ARTICLE AD BOX

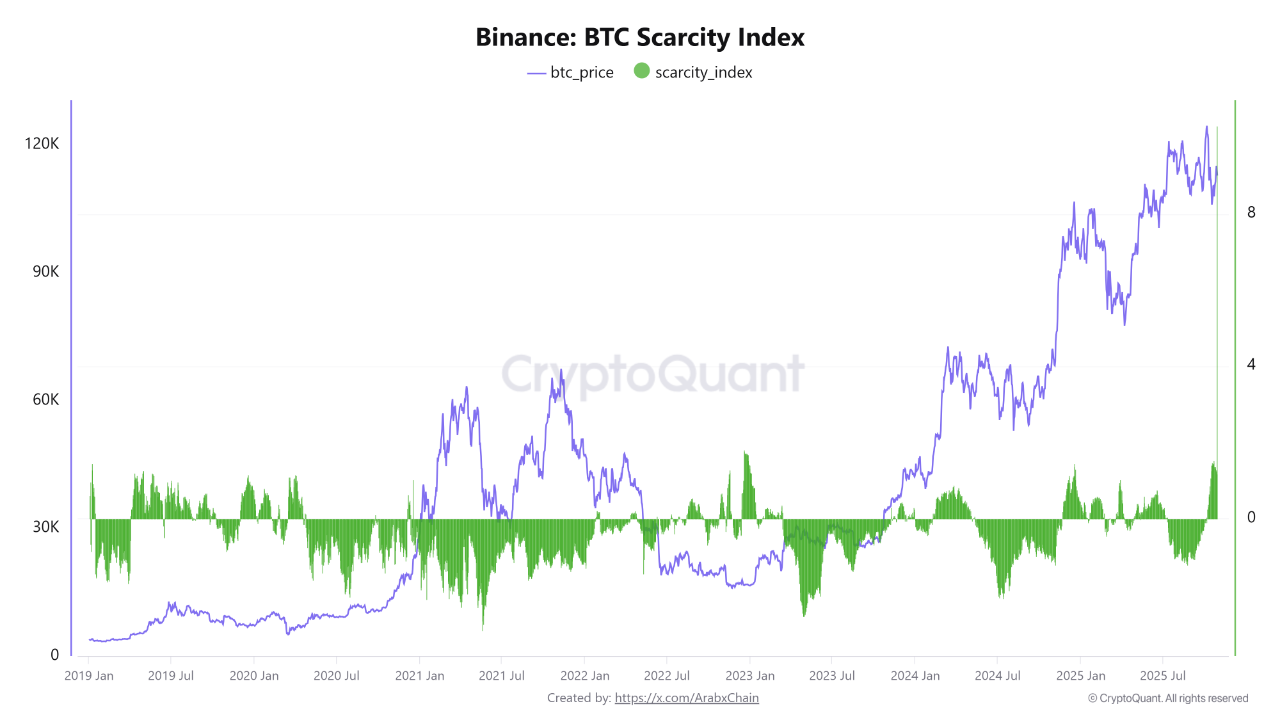

- Binance’s Bitcoin Scarcity Index surged in October, signaling intensified accumulation by whales and large investors amid reduced BTC supply.

- Spot trading dominance on Binance reflects stronger organic demand and investor confidence shifting away from leveraged positions.

Throughout October, the Bitcoin supply squeeze on Binance became increasingly apparent.

Analyst Arab Chain on CryptoQuant recorded a surge in the platform’s BTC Scarcity Index, which reached its highest level this month, breaking through 9. This means the amount of Bitcoin available for trading on Binance continues to decline.

Source: CryptoQuant

Source: CryptoQuantBitcoin Scarcity Spurs Aggressive Buying Amid Market Shifts

The index doesn’t directly measure inflows of demand, but it does demonstrate one thing: when the index rises, it means more BTC is being “hidden” from the market by large entities.

In this context, analysts call this an accumulation phase by whales and institutional investors. This tends to be a bullish signal in the medium term, as they are unlikely to acquire large amounts of Bitcoin without careful calculation.

Interestingly, this index surge coincided with fluctuating price volatility. But volatility isn’t the only factor here. As the supply of Bitcoin on exchanges dwindles, many buyers appear to become more aggressive.

Arab Chain noted that this phenomenon typically occurs after capital inflows or news that fuels optimism. However, accumulation alone won’t help much if new demand doesn’t emerge.

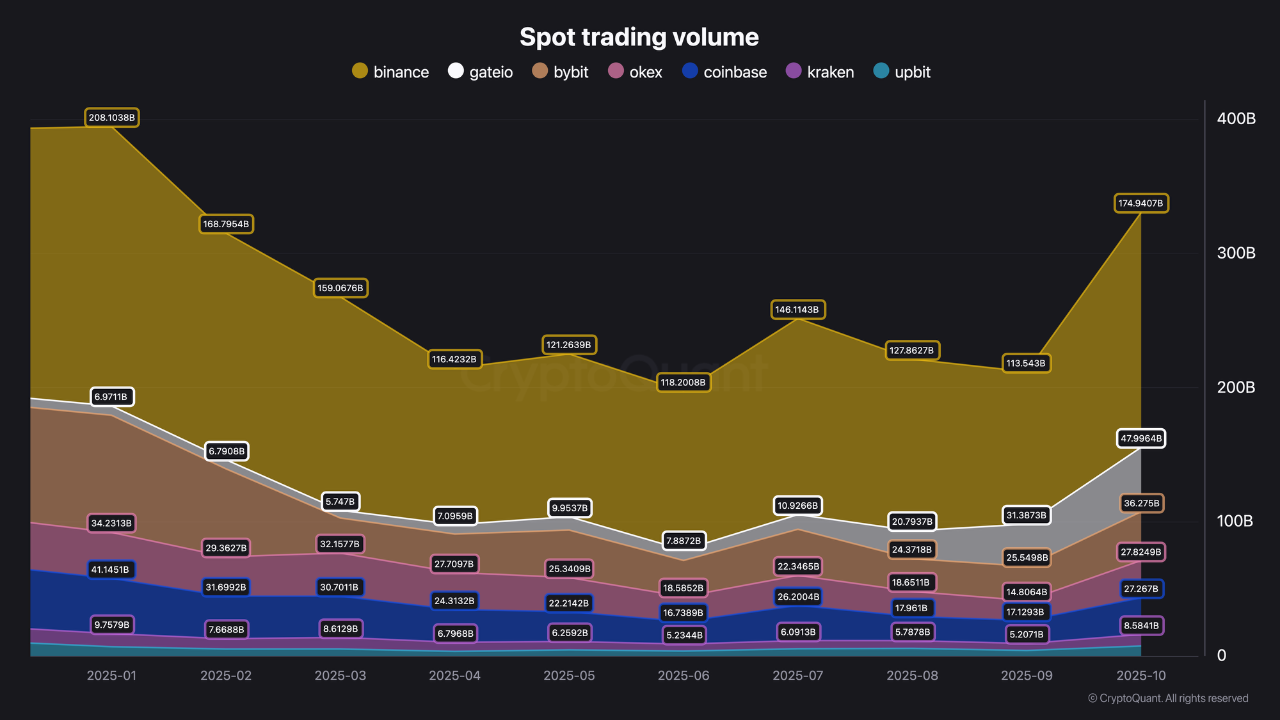

One factor that reinforces this narrative comes from spot data. According to analyst Darkfost, Bitcoin spot trading volume on Binance during October exceeded $174 billion—the second highest all year.

Source: CryptoQuant

Source: CryptoQuantTotal BTC spot volume across all exchanges reached over $300 billion. This data reflects that investors—both retail and institutional—are becoming risk-averse in the derivatives market and are shifting to spot.

Furthermore, the massive liquidation event on October 10th is considered the main trigger for this shift. It was the largest liquidation in the history of the crypto market.

Many traders seem to realize that playing with excessive leverage is like sitting on a rocking chair above a cliff. It’s terrifying. So, they’re choosing the safe route—buying Bitcoin outright and holding it for themselves.

Price Drops, But Major Moves Continue

Interestingly, all of this dynamics are occurring while Bitcoin’s price is actually sliding. Meanwhile, as of press time, BTC is trading at about $108,433, down 4.42% in the last 24 hours, with daily spot volume reaching $9.76 billion.

However, the buying behavior of large investors indicates they’re not chasing short-term swings, but rather trusting the market to correct itself in time.

CNF also previously reported that the long-term trend shows that Bitcoin is increasingly being held and withdrawn from exchanges. This is similar to the strategy of central banks that continue to accumulate gold as a reserve of value, and now Bitcoin is starting to be treated in the same way.

Of course, not all analysts share this view. We previously highlighted Peter Brandt’s warning, stating that the broadening top pattern on the BTC chart reminded him of the soybean price crash of the 1970s.

In the worst-case scenario, the price could plummet. However, on the other hand, some analysts still believe that Bitcoin could still reach $250,000 before the current cycle is over.

.png)

2 hours ago

2

2 hours ago

2

English (US)

English (US)