ARTICLE AD BOX

- Bitcoin (BTC) has been predicted to build on the current market momentum to reach an unprecedented height as the Federal Reserve releases its FOMC minutes.

- Another analyst has cautioned that Bitcoin has only a few months on the “bullish calendar.”

Bitcoin (BTC) made an unexpected turn, breaking its previous all-time high price at $111.8k to set a new record high at $112k, following a 44.7% increase in its daily trading volume. Just as predicted in a CNF report, Bitcoin attained this height after strongly holding above the $108k support level for days.

Reason for this Upsurge

Researching into this rally, we found that the market simply reacted to the recent release of the Federal Open Market Committee (FOMC) minutes from the June 17 and 18 meeting, which was highlighted in a CNF publication.

According to the details, policymakers admitted that inflation has eased. Most importantly, most participants agreed that a rate cut would be appropriate in 2025. However, some Fed officials reportedly argued against any rate cut this year. Even so, it is strongly believed that reduction could come as early as July 30.

Following this report, investors increased their positions in the market under the assumption that liquidity conditions could improve for the rest of the year. According to on-chain data, both short and long-term holders continue to accumulate Bitcoin, creating temporary shortages on exchanges and pushing the price up the curve.

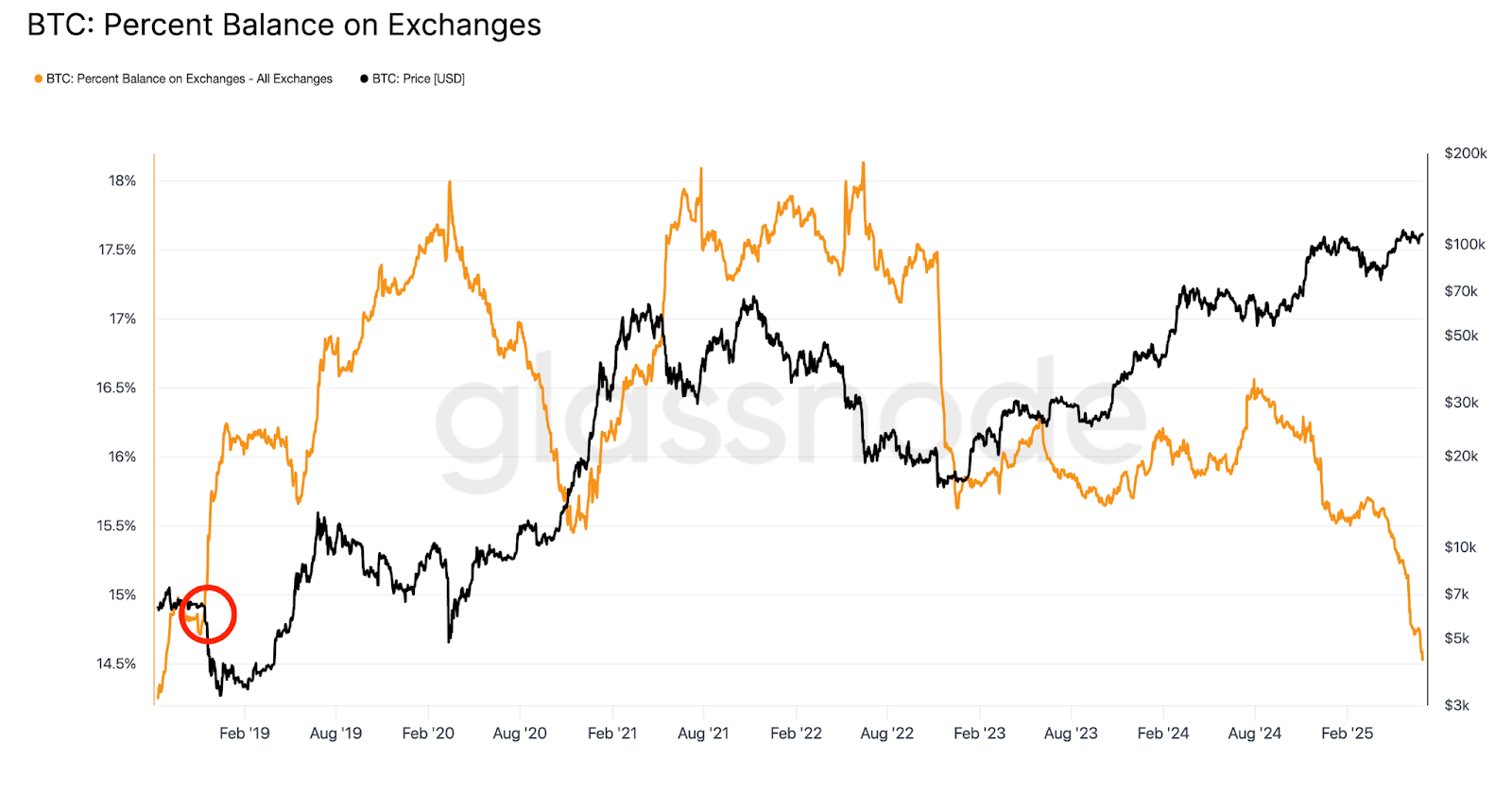

Confirming this claim, a CryptoQuant contributor called Chairman Lee disclosed that Bitcoin reserves on centralized exchanges have fallen to a multi-year low of 2.4 million BTC. Fascinatingly, this did not start today. As of July 1, less than 15% of Bitcoin was left on exchanges for the first time since August 2018, according to Glassnode data.

Source: Coinglass

Source: Coinglass A similar drop recorded in 2020/2021 was followed by an explosive surge in the Bitcoin price. According to Chairman Lee, this was largely due to the demand and supply mechanism.

This persistent decline in reserve level suggests that sell-side liquidity is drying up. Historically, such conditions precede major bullish expansion as demand exceeds supply.

What is Next for Bitcoin BTC?

According to analyst TradingShot, the long-term outlook of Bitcoin is very strong. Explaining his claim, TradingShot pointed out that Bitcoin has traded within an upward channel since November 2022, and this aligns with a Fibonacci channel “that has tracked the Bitcoin price since 2013.”

Also, the analyst highlighted that Bitcoin embarks on a parabolic surge whenever the price goes above the buy zone. Per his observation, this happened in the last two cycles. However, a similar trend is yet to play out in this cycle.

So far, we haven’t had such a rally during the current Cycle, and with time running out (assuming the 4-year Cycle model continues to hold), do you think we will get one this time around?

The bullish potential of Bitcoin has also been confirmed by multiple analysts, with popular trader Darkfost positioning the near-term target at $140k, as discussed in our last analysis.

Samson Mow, another renowned Bitcoin advocate, has predicted that the asset could finish the cycle at $1 million. For Bitget CEO Gracy Chen, Bitcoin could finish the year at $190k, as noted in our recent coverage.

.png)

11 hours ago

2

11 hours ago

2

English (US)

English (US)