ARTICLE AD BOX

- On-chain data reveals Bitcoin’s short-term holder realized price (STH RP) at $98,200, marking a crucial support level.

- Industry leaders like Arthur Hayes and Mike Novogratz emphasized the importance of geopolitical stability in shaping market sentiment.

Bitcoin price momentarily dipped below $100,000 over the weekend under the pressure of rising tensions in the Middle East before recovering above $101,000. The slump came following the U.S. attack on the Iranian nuclear facilities as a move to escalate the overall conflict between the opponents Israel and Iran, as reported by CNF.

Crucial Metric For Bitcoin Price Amid Geopolitical Tensions

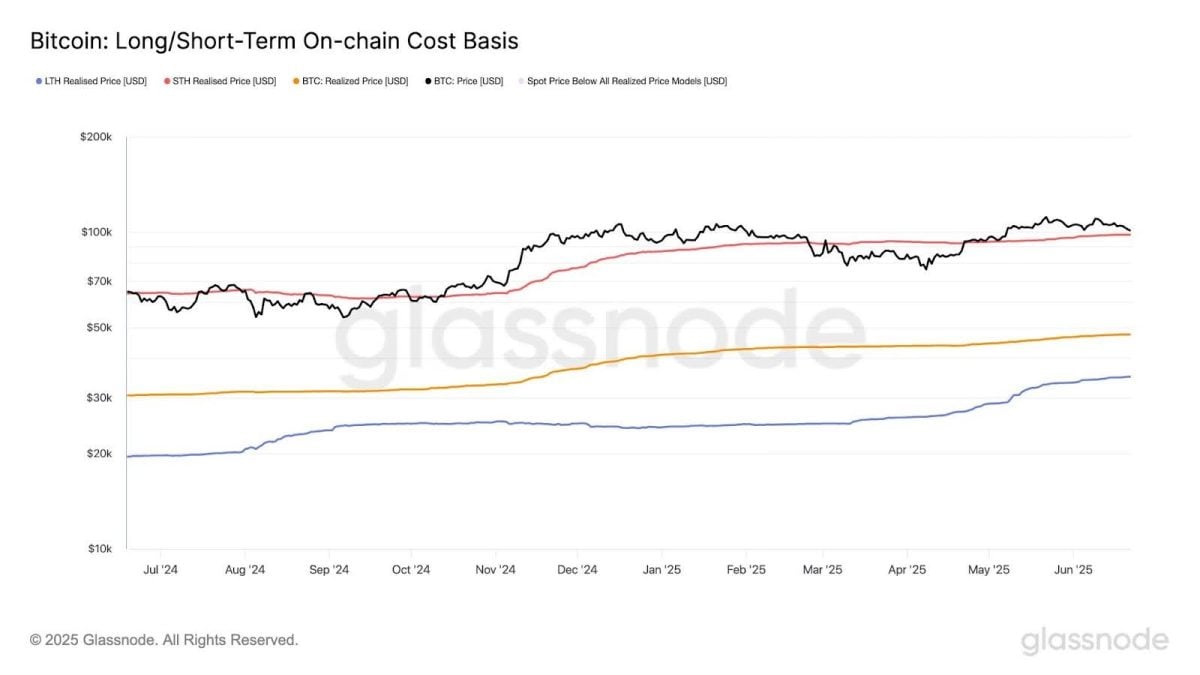

With global markets shuttered during the weekend, many investors sought liquidity, offloading Bitcoin not out of speculation but out of immediate necessity. Meanwhile, the on-chain data on Glassnode suggests that the short-term holder realized price (STH RP) for Bitcoin currently stands at $98,200.

Source: Glassnode

Source: GlassnodeFor context, this metric represents the average acquisition price of BTC moved within the past 155 days and held outside of exchange reserves. Cryptocurrencies in this segment have a better chance of being spent, and thus, they are highly sensitive to market fluctuations.

Traditionally, the higher the positions BTC goes past the STH RP the more it can be viewed as a bullish indication. Below, it means that drops are likely to signal consolidation or bearish time. In the two other past downturns, between June and October 2024 and between February and April 2025, Bitcoin prices dipped below the two STH RP thresholds listed at the time of $62,000 and then of $92,000, respectively.

The bounce back above this level is currently being monitored to see whether it gives some signs of strength in the market. Bitcoin recovered strongly despite hitting a low of $98,286 on the weekend. The positive developments in the market are actually pegged by an increase in optimism that geopolitical tensions will not continue to get out of hand.

Will BTC Price Continue To Recover?

BitMEX co-founder Arthur Hayes explained why he still believes in the strength of Bitcoin despite the latest nosedive.

“Do you hear that? … it’s the sound of the money printers revving up to do their patriotic duty. This weakness shall pass and $BTC will leave no doubt as to its safe haven status,”

Hayes reported. It suggests that monetary easing could support risk assets in the wake of geopolitical unrest.

However, traders are still wary. The airstrikes of the U.S. were a major step to the extent and the possibility of Iranian response keeps instability on the table. The coming 72 hours are extremely crucial in the history of Bitcoin and world markets as a whole, according to Galaxy Digital CEO Mike Novogratz.

His pressing point is that the market will react depending on whether Iran responds to the attack with a massive counterattack. Should the tensions subside, Novogratz believes that there would be a robust rally both in the crypto and traditional markets at the end of the week.

Nonetheless, sentiment has become more tentative as attention shifts to oil prices, technical chart patterns, and overall macroeconomic developments. According to analysts, the Bitcoin price should hold above the $98,200 level to continue with the bullish trend.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)