ARTICLE AD BOX

Crypto analyst Dr. Cat (@DoctorCatX) has issued a high-stakes warning about Bitcoin’s trajectory, suggesting the market now stands at a decisive technical crossroads. In a detailed post on X, Dr. Cat challenged the widespread optimism surrounding a casual correction to $90,000, dismissing the idea as “a fairy tale” unsupported by multi-timeframe Ichimoku data.

Bitcoin $90,000 Dream Is A “Fairy Tale”

“To make it clear,” the analyst wrote, “the idea to casually dip to 90K and resume the daily uptrend sounds like a fairy tale to me.” According to Dr. Cat, such a move would require Bitcoin to breach no fewer than four critical support levels on higher timeframes, which he considers “so unrealistic that… [it] may come only in the dreams of someone sidelined waiting for these prices.”

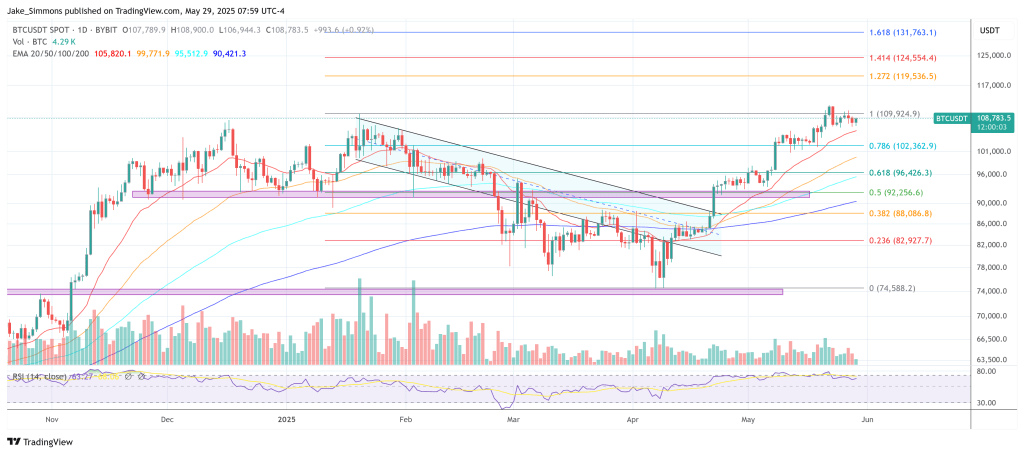

Instead, Dr. Cat identifies a narrow window of “imbalances” across the daily, 2-day, and 3-day Ichimoku indicators—most notably between $102,600 and $106,300—that remain untapped. “These are pending a touch,” he noted, pointing to the Kijun Sen and Tenkan Sen levels as crucial balance markers.

The weekly Chikou Span (lagging span), a key indicator in Ichimoku theory, currently sits above prior candle closes—a historically bullish condition that suggests Bitcoin is still in a strong uptrend unless it closes below those support levels. Dr. Cat charted these historical supports using the 26-period look-back rule: approximately $103.600 for this week, rising to $108.300 by mid-June before dipping toward $99,000 by late June. “If CS has managed to keep above candles so well until now on the steepest past slope, it’s very unlikely to go below them,” he emphasized.

However, the bullish case comes with a short fuse. A pivotal technical event—the bullish TK cross on the weekly chart—is expected on June 9. “But if [it’s] below ATH, it will be fake as Kijun Sen will be flat,” he warned. In plain terms: unless Bitcoin prints a new all-time high shortly after the TK cross, the signal will be invalidated. On the other hand, a new ATH post-cross would confirm what Dr. Cat calls a “super clear and bullish signal: very, very unlikely not to be followed immediately by a strong bullish continuation.”

Notably, he flags a divergence between BTCUSD and BTCEUR, the latter of which is already showing the Chikou Span dipping into candle territory, a neutral-to-bearish signal. “BTCEUR… looks significantly worse than BTCUSD,” he observed. “This chart is simply neutral and can go either way: much higher than here, or as low as ~70K EUR.” He attributes some of the current BTCUSD bullishness to USD weakness, adding that mid-June will likely clarify whether this price strength is structurally sound or artificially inflated.

Zooming out to the monthly chart, Dr. Cat unveiled his most aggressive forecast yet: $270,000 per BTC, based on Ichimoku Price Theory’s “4E model.” While he acknowledged this as a “wild guess,” he argued that the crypto market tends to defy consensus expectations. “Plenty of people seem to be skeptical of this bull run,” he said. “And even if they expect it to continue, they bet mostly on shy/moderate targets. My bet is on the latter [being surpassed].”

The next two to three weeks will be decisive. A failure to break all-time highs in June—combined with Chikou Span weakness or daily trend breakdowns—could signal a prolonged cool-off into Q4. Until then, all eyes are on the weekly TK cross and the market’s reaction.

At press time, BTC traded at $108,783.

.png)

1 day ago

1

1 day ago

1

English (US)

English (US)