ARTICLE AD BOX

The post Bitcoin Supply Shock Incoming: Nakamoto Holdings and KindlyMD Merges With $710M to Form a BTC Treasury Vehicle appeared first on Coinpedia Fintech News

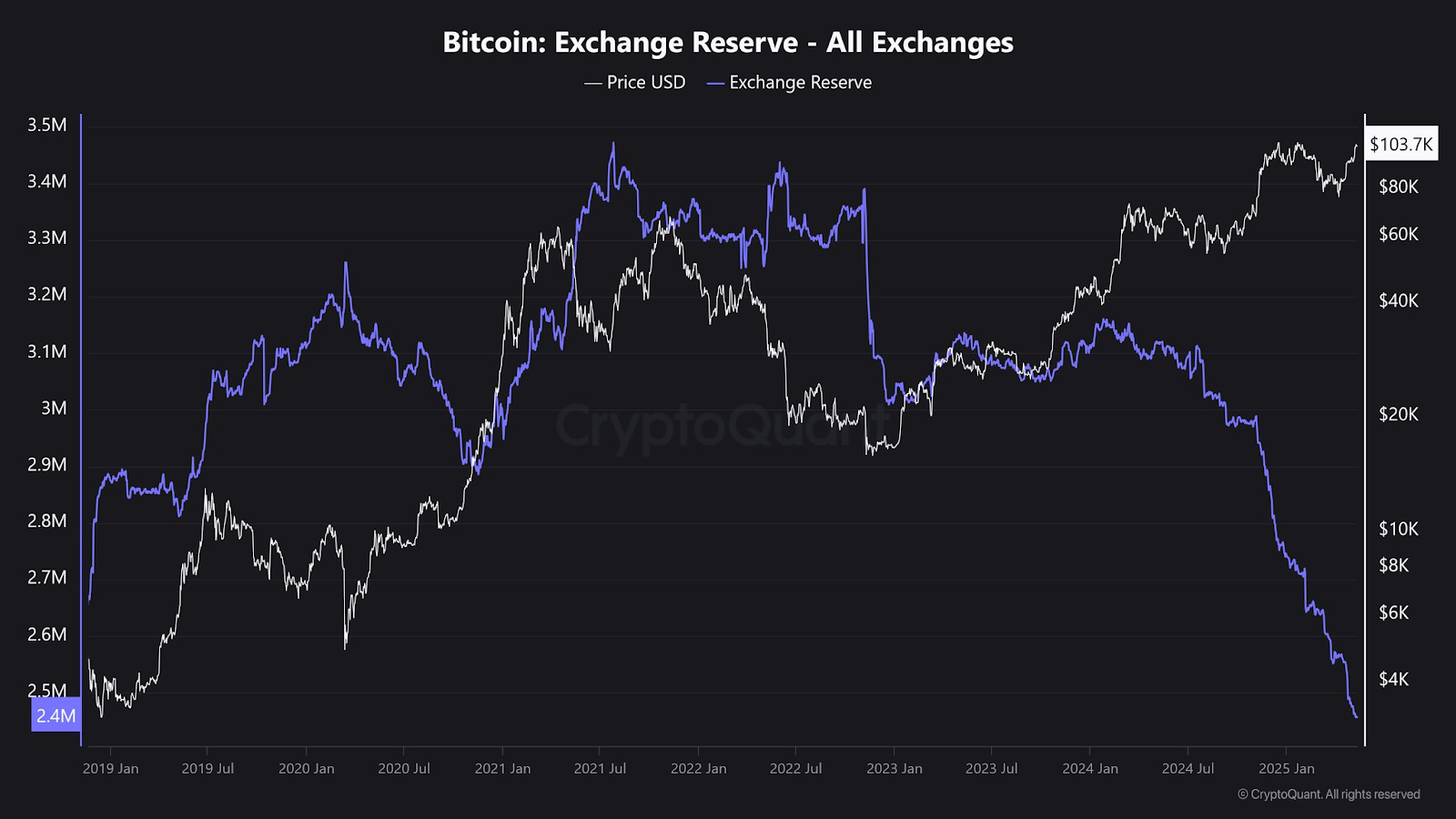

- The supply of Bitcoin on centralized exchanges has exponentially declined in the past few years.

- Technical analysis suggests the onset of a BTC price parabolic rally in the next few months.

The Bitcoin (BTC) market has recorded a significant cash inflow in the past two years, mostly from institutional investors. The demand will further increase as nation-states, led by El Salvador and the United States, focus on the Bitcoin network to counter their respective debts and inflation.

According to on-chain data analysis from CryptoQuant, the supply of Bitcoin on centralized exchanges has dropped by nearly 1 million to 2.4 million in the past two years. With Bitcoin’s total supply fixed at 21 million, while long-term holders continue to aggressively accumulate, it is evident a supply shock is imminent.

Nakamoto Holdings and KindlyMD Focuses on Bitcoin

Earlier on Monday, KindlyMD, Inc. (NASDAQ: KDLY), an established provider of integrated healthcare services, announced a definitive merger with David Bailey’s Nakamoto Holdings to form a publicly traded Bitcoin treasury vehicle ahead.

According to the announcement, the newly formed company secured a total of $710 million to purchase Bitcoins for its treasury. As a result, the new company will join 193 more entities, led by Strategy and Metaplanet, which currently holds over 3.3 million BTCs in treasuries.

“Nakamoto’s vision is to bring Bitcoin to the center of global capital markets, packaging it into equity, debt, preferred shares, and new hybrid structures that every investor can understand and own. Our mission is simple: list these instruments on every major exchange in the world,” Bailey, Founder and CEO of Nakamoto, noted.

BTC Price Enters Parabolic Phase

In the established four-year Bitcoin cycles, it is evident that BTC price, against the U.S. dollar, has begun the euphoric phase of the 2025 bull run. Considering the diminishing returns theory, Bitcoin price is well positioned to reach between $250k and $350k before the end of this year.

From a technical analysis standpoint, Bitcoin’s monthly Relative Strength Index (RSI) tends to reach about 90 percent at the peak of every macro bull cycle. Furthermore, Bitcoin’s monthly MACD line remains above the signal line and the zero line amid the rising bullish histograms, which suggests rising cash inflows.

.png)

1 month ago

4

1 month ago

4

English (US)

English (US)