ARTICLE AD BOX

- Ethereum ETFs have seen a cumulative net inflow exceeding $4 billion in 11 months, with $1 billion added in the past 15 trading sessions alone, taking the combined AUM to $9.87 billion.

- On June 24, ETHA reported a net inflow of $97.98 million, with its share price rising 5.31% to $18.45, leading to an upside push on ETH price.

Spot Ethereum ETF products have become a hot topic in the industry. BlackRock’s iShares Ethereum Trust (ETHA) is leading the Ether spot ETF market in the United States with over $5.3 billion net inflow by Tuesday, June 24.

Spot Ethereum ETFs Record Robust Inflows

According to SoSoValue data, BlackRock Ethereum ETF had a daily net inflow of $97.98 million, with the ETHA share price closing at 18.45, surging by 5.31% on Tuesday. However, ETHA was valued at a discount of 0.98% in the premarket trading session on Wednesday, indicating a sluggish start for the day.

Source: SoSoValue

Source: SoSoValueAlso, it’s worth noting that U.S. spot Ethereum ETFs have already had more than $4.1 billion of cumulative net inflows in a relatively short time of 11 months. The sector has attracted over $1 billion in fresh capital over the past 15 trading sessions. On Tuesday alone, the daily total net inflow reached $71.24 million.

Further, the combined assets under management (AUM) of all U.S. spot Ethereum ETFs touched a whopping $9.87 billion. As the figure nears the $10 billion market, it indicates the increased interest of institutional and retail investors in Ethereum-based investment products, as mentioned in our previous post.

Meanwhile, Fidelity took the second position after BlackRock in total but for the day, FETH recorded an outflow of $26.74 million. Still, FETH market price also increased by 5.32% to $24.36. Another noteworthy contender, Bitwise’s ETHW closed at $17.48 with a 5.30% daily increase and no net inflow.

Moreover, Grayscale’s ETHE and ETH products also remained flat in terms of net inflow. ETHE, priced at $20.15, gained 5.06% on the day. Grayscale’s other ETH vehicle closed at $22.95, up by 5.23%.

Some other issuers, VanEck (ETHV), Franklin (EZET), Invesco (QETH), and 21Shares (CETH) had good daily returns showing ranging from 5.24% to 5.41%, but failed to report any new investment on June 24.

What’s Next For ETH Price?

Amid strong ETF inflows, Ethereum price resumed an upswing after securing support $2200. In the continuation of Bitcoin’s bullish moves, ETH also broke above major resistance levels of $2,220 and $2,250 to enter a favourable trading area, as reported earlier by CNF.

Source: TradingView

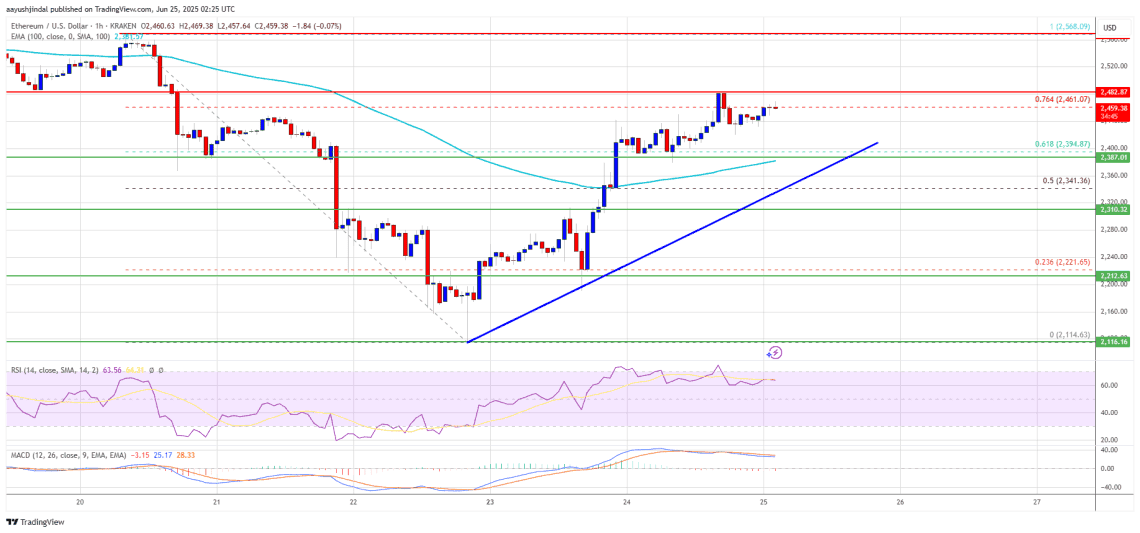

Source: TradingViewEthereum price saw a breakout from the formidable Fibonacci level retracement of 61.8% measured using the fall between the $2,568 peak and the $2,115 low. As of writing, ETH is still hovering over $2,320, trading well above its 100-hourly Simple Moving Average, which implies that the bullish sentiment hasn’t faded yet.

The current price action places ETH just beyond the 76.4% Fib retracement level derived from the same downtrend. However, tension continues with the entry of sellers around $2,480 and $2,500. In case the ETH price is able to clear these levels, the next critical resistance sits at $2,550. Meanwhile, further gains hinge on a successful breakout from the $2,565 resistance.

.png)

4 months ago

6

4 months ago

6

English (US)

English (US)