ARTICLE AD BOX

- Massive Bitcoin outflows from Binance suggest renewed accumulation by whales and institutions instead of short-term trading behavior.

- Rising OTC activity and declining exchange supply indicate growing institutional confidence and long-term holding sentiment.

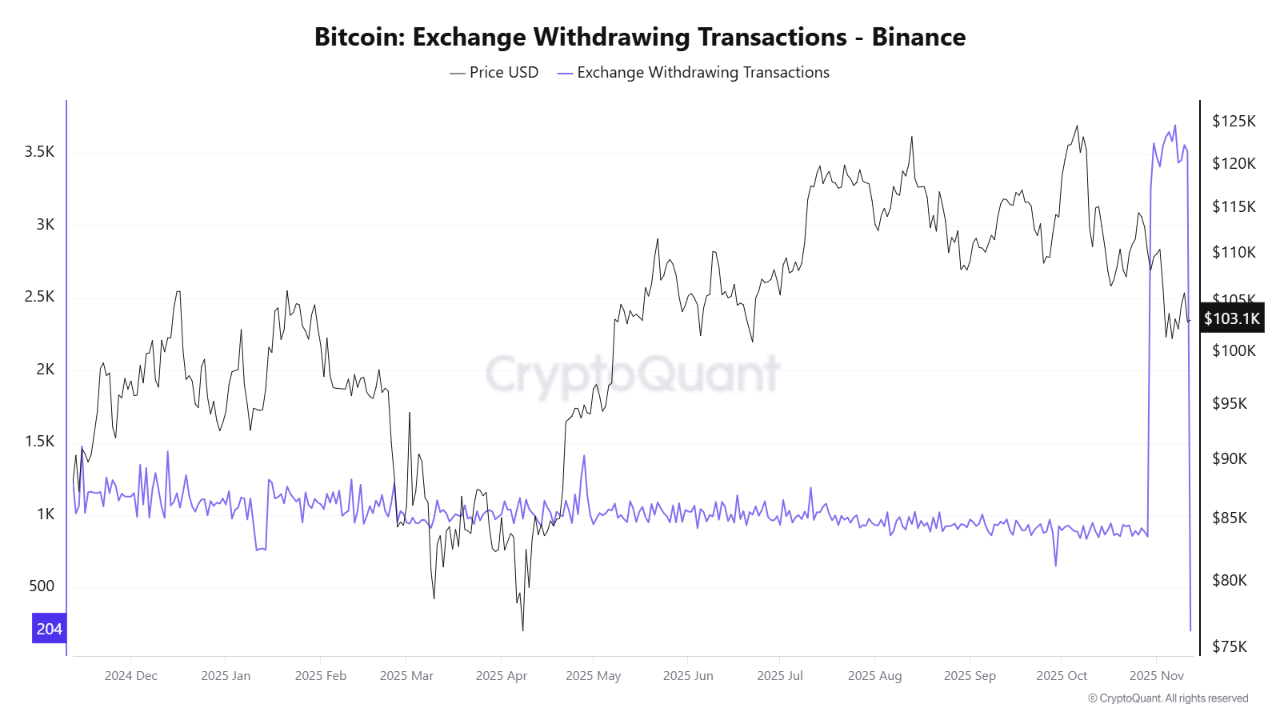

According to data from XWIN Research Japan on CryptoQuant, in early November, Binance recorded a significant spike in Bitcoin withdrawal transactions, one of the largest in 2025.

For some market participants, this wasn’t a bad sign, but rather a signal that something was being “quietly accumulated” by large players, or whales.

Whales Quietly Accumulating as Exchange Outflows Surge

Historically, whenever Bitcoin outflows from exchanges spike, it’s usually not due to panic, but rather a long-term accumulation phase.

Investors moved their BTC to cold wallets, indicating an intention to hold, not trade. The timing was interesting. This surge occurred just after a period of price consolidation around $103,000 in late October, indicating that whales and institutions may be preparing for their next big move.

Source: CryptoQuant

Source: CryptoQuantHowever, XWIN Research Japan believes some of this activity could also stem from Binance’s internal wallet restructuring and new risk management policies.

Large exchanges like Binance frequently reshuffle funds between cold wallets, which sometimes causes withdrawal data to appear spiked. However, on-chain patterns suggest that the majority of outflows this time actually came from users, not internal maintenance activities.

Meanwhile, as of press time, BTC is changing hands at about $103,371, slightly up 0.83% over the last 4 hours with $6.00 billion in daily trading volume.

Bitcoin Liquidity Shrinks as Institutions Quietly Return

On the other hand, a previous CNF report indicated that Bitcoin failed to break through the $110,000 level due to selling pressure from long-term holders (LTHs).

LTHs increased inflows to exchanges, amplifying profit-taking pressure. Simultaneously, ETF outflows reached $1.5 billion, leaving the market without strong support from institutional investors.

This created a liquidity vacuum, providing an opportunity for large investors to fill positions. Interestingly, activity on OTC desks also increased during the same period.

Many view this as a sign of private transfers to custodial wallets, a strong indication that large institutions are starting to get involved again behind the scenes.

Furthermore, XWIN Research Japan believes this situation could be the beginning of a shift in market direction. When the supply of Bitcoin on exchanges decreases, selling pressure automatically decreases.

In such conditions, even a small increase in demand could push prices higher due to tighter supply.

Also, we previously highlighted the views of Samson Mow, founder of Bitcoin infrastructure company Jan3, who believes the recent price drop was caused not by genuine investors, but by speculative capital.

Mow believes that the true bull market has not yet fully begun. This means that what appears to be a correction may actually be forming the foundation for the next leg up.

If this is true, then the surge in Bitcoin outflows from Binance may not be a coincidence. According to Mow, this movement potentially indicates that major players are preparing for the next phase of the market cycle.

.png)

1 hour ago

2

1 hour ago

2

English (US)

English (US)