ARTICLE AD BOX

- MicroStrategy’s Michael Saylor hints at more Bitcoin purchases after acquiring an extra 4,225 BTC last week to send its total holdings to 601,550 BTC.

- Multiple analysts have predicted that the Bitcoin price could reach $200k by the end of the year, and this could be triggered by the rising Institutional adoption and regulatory clarity.

On Sunday, July 20, founder of MicroStrategy, Michael Saylor, disclosed that the company could soon make another Bitcoin purchase as part of its routine acquisition, which started in August 2020. Hinting at this activity, Saylor highlighted in a short tweet that:

Stay Humble. Stack Sats

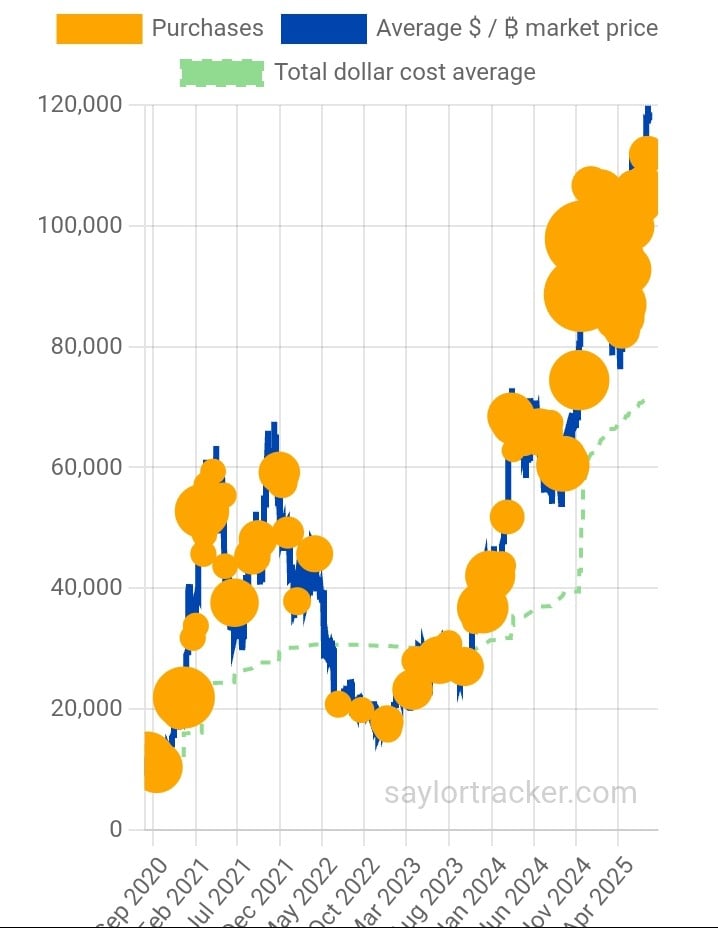

Fascinatingly, its recent purchase came on July 14 when it spent $472.5 million to obtain 4,225 BTC. According to the Saylor tracker chart, the company currently holds 601,550 BTC valued at $71.63 billion per the current rate.

Source: Saylor Tracker

Source: Saylor TrackerAs previously mentioned in our report, MicroStrategy is aiming for a historic $84 billion Bitcoin purchase.

The latest tweet underscores the rising Bitcoin demand, which is also confirmed by the Spot Exchange Traded Fund (ETF) inflows, which have remained positive since the beginning of the month. From the available data published by Bitcoin Treasury, 3.54 million Bitcoins are currently held in Treasuries, representing a 2.7% increase in the last 30 days.

Bitcoin (BTC) to Hit $200k?

Earlier, Bitwise Chief Investment Officer (CIO) Matt Hougan predicted that the strong ETF flows and the massive demand from Bitcoin Treasury companies could push the BTC price to $200k this year.

As outlined in our recent blog post, Hougon’s explanation was primarily based on the demand-side of drivers. Meanwhile, he was less confident in the potential of Ethereum (ETH) and Solana (SOL) contrary to the popular statement that suggests that a “rising tide affects all boats”.

The Bottom Line: We’re holding firm to our BTC $200k prediction, as there is simply too much institutional demand for BTC to keep prices flat for long. We’re less confident on ETH and SOL but hope that rising interest in stablecoins, ETF approvals, and the emergence of ETH and SOL treasury companies can drive prices substantially higher.

In agreement with Hougan’s projection, Toobit experts known for their deep understanding of market dynamics have explained that the drive towards $200k could be fueled by the “convergence of multiple macroeconomic and crypto-specific trends.” According to their report, institutional adoption, regulatory clarity, and geopolitical instability could be the key catalysts in this case.

Joining the Bitcoin discussion, Standard Chartered projected in its second half of the year (H2 2025) outlook that the asset could likely reach $200,000 by December 31. By 2029, they expect Bitcoin to hit $500k. Interestingly, analyst apsk32 believes that this is a conservative estimate. As indicated in our earlier discussion, this analyst argues that the market is slowly approaching the “Extreme Greed” territory, and could see Bitcoin rising as high as $258,000.

Fascinatingly, popular author Robert Kiyosaki believes that many fear-driven investors could miss out on this potential surge, as featured in our recent coverage.

At the time of writing this article, Bitcoin was trading at $118.7k and was down by 2% on its weekly price chart. However, its 24-hour and monthly price charts had 0.56% and 14% gains, respectively, with the market cap sitting around $2.6 trillion.

.png)

3 months ago

8

3 months ago

8

English (US)

English (US)