ARTICLE AD BOX

- Charles Hoskinson insists Input Output is not involved in an impersonation scam.

- The ADA price chart is looking good as the coin fights to climb towards the $1 mark.

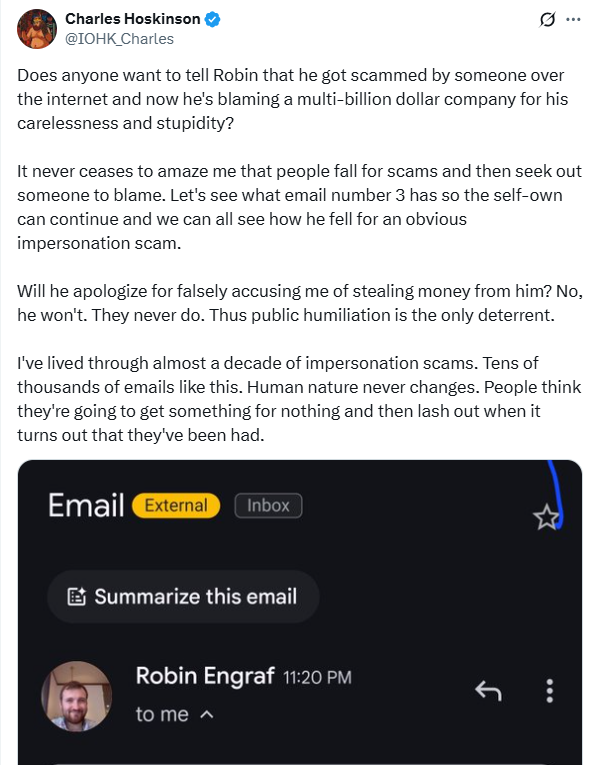

Cardano founder Charles Hoskinson called Robin Engraf out over unfounded scam accusations. Hoskinson has denied the allegations from Engraf, who accused an Input Output employee of misappropriating funds under the pretense of trade withdrawals.

Charles Hoskinson Rebuts Scam Allegations

In an X post, the Cardano founder failed to empathize with Engraf. Instead, Hoskinson blamed the crypto trader for failing to perform due diligence.

The rift started when Egraf sent an email to Hoskinson, accusing Input Output of a scam. In the email, Engraf accused Gabriel Martin, an employee of Input Output, of collecting funds under the guise of trade withdrawals.

Engraf said he had months of bank records and chats to back his claims. He went on to accuse Input Output of allowing and supporting theft.

In response to the email, Hoskinson denied the allegations, issuing a stern warning to Engraf. Charles Hoskinson said Engraf fell for an obvious impersonation scam. He described it as part of a broader pattern of impersonation scams targeting high-profile crypto figures.

Image Source: Charles Hoskinson on X

Image Source: Charles Hoskinson on XThe Cardano founder emphasized that impersonation scams thrive on the victims’ eagerness to make quick gains. Hoskinson maintained that Engraf has refused to accept personal accountability, and thus, the reason for the callout.

Hoskinson continued that he has seen thousands of similar emails and messages from victims over the past decade.

“It never ceases to amaze me that people fall for scams and then seek out someone to blame. People think they’re going to get something for nothing and then lash out when it turns out that they’ve been had,” says Hoskinson.

The response from Hoskinson serves as a reminder that due diligence is essential when engaging with investments. Traders must particularly scrutinize investment opportunities that promise outsized gains without clear substantiation.

Additionally, it highlights that scams continue to pose a significant challenge to the broader crypto ecosystem. As we covered in our latest report, scammers are shifting tactics to target new investors. The report also highlighted that stablecoins are increasingly used in phishing and online fraud schemes across major blockchain networks.

In May, BNB launched an AI Bot to assist developers and users across platforms. As we discussed earlier, the AI bot also enhances security on Discord, blocking scams and phishing links.

ADA Price Eyes the $1 Milestone

Away from the crypto scam discussions, ADA, the native token of the Cardano blockchain, has exhibited an impressive performance.

Within the last 24 hours, ADA price has rallied over 2.8%, according to CoinMarketCap data. ADA is currently $0.746, with the market capitalization standing at $26.4 billion.

The price chart revealed ADA rallied as high as $0.75, only $0.25 away from the $1 mark. In our last update, we examined that ADA jumped 30% on the weekly chart to a high of $0.777.

The ADA price recently tested the 200-day simple moving average (SMA), acting as a key resistance point around $0.749. This level is crucial as it often signals a shift in trend when broken.

ADA may see a stronger push toward $0.90 and $1.20 if it can break through and stay above the 200-day SMA.

Moreover, the Cardano blockchain has seen increased activity over the past few weeks, further supporting the bullish case. The Cardano weekly development report released on July 4, 2025, confirmed that total transactions within the week increased to 111 million.

.png)

3 months ago

8

3 months ago

8

English (US)

English (US)