ARTICLE AD BOX

- Bitcoin is being quietly withdrawn from exchanges, signaling long-term accumulation by holders rather than short-term trading activity.

- Derivatives and options markets are heating up as traders prepare for a potential major move in Bitcoin’s future.

There is one thing that cannot be ignored: Bitcoin is increasingly disappearing from crypto exchanges. Not in the sense of disappearing or disappearing without a clear direction, but slowly and consistently being withdrawn by its owners.

According to analysis by Baykus Charts at CryptoQuant, the number of BTC stored on exchanges in July 2024 reached 1.55 million coins. Now? Only 1.01 million BTC remain. In a year, around 550,000 BTC have been withdrawn. That’s not a small number, and it’s certainly not a coincidence.

Source: CryptoQuant

Source: CryptoQuantBitcoin Leaves Exchanges, But Derivatives Heat Up Fast

If people are withdrawing BTC from exchanges, it means they don’t want to sell anytime soon. They’re not day trading, they’re not looking for quick profits. They’re saving, and most likely in a cold wallet or personal wallet. Simply put, they believe the price will still go up. Like someone who keeps gold bullion in their home safe—they believe it’s safer there than in a public place.

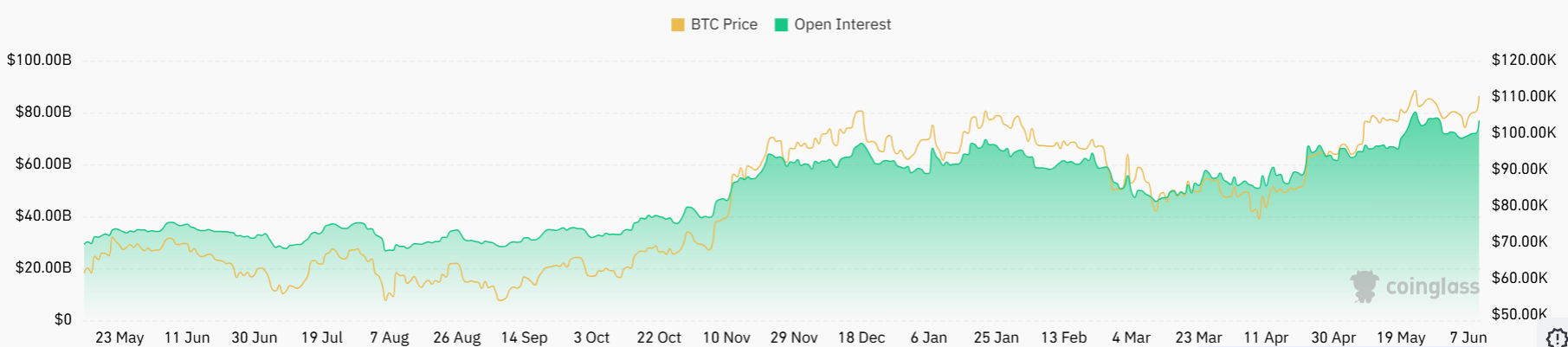

On the other hand, data from CoinGlass shows that the Bitcoin derivatives market is actually getting busier. Its trading volume has soared by more than 116%, now reaching $107.85 billion. This is real activity. This means that even though physical BTC is being withdrawn, traders and institutions are actually becoming more active in the futures and options contracts.

Source: CoinGlass

Source: CoinGlassNot only that, the total Open Interest in the derivatives market has also increased by more than 7%, now at around $77.03 billion. Many are starting to hold their positions longer, a sign that market players are starting to prepare a medium-term strategy.

Meanwhile, in the options segment, the spike was even more striking—transaction volume rose 216% to $4.32 billion. Interest in protection and speculation is increasingly felt, especially with volatility that has not subsided.

Not Panic, Just Quiet Accumulation Behind the Scenes

While many retail investors are starting to panic every time the price goes up and down, big players seem to choose to remain calm. Previous report from CNF revealed that the flow of Bitcoin from miners to exchanges had exceeded $1 billion per day. This had worried some investors. But strangely enough, the two big names in the mining sector, CleanSpark and MARA, continued to expand.

So who is actually withdrawing Bitcoin from exchanges? It could be patient investors. It could also be an institution that doesn’t want to leave too obvious a mark. What is clear is that this is not a whim.

If you think about it, it’s similar to someone who secretly buys groceries in the middle of the night, when everyone is still busy debating the price of chilies. When morning comes, the goods on the shelves are already empty. And the calmest are those who were ready from the start.

At this point, the direction of price movement is still uncertain. But one thing is clear: many people no longer consider Bitcoin to be just a speculative asset. For some, it is equivalent to “digital gold.”

Meanwhile, as of the writing time, BTC is changing hands at about $110,074.55, up 4.05% over the last 24 hours, with $57.3 billion in daily trading volume.

.png)

22 hours ago

2

22 hours ago

2

English (US)

English (US)