ARTICLE AD BOX

- The institutional inflows from ETFs like BlackRock’s IBIT are continuing to drive Bitcoin’s rally and reinforce its mainstream credibility.

- Some of main record-setting prices and reduced exchange liquidity point toward the prudent ongoing bullish momentum—fueled by both retail FOMO and strategic institutional accumulation.

As predicted by a previous Crypto News Flash (CNF) update on Bitcoin retesting its all-time high at $112K–$115K with $120K in sight, Indeed, Bitcoin (BTC) has shattered records once again, surging to a new all-time high of $118,400, according to live data and TradingView.

This surge marks a significant milestone, driven by a confluence of institutional, macroeconomic, and market dynamics. As stated by Joshua Chu, co-chair of the Hong Kong Web3 Association:

Bitcoin’s new all-time high is being driven by relentless institutional accumulation – major players are scooping up supply and drying up liquidity on exchanges.

Here in this report, we will delve into the factors fueling Bitcoin’s price, provide a detailed outlook for its future, and explore implications for the market—ensuring a comprehensive understanding for investors and enthusiasts.

According to recent analyses, a major cornerstone of Bitcoin’s recent surge is the growing embrace by institutional investors, particularly through Bitcoin Exchange-Traded Funds (ETFs).

This happened because of the approval of spot Bitcoin ETFs in the United States has unlocked a flood of capital, offering a regulated and straightforward avenue for investors to gain exposure to BTC without holding it directly.

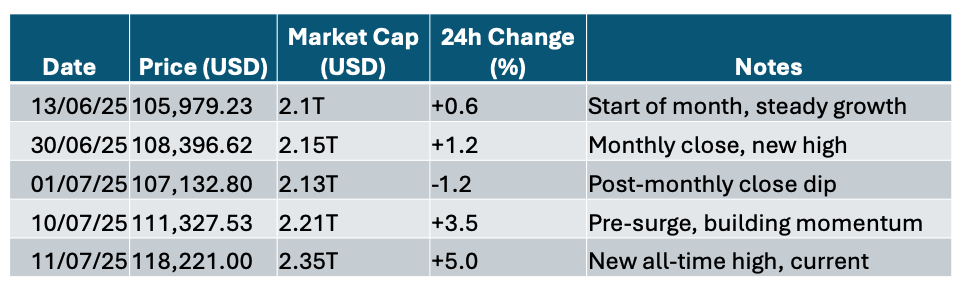

To provide a more comprehensive view, here’s a table summarizing key price movements and market metrics for Bitcoin over the past month, based on reliable data:

Note: Bitcoin has gained nearly 20% over the past month, surging from roughly $98K in late June to around $118K today—reflecting solid momentum amid renewed institutional interest and ETF flux . Note: Data aggregated from Barchart, TradingView, Finance APIs, and CoinMarketCap.

Note: Bitcoin has gained nearly 20% over the past month, surging from roughly $98K in late June to around $118K today—reflecting solid momentum amid renewed institutional interest and ETF flux . Note: Data aggregated from Barchart, TradingView, Finance APIs, and CoinMarketCap.What Is Fueling BTC’s Price to New All-Time High?

Over the past five weeks, Reports highlighted that these ETFs have recorded net inflows of $7.4 billion, signaling robust demand from both retail and institutional players. This influx has sparked a wave of Fear of Missing Out (FOMO), amplifying the rally.

As previously shared in a CNF update, net inflows into U.S. spot Bitcoin ETFs have surpassed $50 billion, with BlackRock’s IBIT contributing significantly. Since then, major financial institutions like BlackRock and Fidelityhave jumped on board, bolstering Bitcoin’s legitimacy and appeal to traditional investors wary of the crypto market’s complexities.

At the time of writing, Bitcoin (BTC) is currently trading at approximately $118,375, reflecting about a 6.7% increase in the past day and an 8.61% increase in the past week, according to CoinMarketCap data. See the BTC price chart below.

.png)

3 hours ago

1

3 hours ago

1

English (US)

English (US)