentWhile the market threatens to extend its current downtrend, investors who have held ADA in the last 90 days are still in profit, according to Santiment data. The ongoing bearish run has also presented a fresh opportunity for investors to accumulate.

A senior official of the current US administration, Thomas Thorgersen, has, for instance, confirmed his investment in the asset. As indicated in our recent publication, Thorgersen is holding between $1,001 to $15,000 in ADA.

Regardless of the current trend, an analyst called Alex Becker expects a rebound by at least 5x. As explained in our last analysis, Becker argues that the Cardano network is very fast and currently operates as the most decentralized blockchain behind Ethereum. Others also believe that the expected upsurge could be triggered by the much-anticipated Leios upgrade. As noted in our earlier post, this initiative is expected to increase transaction speed and improve scalability.

The implementation timeline is also being accelerated to 2026 to position it ahead of competitors. Until then, Cardano is already recording an increasing activity on the network as total transactions cross 110.43 million while the number of projects building on the blockchain reaches 2004, according to its weekly report dated June 13. As highlighted in our earlier discussion, the Consensus team recently worked on the Leios ledger and protocol design by adding transactions to the Haskell Leios simulator.

Apart from this, the price of ADA could also be fueled by the potential approval of its Exchange Traded Fund (ETF) application, which is expected to be approved this year. As discussed in our earlier blog post, Bloomberg’s ETF analysts James Seyffart and Eric Balchunas believe that it has a 65% chance of approval in 2025.

.png)

4 months ago

6

4 months ago

6

English (US)

English (US)