ARTICLE AD BOX

The post Bitcoin Price Slips Over 5% After Hitting New All-Time High appeared first on Coinpedia Fintech News

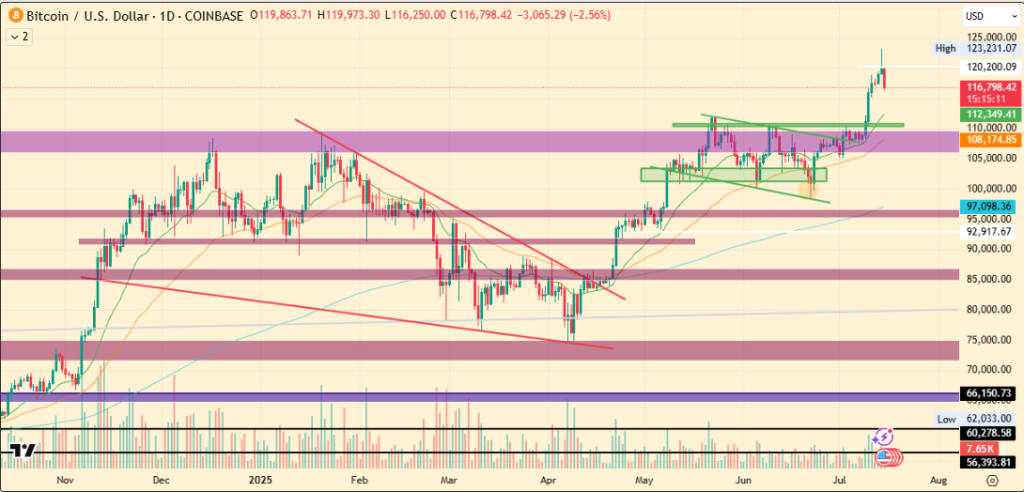

The Bitcoin price rally cooled off in the last 24 hours, with the price dropping more than 5% after reaching a new all-time high of $123,231. This pullback comes as many investors decided to lock in profits at record levels that pushed to $116,700, when writing.

While the market still appears structurally bullish, recent data and insights suggest a short-term consolidation might be underway before continuing another leg up.

Profit-Taking Drives Market Pullback In Bitcoin Price Chart

According to on-chain data from Glassnode, the correction strongly aligns with a significant spike in the realized profits.

In total, investors realized over $3.5 billion in profits. Notably, long-term holders (LTHs) accounted for $1.96 billion, while short-term holders (STHs) contributed $1.54 billion.

This level of profit realization by LTHs suggests a maturity in market participation instead of a newbie move. These kinds of investors are identified as those individuals or institutions who typically accumulate during bear phases and selectively offload during high volatility or market peaks.

The current wave of profit booking shows that many LTHs saw the $123K milestone as a strategic exit point for partial gains.

Key Support at $110K May Trigger Next Bounce in BTC Price

Despite the correction, some analysts remain constructive on Bitcoin crypto’s outlook. According to Mister Crypto, the recent decline could be healthy in the broader uptrend.

In his view, if Bitcoin price revisits the EMA ribbons, which are aligned near the $110K level, which is also June’s previous high, it could create an ideal bounce scenario.

TradingView

TradingViewHe also hinted that in strong bullish trends, the EMA ribbons tend to act as dynamic support. If Bitcoin tests this zone and holds, it may quickly reverse higher, potentially targeting $135K in the next leg up.

Institutional Holdings Reflect Long-Term Optimism In BTC

Adding to the longer-term bullish backdrop, Mister Crypto also highlighted that Bitcoin Treasury companies, which include public firms holding BTC on their balance sheets, now collectively hold more than half the amount of Bitcoin currently held by all ETFs combined.

This indicates that long-term institutional interest is not only growing but may be more influential than Bitcoin ETF flows alone.

Such holdings often reflect strategic positioning rather than short-term speculation, suggesting that large players still view Bitcoin as a viable long-term store of value.

.png)

6 hours ago

2

6 hours ago

2

Long-term holders took $1.96B (~56%)

Long-term holders took $1.96B (~56%)

English (US)

English (US)